Market Data

September 16, 2022

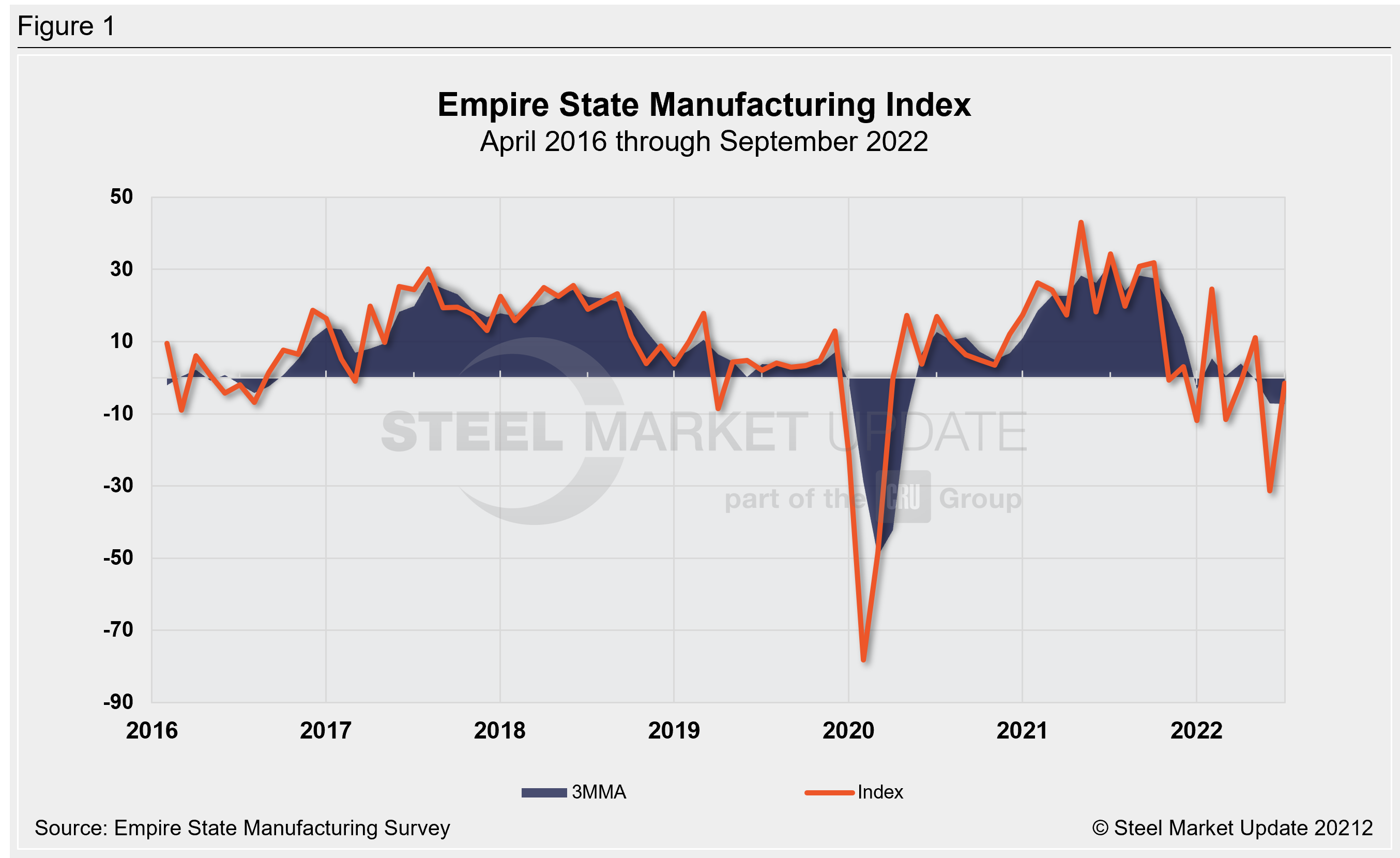

Though Improved, Empire State Manufacturing Remains Depressed

Written by David Schollaert

Business activity in the state of New York improved in September, remaining in negative territory, though, following a sharp decline the month prior, according to the Empire State Manufacturing Survey.

The New York Fed’s Empire State headline general business conditions index—a gauge of manufacturing activity in the state—recovered by 29.8 points in September to a reading of -1.5, remaining in negative territory for a second straight month.

The index stood at -31.30 in August, the lowest reading since May 2020 and the second-largest monthly decline on record.

The September recovery was a welcome sight. The reading came in better than the market expectation of -13. (Any reading below zero indicates deteriorating conditions.)

“Labor market indicators pointed to a modest increase in employment and no change in the average workweek,” the NY Fed said in its publication. “Price indexes moved notably lower, pointing to a deceleration in price increases. Looking ahead, firms were not very optimistic that business conditions would improve over the next six months.”

The report provided a few key takeaways. The NY Fed reading reflects the percentage of companies reporting expansion versus contraction, suggesting manufacturing was broadly in a pullback for the month.

On the one hand, the report said delivery times extended, inventories edged higher, and unfilled orders also grew. On the other hand, the report pointed to some softening in price pressures. The prices paid and prices received indexes respectively declined 15.9 and 9.1 points, though both remained solidly in growth territory with readings of 39.6 and 23.6.

Employee indexes both grew in September after declining for two consecutive months in July and August. The average workweek index was -0.1, up from -13.1 points from August’s reading, while employment grew by just 2.3 points to a reading of 9.7.

Firms were again not very optimistic that business conditions would improve over the next six months, a sentiment expressed only five times in the survey’s history but for the third straight month, the report said.

Though employment is expected to pick up, the indexes for future new orders and shipments were depressed. Delivery times are expected to shorten, and only moderate increases in capital and technology spending are planned for the months ahead.

An interactive history of the Empire State Manufacturing Index is available on our website. If you need assistance logging into or navigating the website, please contact us at info@SteelMarketUpdate.com.

By David Schollaert, David@SteelMarketUpdate.com