Analysis

September 22, 2022

NAHB: Housing Starts Surge in August, Single-Family Still a Drag

Written by David Schollaert

Housing starts saw a double-digit gain in August driven by a surge in multifamily production. Despite the overall gain, high mortgage rates and building production bottlenecks continue to act as a drag on the single-family housing market.

Overall housing starts increased 12.2% to a seasonally adjusted annual rate of 1.58 million units in August from a downwardly revised July reading, according to the latest data from the US Census Bureau and the Department of Housing and Urban Development.

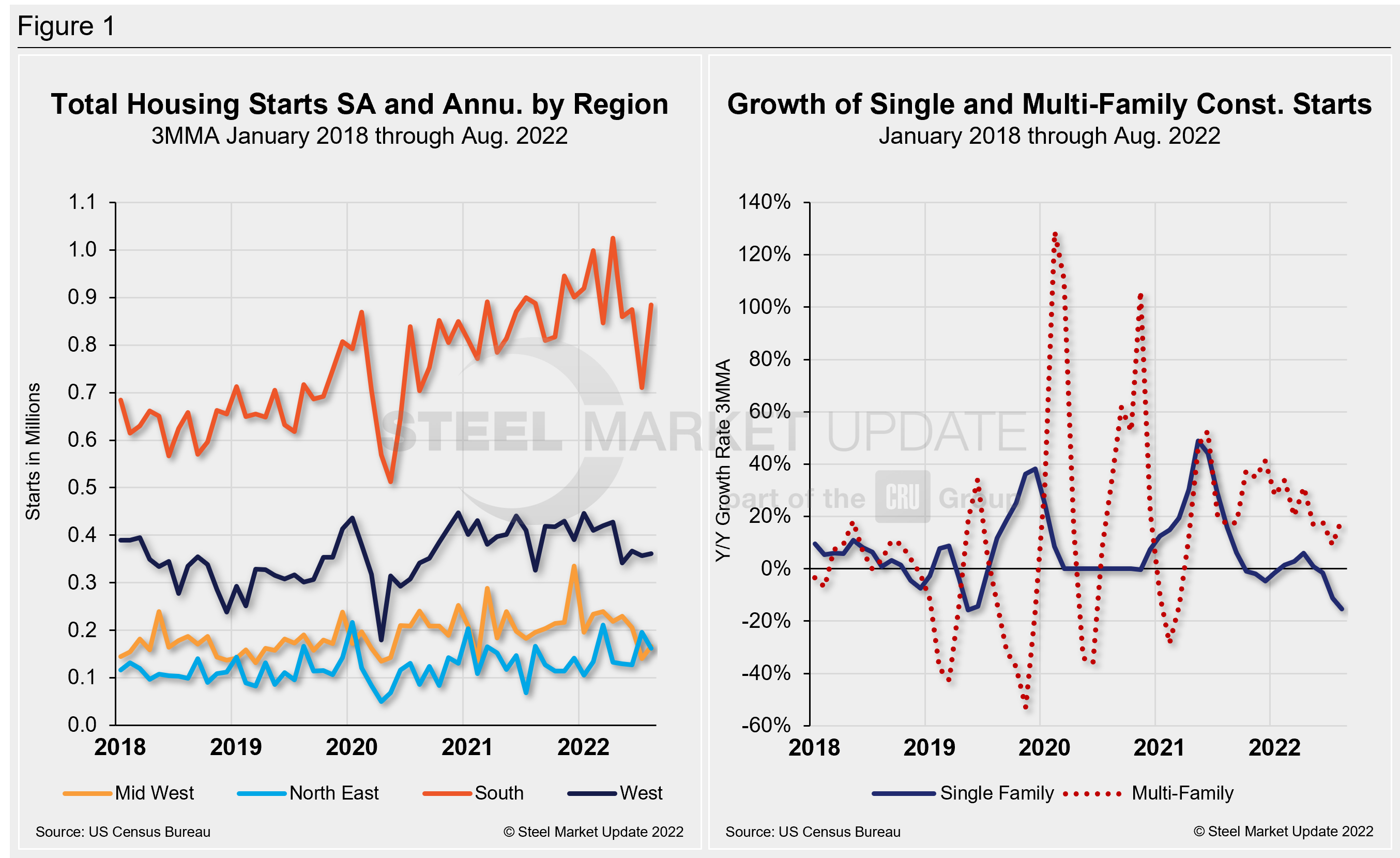

The August reading of 1.58 million starts is the number of housing units builders would begin if development kept this pace for the next 12 months. Within this overall number, single-family starts increased 3.4% to a 935,000 seasonally adjusted annual rate. Year to date, single-family starts are down 4%. The multifamily sector, which includes apartment buildings and condos, increased 28% to an annualized 640,000 pace.

“Single-family production is running at a weakened pace due to elevated mortgage rates and high construction costs that have led to a major slowing of the housing market and exacerbated housing affordability,” said Jerry Konter, the National Association of Home Builders’ chairman and a home builder and developer in Savannah, Ga. “The slowdown in the single-family market has been reflected in our builder surveys, which have posted declines every month in 2022.”

On a regional year-to-date (YTD) basis through August, combined single-family and multi-family starts varied. The Northeast and the Midwest regions were up 4.6% and 2.4%, respectively. The South was also higher YTD, up 5.6%, while the West was 1.5% lower over the same period.

“Today’s housing starts report is more evidence that the housing recession is deepening for the single-family market, with the pace below 1 million for the last two months,” said Jing Fu, NAHB’s director of forecasting and analysis. “Expected additional tightening of monetary policy from the Federal Reserve, falling builder sentiment, and a 15.3% year-over-year decline in single-family permits point to further weakening for the housing sector. The one bright spot is multifamily construction, which remains very strong given solid demand for rental housing.”

Overall permits fell 10% to a 1.52-million-unit annualized rate in August. Single-family permits fell by 3.5% to an 899,000-unit rate. Multifamily permits increased 17.9% to an annualized 618,000 pace.

Compared to the previous year, regional permit data shows that permits are 3.1% lower in the Northeast and 1.4% lower in the West. They are 1.2% higher in the Midwest and 1.2% higher in the South.

The number of apartments under construction (890,000 residents in 2-plus unit properties) is at the highest level since the first quarter of 1974.

By David Schollaert, David@SteelMarketUpdate.com