Prices

September 13, 2022

SMU Price Ranges: Soft Sideways (Again)

Written by Michael Cowden

Sheet and plate prices continued to drift sideways this week as steel mills attempt to hold the line despite weak signals from the scrap market.

Mills are more unified in trying to hold the line around $800 per ton ($40 per cwt) on hot-rolled coil following deep discounting ahead of announced price increases last month.

The idea: to push out lead times and give them more leverage to stick to higher prices. A raft of maintenance outages might also help that effort.

But questions remain about demand in the second half of the year. Is it strong enough to support higher prices?

Other wildcards to consider are ongoing talks between the United Steelworkers (USW) union and US Steel, as well as a potential strike by workers at major North American railroads.

We are keeping our pricing momentum indicators at neutral until a clear direction is established.

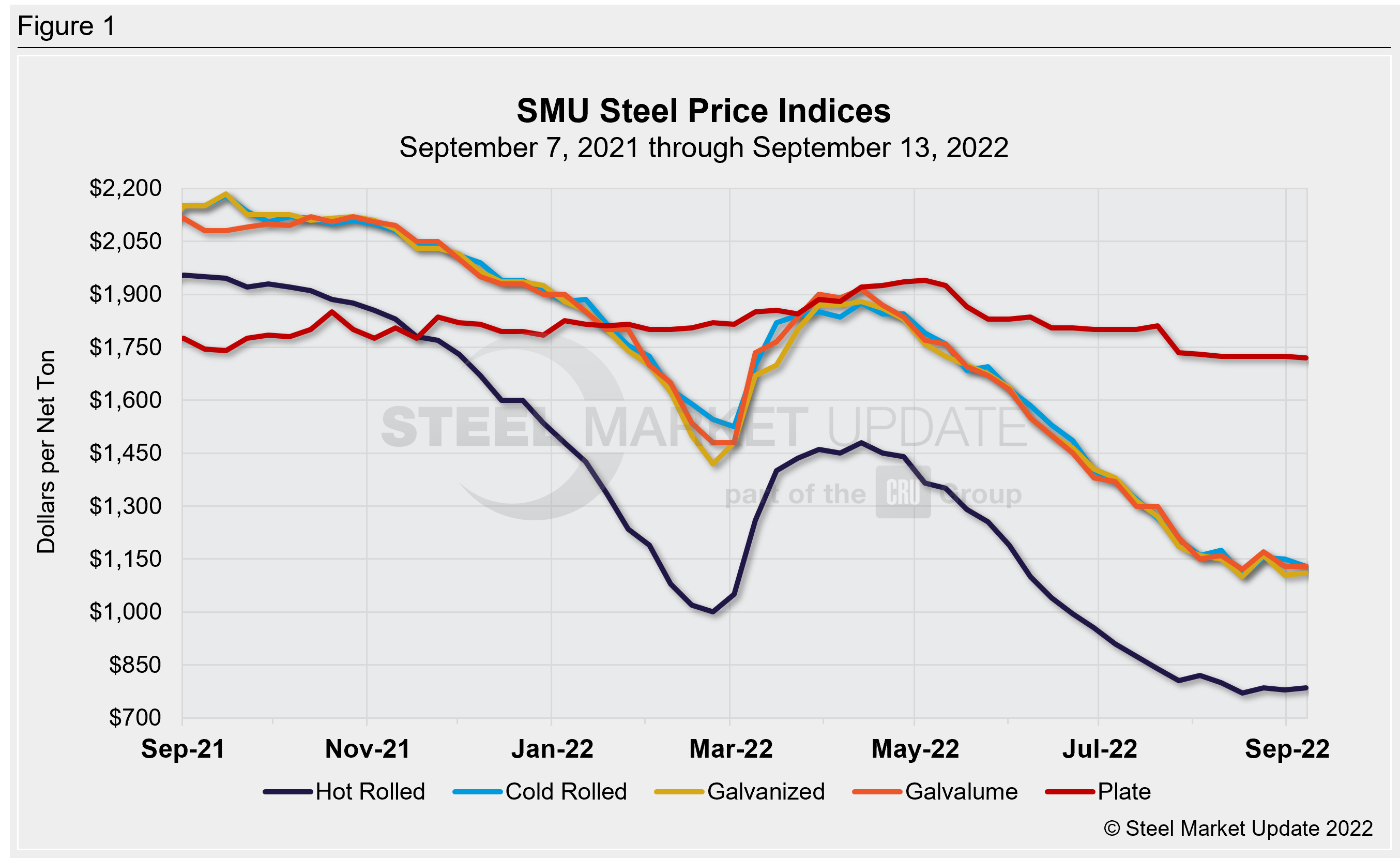

Hot-Rolled Coil: SMU price range is $740–830 per net ton ($37.00–41.50/cwt) with an average of $785 per ton ($39.25/cwt) FOB mill, east of the Rockies. The lower end of our range increased $10 per ton compared to one week ago, while the upper end remained unchanged. Our overall average is up $5 per ton from last week. Our price momentum indicator on hot-rolled steel points to Neutral until the market establishes a clear direction.

Hot-Rolled Lead Times: 4–6 weeks* (preliminary ranges from our ongoing market survey, final lead times data will be released on Thursday)

Cold-Rolled Coil: SMU price range is $1,080–1,180 per net ton ($54.00–59.00/cwt) with an average of $1,130 per ton ($56.50/cwt) FOB mill, east of the Rockies. Both the lower and upper ends of our range declined $20 per ton compared to last week. Our overall average is down $20 per ton from one week ago. Our price momentum indicator on cold-rolled steel points to Neutral until the market establishes a clear direction.

Cold-Rolled Lead Times: 5–8 weeks*

Galvanized Coil: SMU price range is $1,050–1,170 per net ton ($52.50–58.50/cwt) with an average of $1,110 per ton ($55.50/cwt) FOB mill, east of the Rockies. The lower end of our range remained unchanged compared to one week ago, while the upper end increased $10 per ton. Our overall average is up $5 per ton from last week. Our price momentum indicator on galvanized steel points to Neutral until the market establishes a clear direction.

Galvanized .060” G90 Benchmark: SMU price range is $1,147–1,267 per ton with an average of $1,207 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 5–8 weeks*

Galvalume Coil: SMU price range is $1,050–1,210 per net ton ($52.50-60.50/cwt) with an average of $1,130 per ton ($56.50/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $10 per ton compared to last week, while the upper end increased $10 per ton. Our overall average is unchanged from one week ago. Our price momentum indicator on Galvalume steel points to Neutral until the market establishes a clear direction.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1,344–1,504 per ton with an average of $1,424 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 6–8 weeks*

Plate: SMU price range is $1,700–1,740 per net ton ($85.00–87.00/cwt) with an average of $1,720 per ton ($86.00/cwt) FOB mill. The lower end of our range remained unchanged compared to one week ago, while the upper end decreased $10 per ton. Our overall average is down $5 per ton from last week. Our price momentum indicator on plate steel points to Lower, meaning we expect prices to decrease over the next 30 days.

Plate Lead Times: 3–6 weeks*

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com.

By Michael Cowden, Michael@SteelMarketUpdate.com