Analysis

July 15, 2022

US Light Vehicle Sales Rebound Slightly in June

Written by David Schollaert

US light vehicle (LV) sales rose to 1.13 million units in June, up 1.8% from 1.11 million units in May. But LV sales in the US fell by 12.6% year-on-year (YoY), the US Bureau of Economic Analysis (BEA) reported.

The YoY decline would have been steeper if it weren’t for the fact that sales were already lower than anticipated in June 2021 because of the chip shortage.

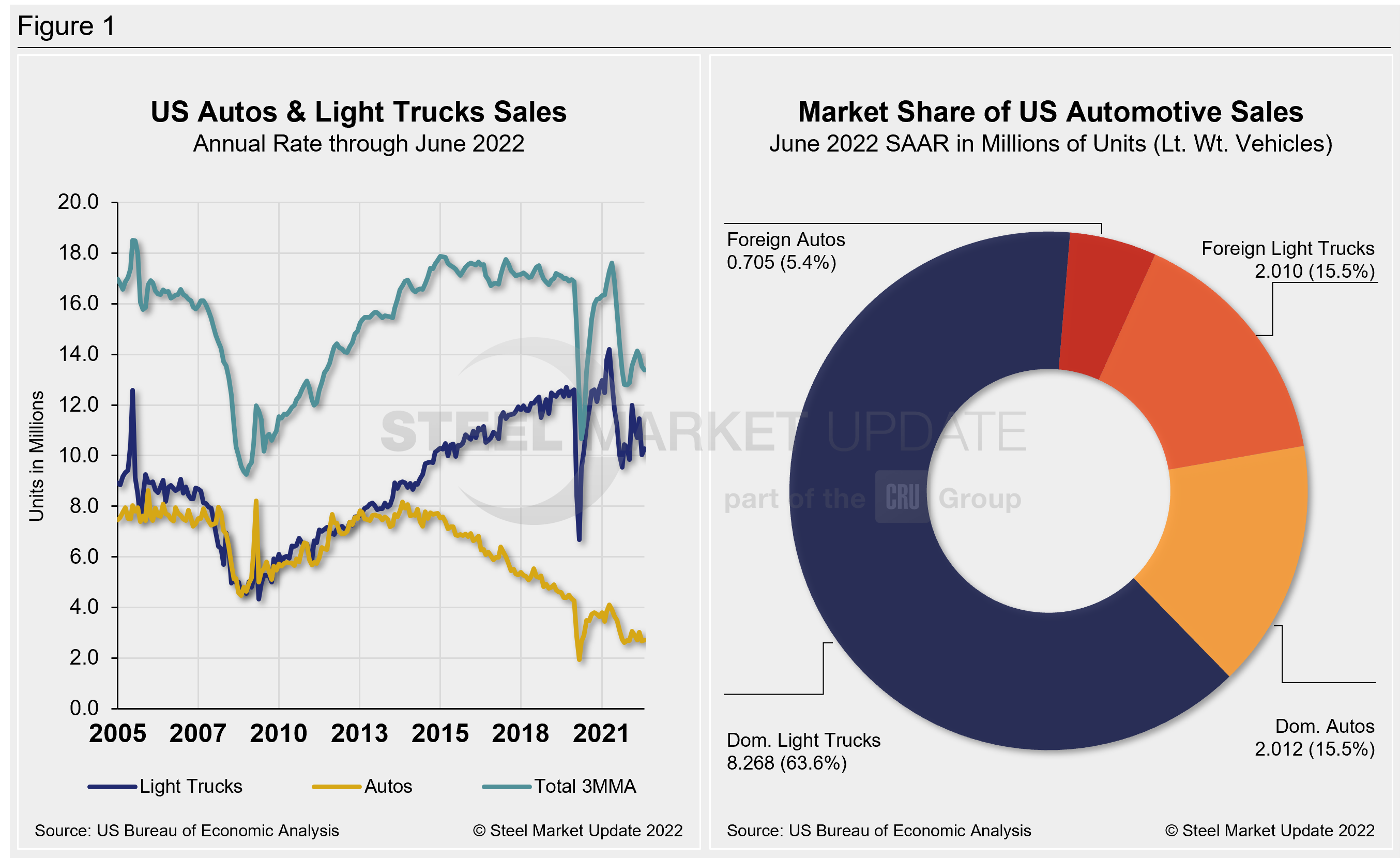

A lack of inventory continues to plague the market, yet the annualized selling rate rose slightly to 12.99 million units last month from 12.71 in May. Supply issues continue to disrupt regular seasonality, distorting that metric to some extent.

These dynamics are not limited to the US or to North America. Globally, the LV selling rate rose to 85 million units annually in June. But in year-to-date (YTD) terms, sales are 8.5% below the same year-ago period, signaling that the global market has a long road to recovery.

While supply issues are still impacting demand in most regions, a strong sales recovery in China, supported by the easing of Covid lockdowns, enabled OEMs to ramp up production. Also helping sales in China was a new temporary tax cut for Passenger Vehicles (PVs), which meant last month’s selling rate rose compared to May, according to LMC Automotive.

Below in Figure 1 is the long-term picture of sales of autos and lightweight trucks in the US from 2005 through June 2022, as well as the market share sales breakdown of June’s 12.99 million vehicles at a seasonally adjusted annual rate.

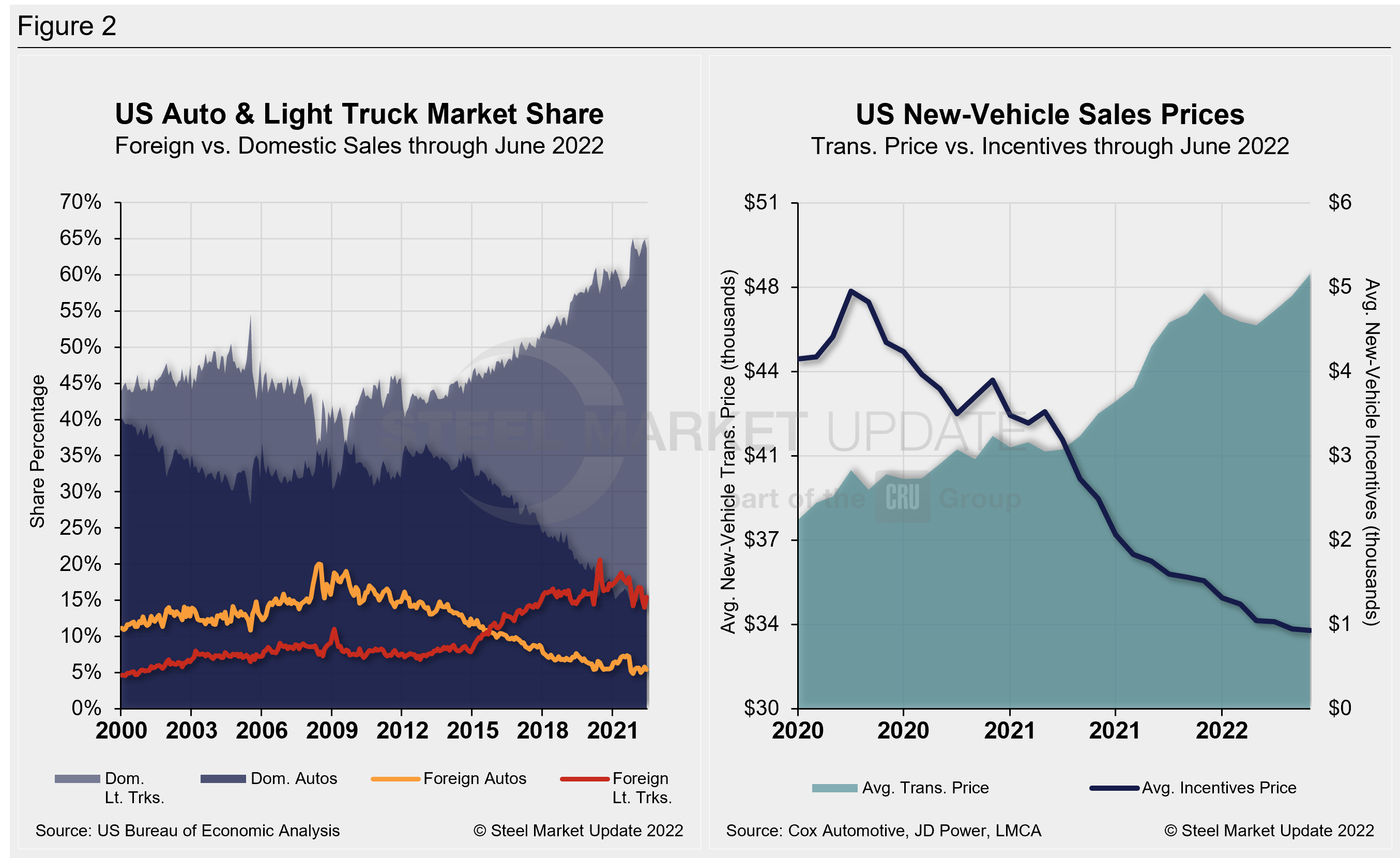

Microchip and parts shortages are still affecting automotive production. Inventories remain tight and are pushing transaction prices higher. The run up in the average transaction price (ATP) continues to coincide with historically low incentives.

New-vehicle ATPs rose to $48,043 in June, rising for the third straight month and hitting a new record high. Prices were up 1.9% (+$895) in June versus the prior month and are 13.7% (+$5,785) above the year-ago period, according to Cox Automotive data.

Incentives dropped to a record low of $930 in June, remaining below the $1,000 mark for the second consecutive month, and roughly 2% of the average transaction price. Incentives are down 62.7%, or $1,562, YoY.

In June, the annualized selling rate of light trucks was 10.279 million units, up 2.4% versus the prior month but down 13% YoY. Auto annualized selling rates were similar during the same periods: up 1.7% and down 25.6%, respectively.

Figure 2 details US auto and light-truck market share since 2010 and the divergence between average transaction prices and incentives in the US market since 2020.

Canada and Mexico saw varying dynamics in June. In Canada, LV sales are estimated to have declined by 11.5% YoY in June, to 149,000 units. The selling rate picked up slightly in June, to just under 1.5 million units annualized. The market, though, is clearly still in a slump due to the lingering inventory shortages.

On the other hand, Mexican auto sales grew by 4% YoY in June, to 90,000 units. The selling rate slowed, however, to 1.11 million units annualized, from 1.18 million units annualized in May.

Editor’s Note: This report is based on data from the US Bureau of Economic Analysis (BEA), LMC Automotive, JD Power, and Cox Automotive for automotive sales in the US, Canada, and Mexico. In specific, the report describes light vehicle sales in the US.

By David Schollaert, David@SteelMarketUpdate.com