Plate

September 6, 2022

SMU Price Ranges: Sheet Slips, Plate Flat

Written by Michael Cowden

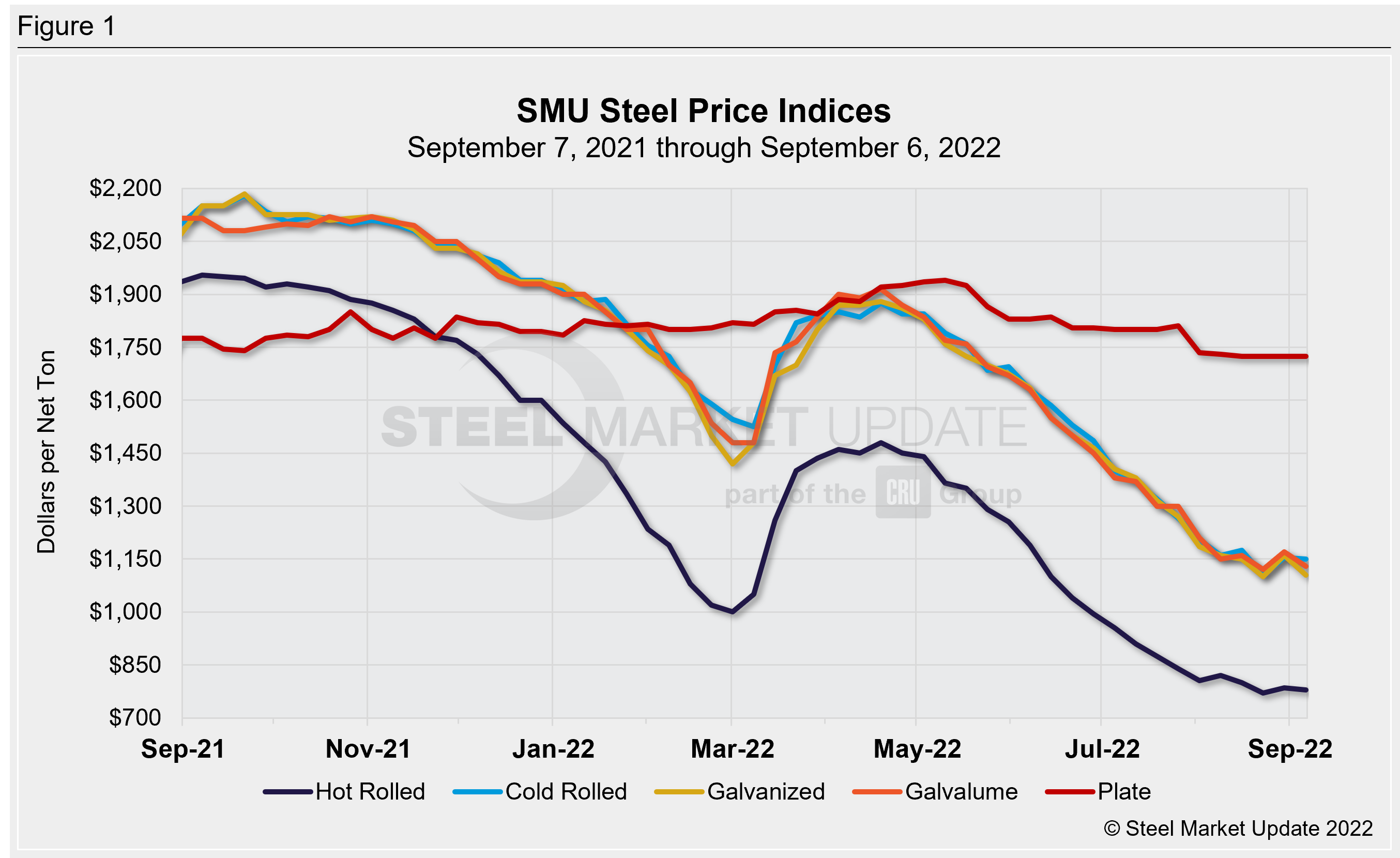

Sheet and plate prices were flat or down this week as some market participants questioned whether tags might be beginning to inflect lower.

Hot-rolled and cold-rolled prices were down $5 per ton week over week. Galvanized (down $55 per ton) and Galvalume (down $40 per ton) fell more significantly.

The steeper declines in coated products follow predictions that the delta between hot-rolled coil and value-added products had become too wide to be tenable.

On the plate side, prices were flat amid continuing concerns that plate prices could follow coil prices lower on a lag.

SMU is keeping its pricing momentum indicator for now until a clear direction is more firmly established.

Hot-Rolled Coil: SMU price range is $730–830 per net ton ($36.50–41.50/cwt) with an average of $780 per ton ($39.00/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $20 per ton compared to one week ago, while the upper end increased $10 per ton. Our overall average is down $5 per ton from last week. Our price momentum indicator on hot-rolled steel points to Neutral until the market establishes a clear direction.

Hot-Rolled Lead Times: 3–6 weeks

Cold-Rolled Coil: SMU price range is $1,100–1,200 per net ton ($55.00–60.00/cwt) with an average of $1,150 per ton ($57.50/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $30 per ton compared to last week, while the upper end increased $20 per ton. Our overall average is down $5 per ton from one week ago. Our price momentum indicator on cold-rolled steel points to Neutral until the market establishes a clear direction.

Cold-Rolled Lead Times: 5–9 weeks

Galvanized Coil: SMU price range is $1,050–1,160 per net ton ($52.50–58.00/cwt) with an average of $1,105 per ton ($55.25/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $30 per ton compared to one week ago, while the upper end decreased $80 per ton. Our overall average is down $55 per ton from last week. Our price momentum indicator on galvanized steel points to Neutral until the market establishes a clear direction.

Galvanized .060” G90 Benchmark: SMU price range is $1,147–1,257 per ton with an average of $1,202 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 5–8 weeks

Galvalume Coil: SMU price range is $1,060–1,200 per net ton ($53.00-60.00/cwt) with an average of $1,130 per ton ($56.50/cwt) FOB mill, east of the Rockies. Both the lower and upper ends of our range declined $40 per ton compared to last week. Our overall average is down $40 per ton from one week ago. Our price momentum indicator on Galvalume steel points to Neutral until the market establishes a clear direction.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1,354–1,494 per ton with an average of $1,424 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 6–7 weeks

Plate: SMU price range is $1,700–1,750 per net ton ($85.00–87.50/cwt) with an average of $1,725 per ton ($86.25/cwt) FOB mill. Both the lower and upper ends of our range remained unchanged compared to one week ago. Our overall average is unchanged from last week. Our price momentum indicator on plate steel points to Lower, meaning we expect prices to decrease over the next 30 days.

Plate Lead Times: 4–6 weeks

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com.

By Michael Cowden, Michael@SteelMarketUpdate.com