Prices

August 9, 2022

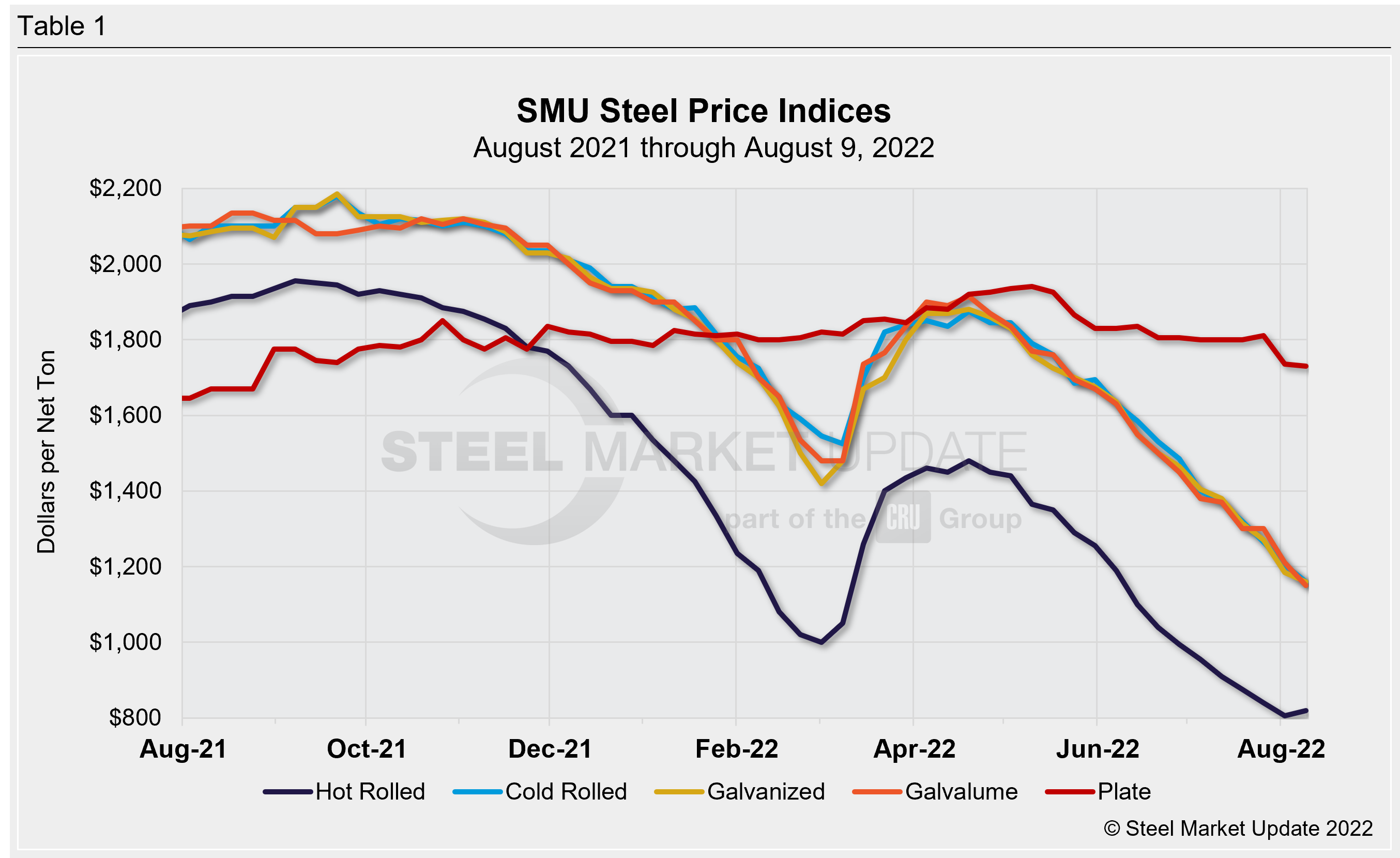

SMU Price Ranges: HRC Sees Gain, CR/Coated Still Falling

Written by Michael Cowden

SMU’s benchmark hot-rolled coil price inched upward for the first time since mid-April, nearly four months ago.

The modest gain came even as cold-rolled and coated prices continued to see significant declines. Plate prices were roughly flat.

By the numbers: Our average hot-rolled coil price now stands at $820 per ton ($41 per cwt), up $15 per ton from last week but still down $150 per ton from $995 per ton in early July.

This week’s HR gain resulted primarily from the higher end of our range increasing week-over-week.

There is not widespread agreement on whether the modest uptick in hot band prices marks the bottom for sheet prices and the start of an upward trend.

Sources who predict HRC prices might have found a floor pointed to a potential bottom in scrap prices, limited import competition, and a $50-per-ton price hike announcement by Nucor on Monday.

But others said the Nucor price increase might have been an attempt to stop prices from falling further and cautioned that it was too soon to say whether the move would stick.

SMU has in the meantime adjusted our sheet momentum indicator to Neutral until the market re-establishes a clear direction. Our plate momentum indicator remains at Lower.

Hot Rolled Coil: SMU price range is $740–900 per net ton ($37.00–45.00/cwt) with an average of $820 per ton ($41.00/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $20 per ton compared to one week ago, while the upper end increased $50 per ton. Our overall average is up $15 per ton from last week. Our price momentum indicator on hot rolled steel now points to Neutral until the market establishes a clear direction.

Hot Rolled Lead Times: 3–6 weeks

Cold Rolled Coil: SMU price range is $1,100–1,220 per net ton ($55.00–61.00/cwt) with an average of $1,160 per ton ($58.00/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $50 per ton compared to last week, while the upper end decreased $40 per ton. Our overall average is down $45 per ton from one week ago. Our price momentum indicator on cold rolled steel now points to Neutral until the market establishes a clear direction.

Cold Rolled Lead Times: 4–8 weeks

Galvanized Coil: SMU price range is $1,100–1,220 per net ton ($55.00–61.00/cwt) with an average of $1,160 per ton ($58.00/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $30 per ton compared to one week ago, while the upper end decreased $20 per ton. Our overall average is down $25 per ton from last week. Our price momentum indicator on galvanized steel now points to Neutral until the market establishes a clear direction.

Galvanized .060” G90 Benchmark: SMU price range is $1,197–1,317 per ton with an average of $1,257 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 4–7 weeks

Galvalume Coil: SMU price range is $1,100–1,200 per net ton ($55.00-60.00/cwt) with an average of $1,150 per ton ($57.50/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $80 per ton compared to last week, while the upper end decreased $40 per ton. Our overall average is down $60 per ton from one week ago. Our price momentum indicator on Galvalume steel now points to Neutral until the market establishes a clear direction.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1,394–1,494 per ton with an average of $1,444 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 4-7 weeks

Plate: SMU price range is $1,700–1,760 per net ton ($85.00–88.00/cwt) with an average of $1,730 per ton ($86.50/cwt) FOB mill. The lower end of our range decreased $20 per ton compared to one week ago, while the upper end increased $10 per ton. Our overall average is down $5 per ton from last week. Our price momentum indicator on plate steel points to Lower, meaning we expect prices to decrease over the next 30 days.

Plate Lead Times: 4–7 weeks

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com.

By Michael Cowden, Michael@SteelMarketUpdate.com