Prices

March 8, 2022

USS, SDI Follow with Increase in Galvanized Extras

Written by Brett Linton

U.S. Steel and Steel Dynamics notified customers of an upward revision to their galvanized steel coating extras on Monday, March 7. New USS extras go into effect on May 1, 2022, while SDI extras go into effect on April 1.

“The cost to procure zinc and aluminum for our Hot Dipped Galvanized and Galvalume products has increased significantly in recent weeks, with the average LME prices now above the current coating weight tables that we put in place in Q1 2022,” Pittsburgh-based U.S. Steel said in a letter to customers.

CSI, UPI and Nucor revised their galvanized coating extras last week, with their new prices going into effect between March 1 and April 1, 2022. SMU provides a comparison of mill galvanized coating extras here in the Resources section of our website, comparing G30, G60 and G90 coating weights between 10 U.S. mills. Detailed extras by individual mill are also available via the right-side navigation menu on that page.

Zinc spot prices have spiked in the last week, reaching a record $1.86 per pound on Monday, according to Kitco.

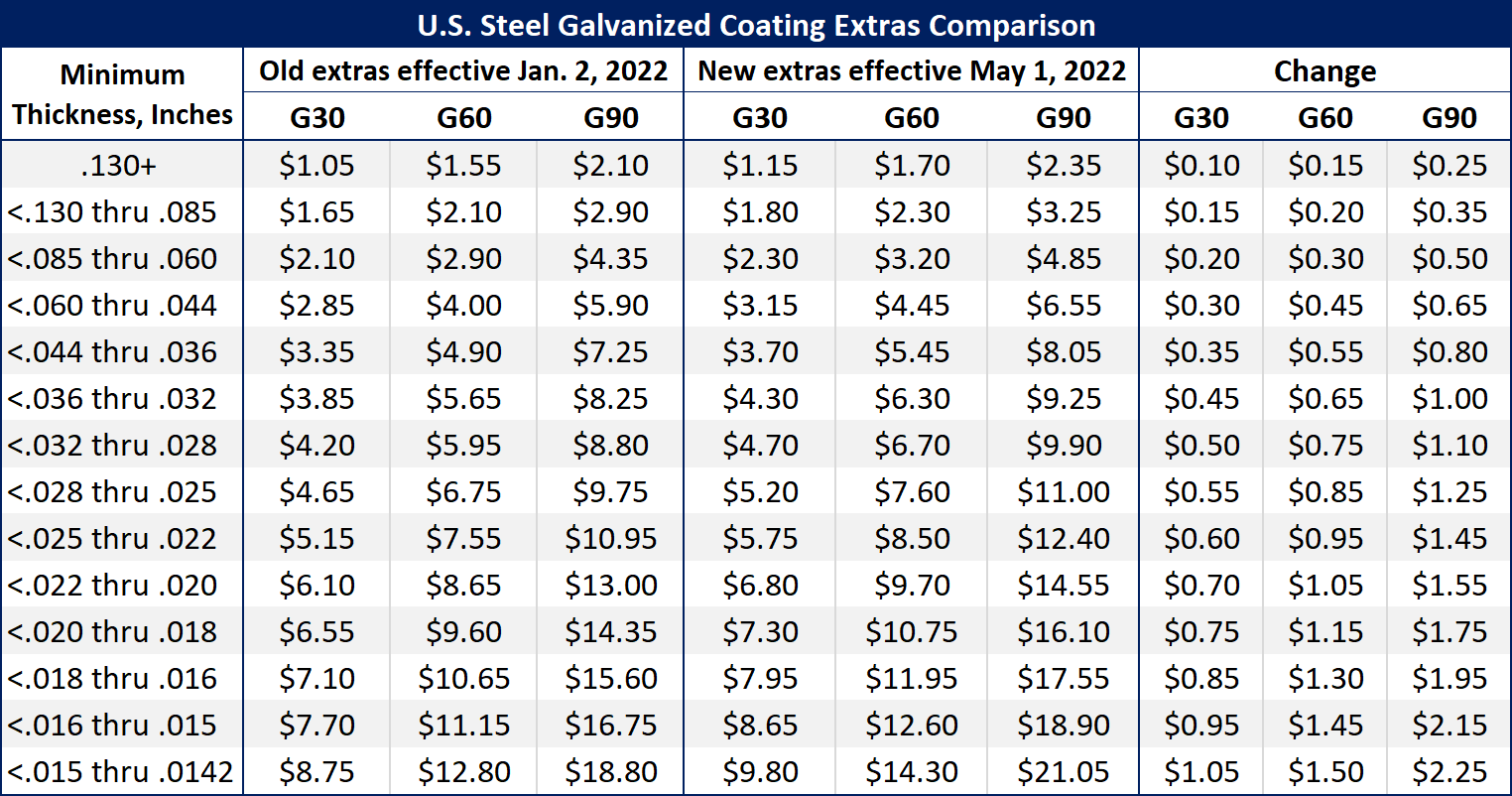

SMU has done an analysis comparing the old and new U.S. Steel extras, provided below. Select extras increased between 9-13%, with an average increase of 11.6% across the weights in the below table. Click here to view detailed U.S. Steel extras data on the SMU website, or click here to view SDI extras data. Note that the SMU Price Estimator Tool uses U.S. Steel extras and has also been updated.

By Brett Linton, Brett@SteelMarketUpdate.com