Prices

August 23, 2022

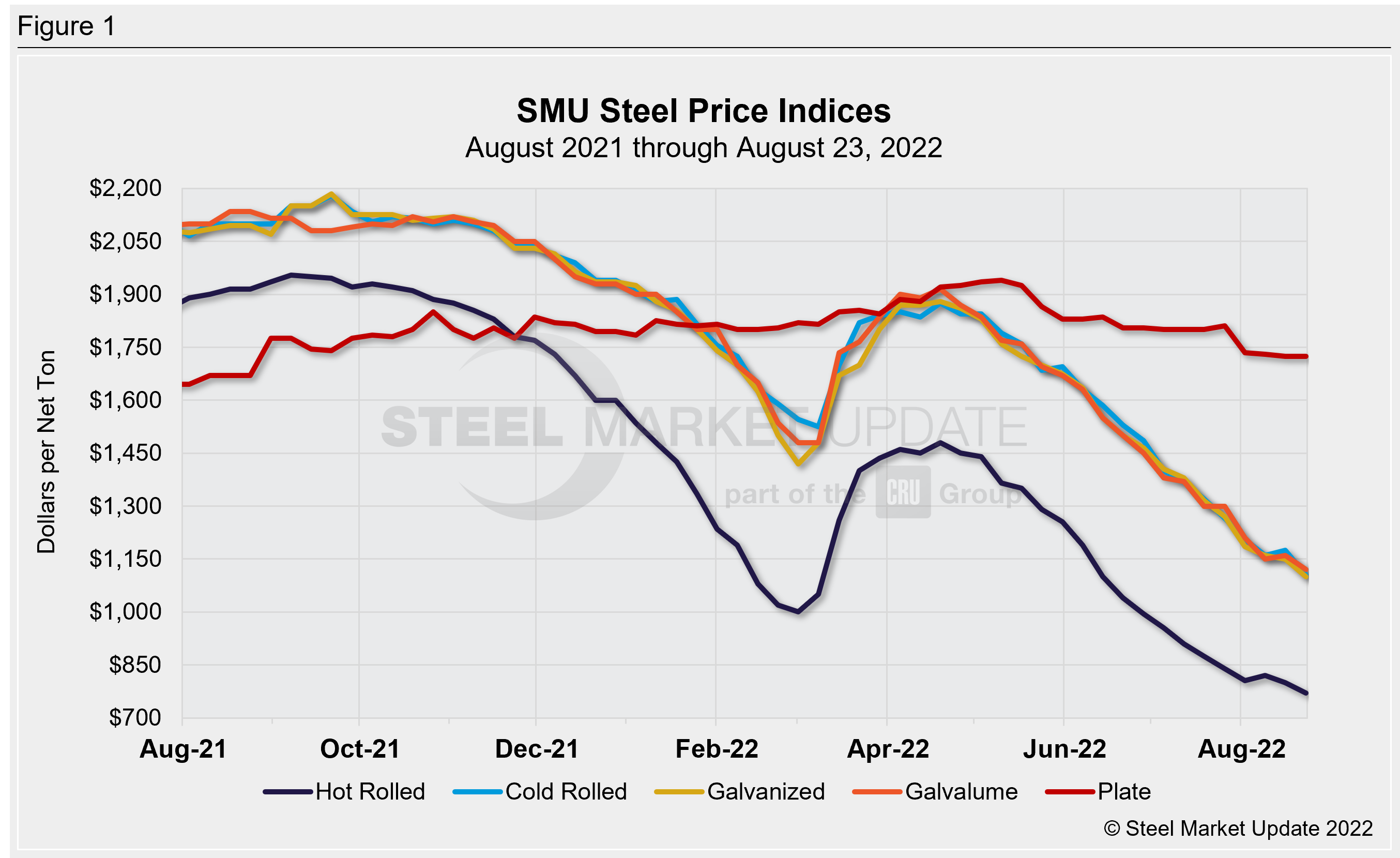

SMU Price Ranges: What Happened to the Floor?

Written by Michael Cowden

Sheet prices are down across the board this week, putting big cracks in any hopes that hot-rolled coil prices would find a bottom around $800 per net ton ($40 per cwt).

The declines came as market participants reported that at least one large producer had cut deals at low levels and, in doing so, put other producers under pressure to lower tags as well.

Some source mills were not trying to hold the line not at $800 per net ton but instead in the mid-to-upper $700s per ton.

The result: SMU’s average hot-rolled coil price declined to $770 per net ton, down $30 from $800 per ton last week and marking the lowest point for HRC prices since November 24, 2020 – or 21 months ago.

Cold-rolled prices fell $70 per ton while galvanized and Galvalume base prices fell $50 per ton and $40 per ton, respectively.

Plate prices were unchanged at $1,725 per net ton on average, though the market is waiting on bated breath for the next plate price announcement expected in the coming days.

Our price momentum indicator remains at neutral this week. But we will keep a close eye out for further declines in the weeks ahead.

Hot-Rolled Coil: SMU price range is $720–820 per net ton ($36.00–41.00/cwt) with an average of $770 per ton ($38.50/cwt) FOB mill, east of the Rockies. Both the lower and upper ends of our range decreased $30 per ton compared to one week ago. Our overall average is down $30 per ton from last week. Our price momentum indicator on hot-rolled steel points to Neutral until the market establishes a clear direction.

Hot-Rolled Lead Times: 3–6 weeks

Cold-Rolled Coil: SMU price range is $1,050–1,160 per net ton ($52.50–58.00/cwt) with an average of $1,105 per ton ($55.25/cwt) FOB mill, east of the Rockies. Both the lower and upper ends of our range decreased $70 per ton compared to last week. Our overall average is down $70 per ton from one week ago. Our price momentum indicator on cold-rolled steel points to Neutral until the market establishes a clear direction.

Cold-Rolled Lead Times: 4–8 weeks

Galvanized Coil: SMU price range is $1,050–1,150 per net ton ($52.50–57.50/cwt) with an average of $1,100 per ton ($55.00/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $10 per ton compared to one week ago, while the upper end declined $90 per ton. Our overall average is down $50 per ton from last week. Our price momentum indicator on galvanized steel points to Neutral until the market establishes a clear direction.

Galvanized .060” G90 Benchmark: SMU price range is $1,147–1,247 per ton with an average of $1,197 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 4–8 weeks

Galvalume Coil: SMU price range is $1,100–1,140 per net ton ($55.00-57.00/cwt) with an average of $1,120 per ton ($56.00/cwt) FOB mill, east of the Rockies. The lower end of our range remained unchanged compared to last week, while the upper end decreased $80 per ton. Our overall average is down $40 per ton from one week ago. Our price momentum indicator on Galvalume steel points to Neutral until the market establishes a clear direction.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1,394–1,434 per ton with an average of $1,414 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 4–8 weeks

Plate: SMU price range is $1,700–1,750 per net ton ($85.00–87.50/cwt) with an average of $1,725 per ton ($86.25/cwt) FOB mill. Both the lower and upper ends of our range remained unchanged compared to one week ago. Our overall average is unchanged from last week. Our price momentum indicator on plate steel points to Lower, meaning we expect prices to decrease over the next 30 days.

Plate Lead Times: 4–6 weeks

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com.

By Michael Cowden, Michael@SteelMarketUpdate.com