Prices

June 12, 2022

April Steel Exports Ease From March High

Written by Brett Linton

US steel exports declined 2% in April to 830,000 net tons, falling from the 45-month high seen in March, according to the latest US Commerce Department data. On a 12-month moving average, April exports have now risen to a 39-month record high. Total April exports are 9% higher than levels seen one year ago.

As shown in the graph below, April exports are at the second-highest monthly level seen in nearly four years. Prior to March, the previous multiyear record high was 790,000 tons in April 2021. Recall that in May 2020 total steel exports had fallen to a 24-year low of 374,000 tons.

Of our six monitored product groups, four decreased month-over-month in April, one increased, and one was flat.

On a year-to-date basis, export levels for the first four months of 2022 now average 773,000 tons per month. This is up from an average of 725,000 tons in the same period of 2021, up from an average of 621,000 tons in 2020 YTD, and up from an average of 650,000 tons in 2019 YTD.

On a rolling 12-month average, April exports are now at a 39-month high of 747,000 tons (recall August 2020’s record low 12MMA of 577,000 tons). Total exports averaged 731,000 tons per month in 2021, compared to 591,000 tons in 2020, 648,000 tons in 2019, and 775,000 tons in 2018.

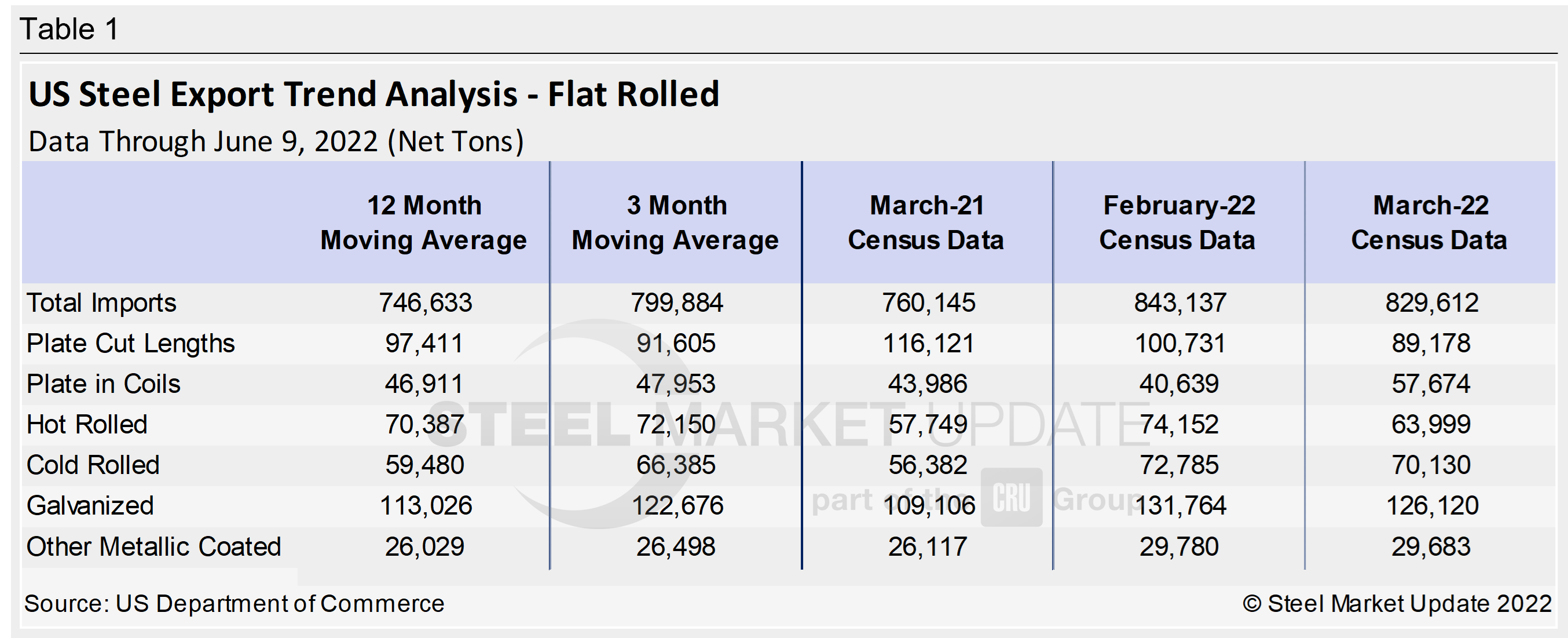

Total April exports are 4% above the three-month moving average (average of February through April 2022), and 11% above the 12-month moving average (average of May 2021 through April 2022). Here is a detailed breakdown by product:

Cut-to-length plate exports fell to 89,178 tons in April, down 11% compared to March and down 23% compared to April 2021.

Exports of coiled plate were 57,674 tons in April, up 42% from the prior month and up 31% from April of last year.

April hot rolled steel exports declined 14% from March to 63,999 tons but were up 11% from one year prior.

Exports of cold rolled products were 70,130 tons in April, 4% lower than March but 24% higher than the same month last year.

Galvanized exports decreased 4% month-over-month to 126,120 tons. Compared to levels one year ago, April is up 16%.

Exports of all other metallic-coated products were 29,683 tons, relatively stable compared to March and up 14% year-over-year.

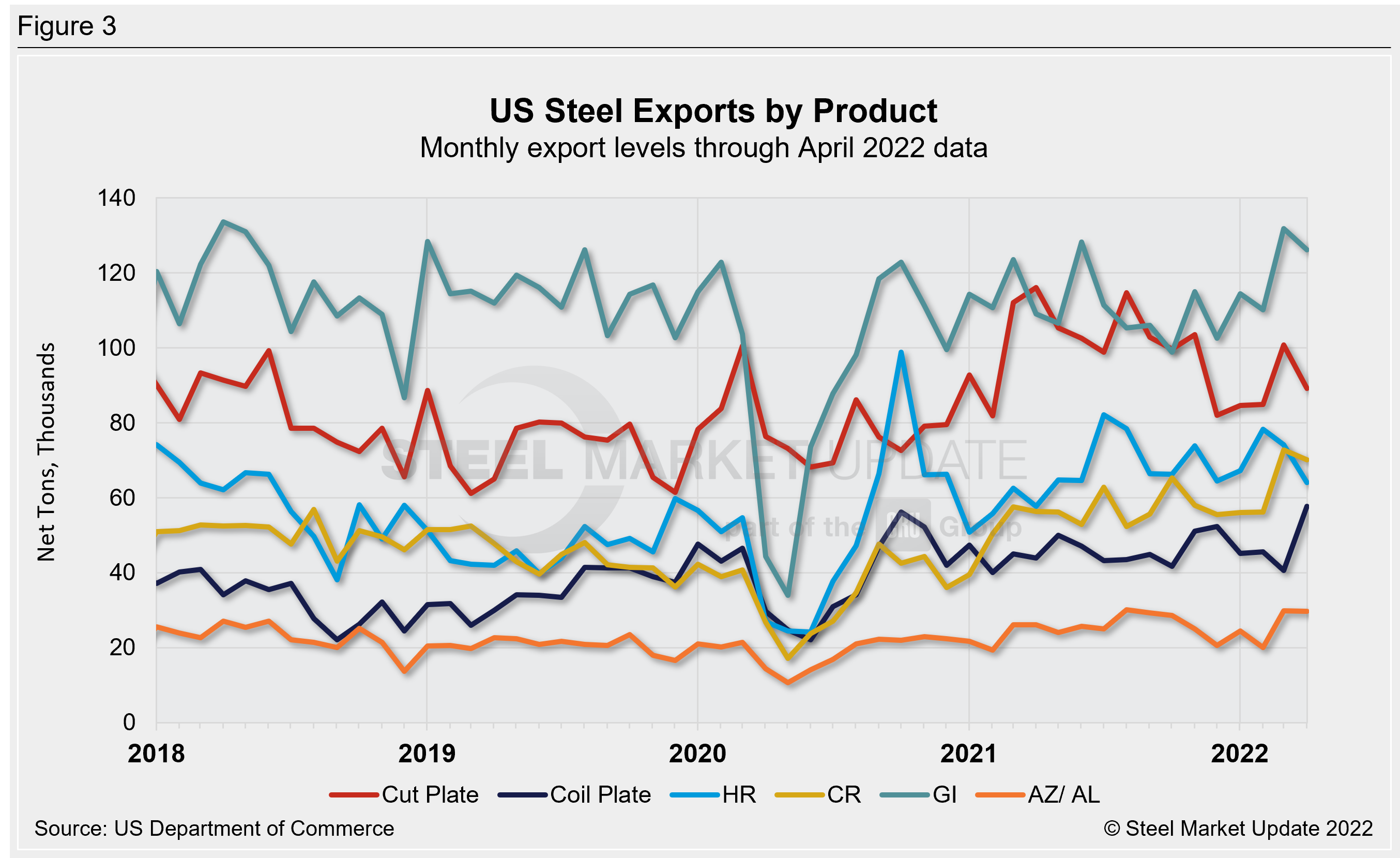

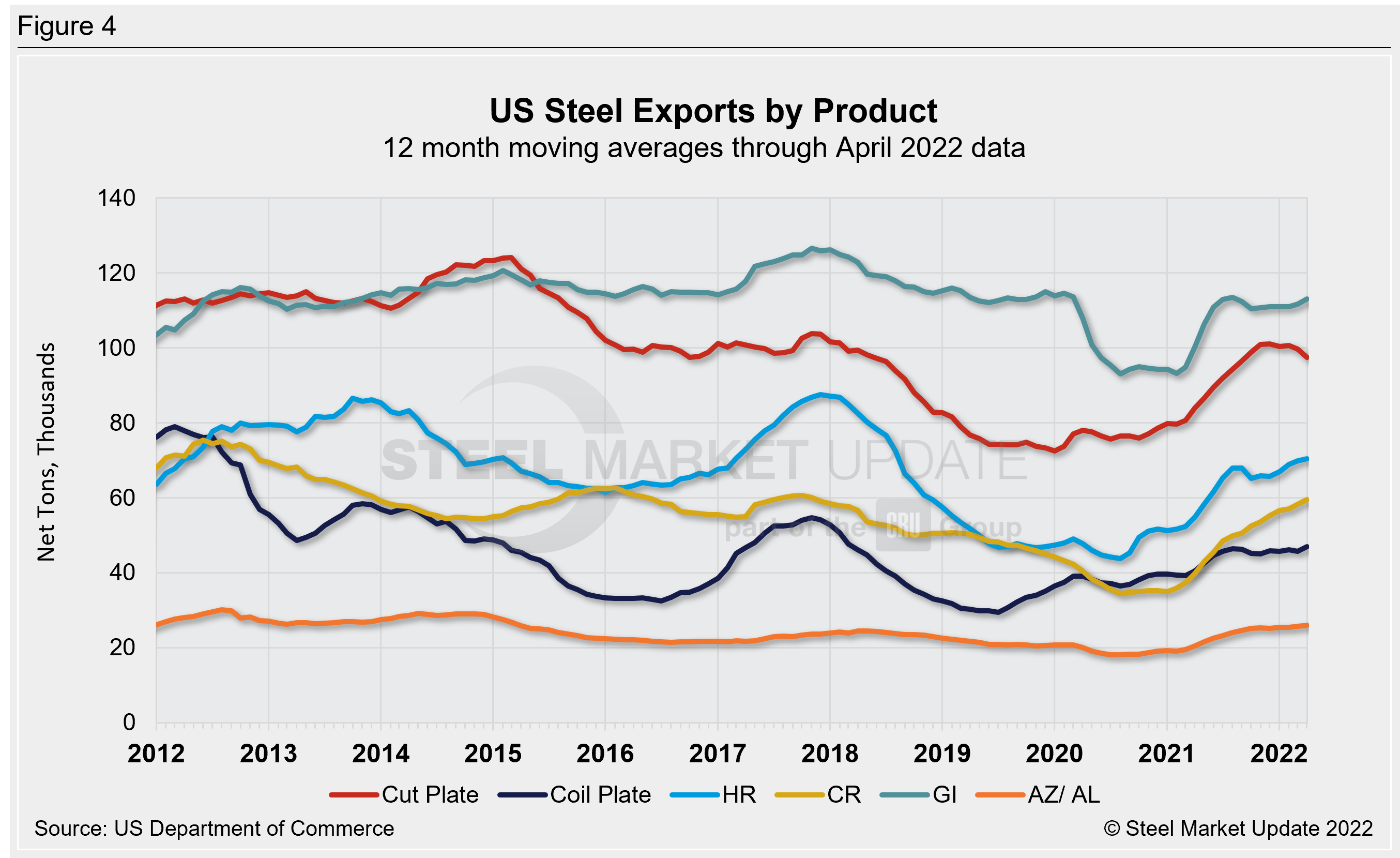

The graphics below show US exports by product, both monthly levels and as a 12MMA.

We have an interactive graphing tool available on our website here. Readers can further investigate historical export data in total and by product. If you need assistance logging into or navigating the website, contact us at Info@SteelMarketUpdate.com.

By Brett Linton, Brett@SteelMarketUpdate.com