Analysis

October 30, 2022

Final Thoughts

Written by Michael Cowden

SMU has released its latest full survey results, and I want to highlight some big changes that we’ve seen in the data compared to just two weeks ago. Chief among them is what appears to be a big shift in service center pricing and buying patterns.

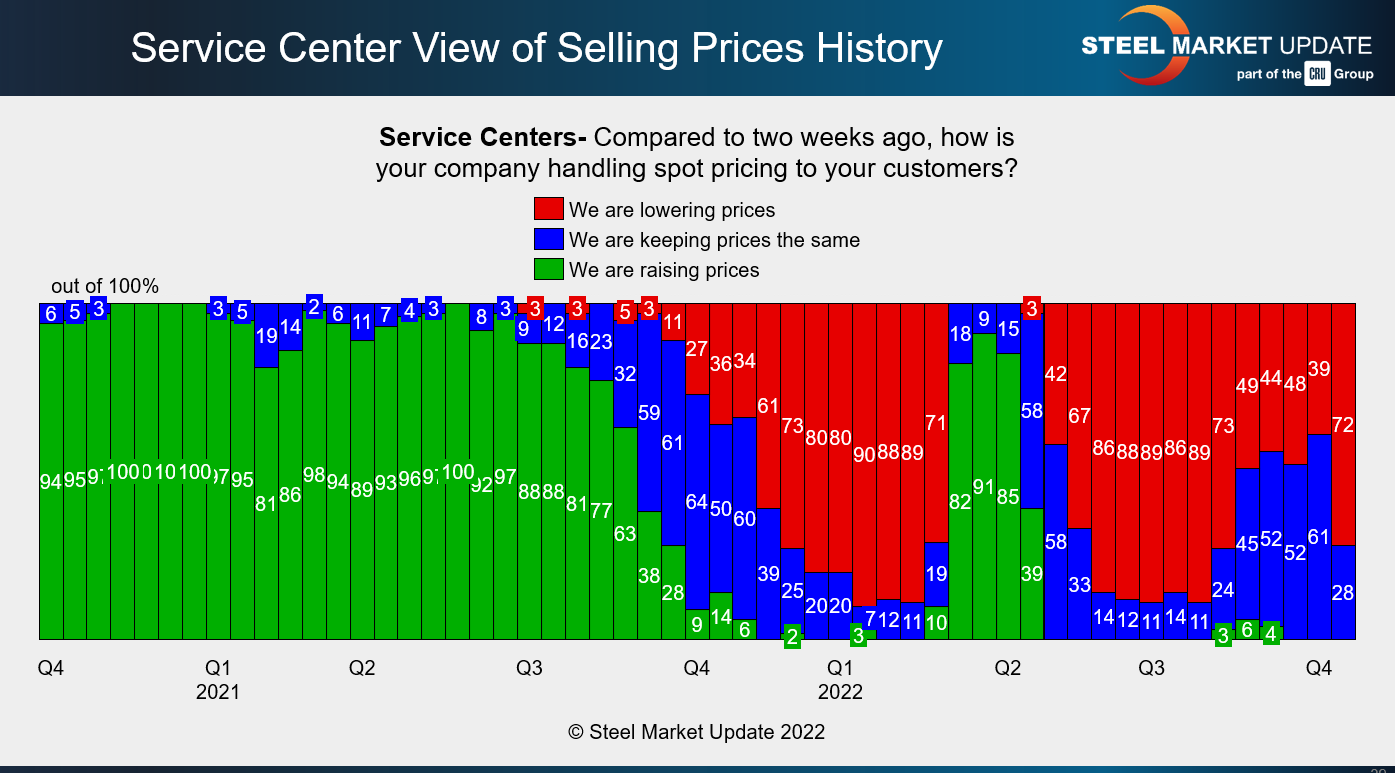

We had seen most service centers trying to hold the line on spot prices to their customers following mill price hike attempts in August. Those mill increase announcements didn’t boost prices. But they did at least slow the bleeding.

It looks the bleeding has resumed as both service centers and manufacturers look to offload inventory.

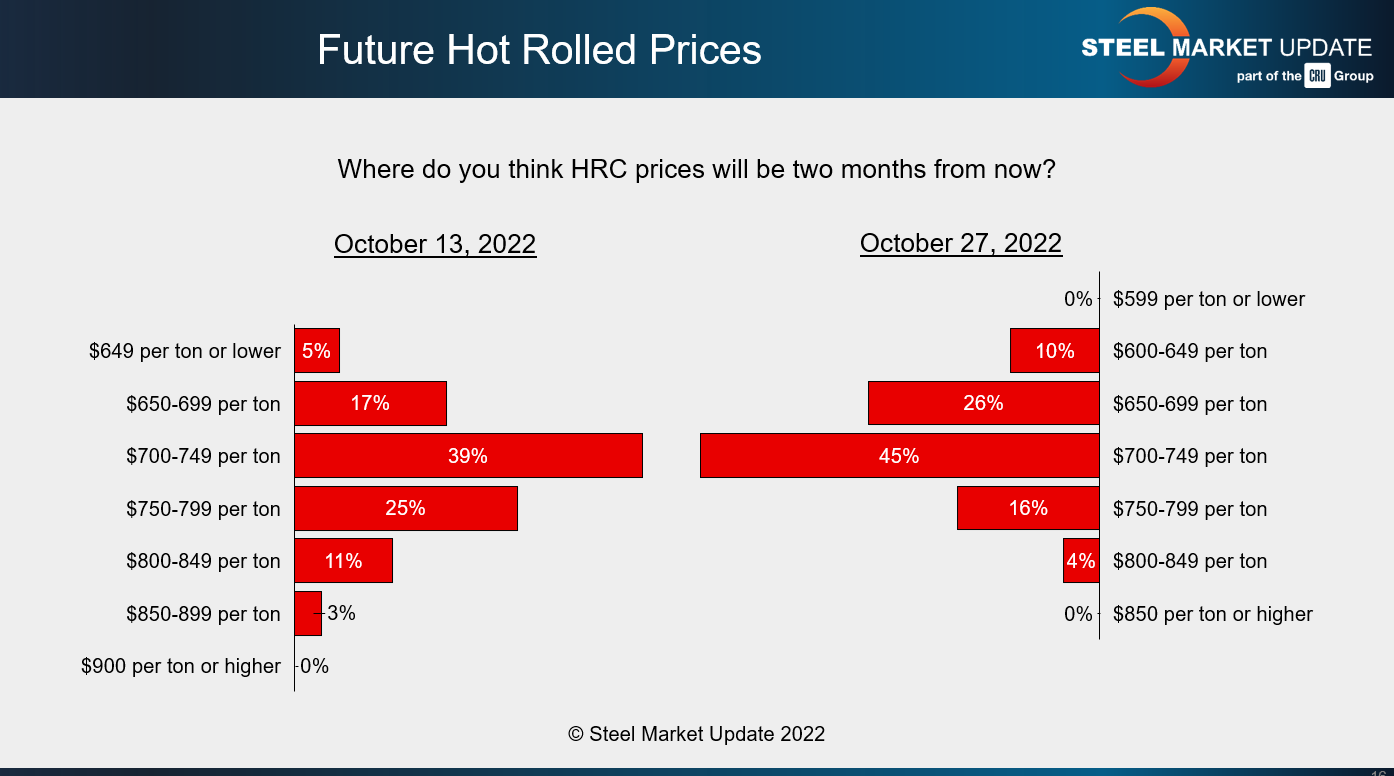

Let’s start with prices at the mill level:

Many respondents (45%) think HRC prices two months from now will be roughly where they are at present (~$700-750 per ton). But an increasing minority (36%) think they will drop into the $600s per ton – something we haven’t seen in two years. One silver lining: no one thinks HRC prices will drop into the $500s per ton.

I’d like to say I’m surprised by that result. But we’ve been noting for weeks that larger, technically non-spot deals were happening in the $600s per ton. The low end of our price range has dropped to that level over the last week. It’s an old story: yesterday’s special price becomes today’s prevailing price.

Also, we’ve been hearing about some lengthy secondary and excess prime lists being floated by various mills. Are those spot fob mill prices? No, of course not. Do they exert gravity over spot fob mill prices over time? Yes, they sure do.

That abundance of low-priced, non-prime material might partly explain why we’re seeing most service centers cutting prices again:

We now see more than 70% of service center respondents reporting that they are lowering prices to their customers. That’s a big change from just two weeks ago. It’s also the highest level we’ve seen since a market swoon earlier this year after the initial shock of the war in Ukraine passed.

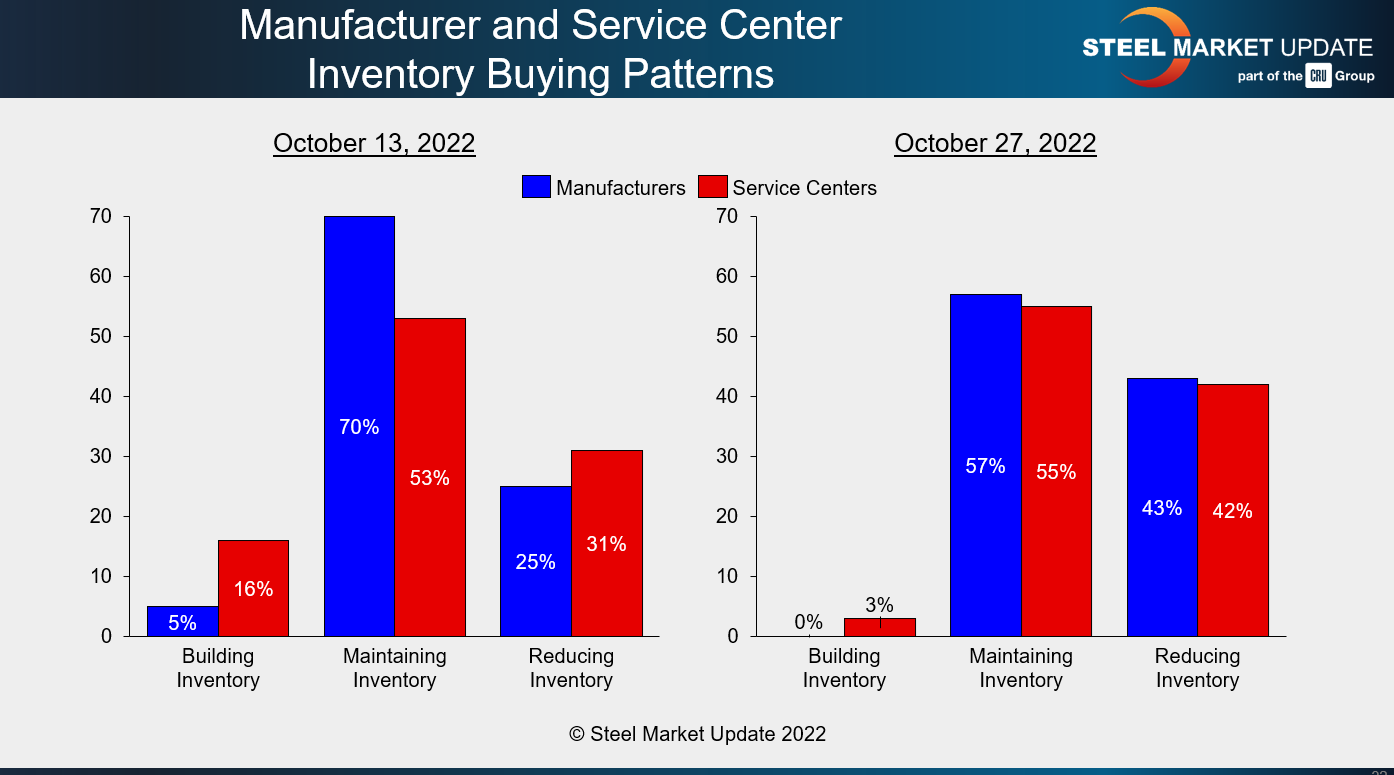

As for buying patterns, we don’t yet have inventory data crunched for October. But we can get an idea of what might be in from the chart below:

Here, too, we’ve seen a big shift between mid- and late October. More than 40% of steel buyer respondents now report back that they are reducing inventories, up from approximately 25-30% in our last survey. Vanishingly few say they are building stocks.

The question here, as it is with lower prices and slipping lead times, is whether this is a matter of typical seasonality or deteriorating supply-demand fundamentals.

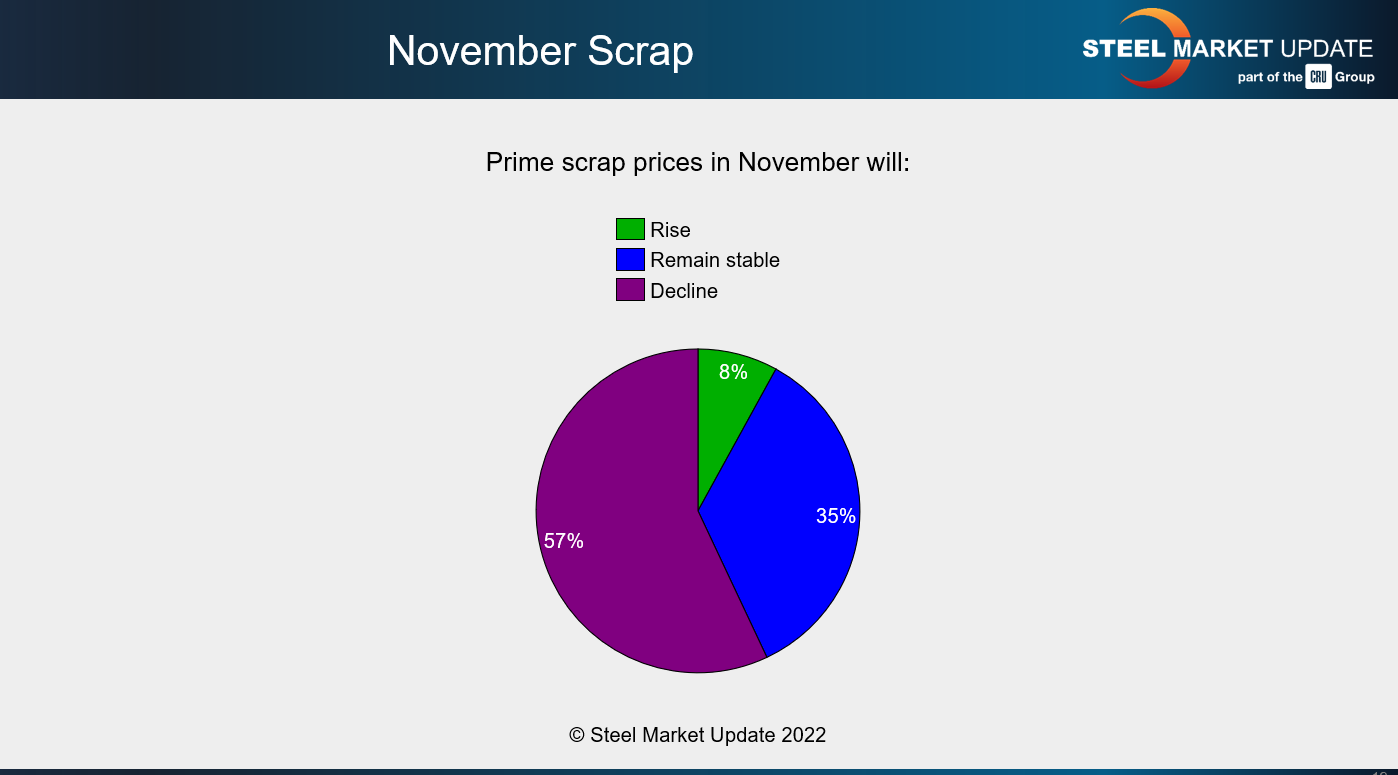

In the short term, there are few indications that the situation will improve. Take expectations for November price scrap prices. Almost no one expects a boost from scrap next month.

The takeaway: I wouldn’t be surprised if we continue to see both steel and scrap prices continue to trend down in November.

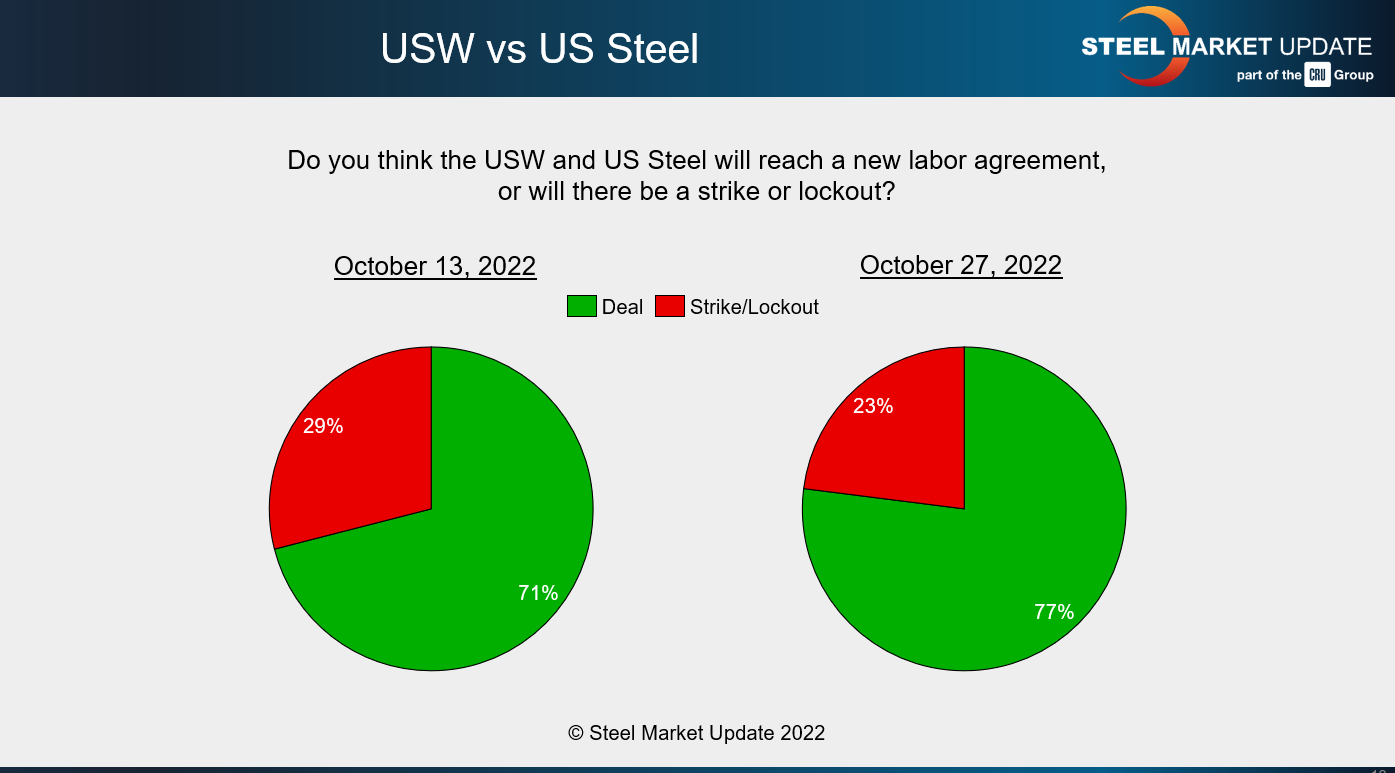

That said, it’s important not to get complacent about factors that might cause prices to move upward again. I’d continue to keep a close eye on ongoing labor talks between US Steel and the United Steelworkers (USW) union.

Recall that US Steel and the USW union remain without a new labor contract two months after a prior pact expired on Sept. 1. The growing consensus among survey respondents is that a deal will be reached:

I’m not saying that consensus wrong. There are precedents for a deal being reached well past the expiration of a prior pact. We saw that happen in talks between the USW and Canadian steelmakers Stelco and Algoma over the summer. And we saw it in the case of a US mill back in 2018, when the USW didn’t ratify a new deal with the former ArcelorMittal USA until late November – despite a prior pact expiring in September. But, like I said, it’s best not be complacent about such things.

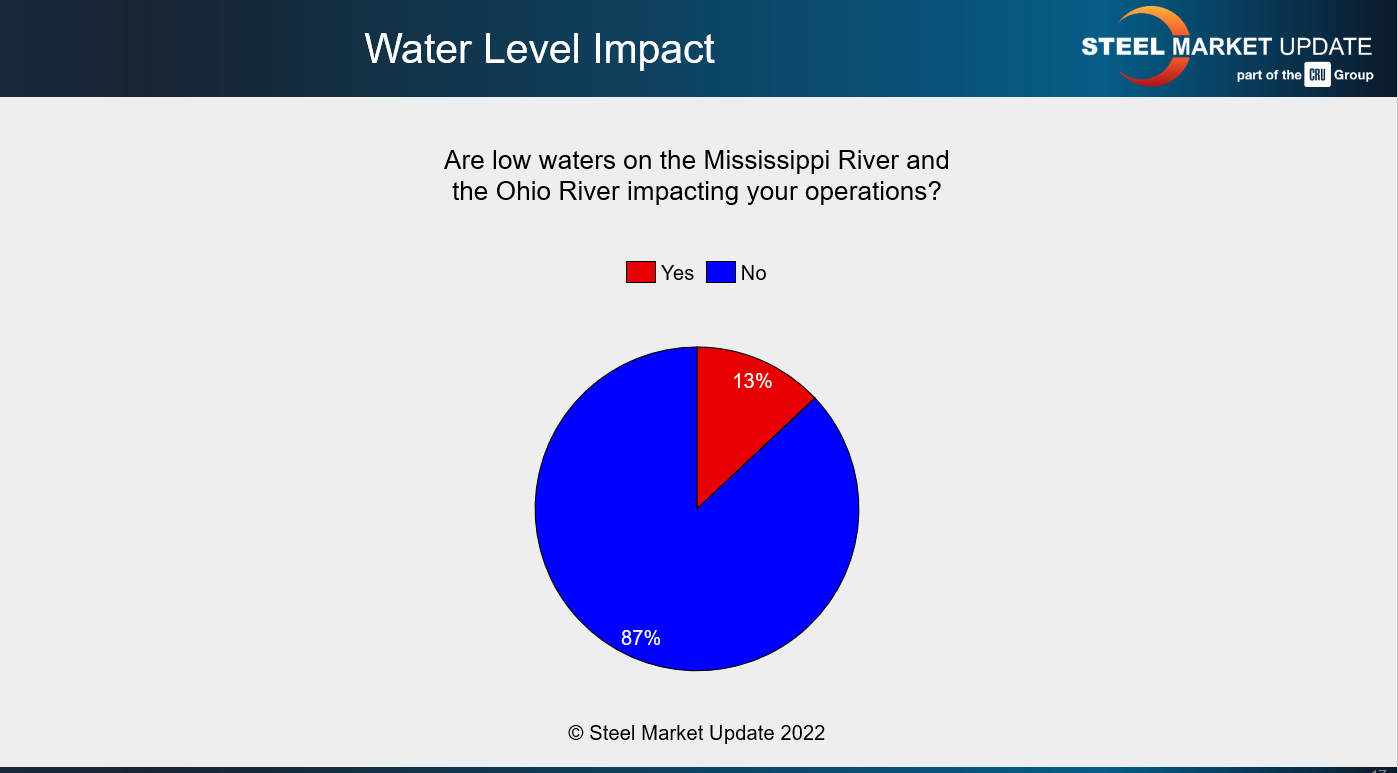

Finally, here is the survey result that surprised me the most. Because I think it has the potential to be the most disruptive.

The vast majority of SMU survey respondents say that their operations haven’t been impacted by dangerously low water levels on the Mississippi and Ohio rivers:

Maybe I should have asked whether you expected them to be impacted. Sure, maybe we’ll finally get some rain, and all of the headlines about a historic drought will prove fleeting. But what happens if water levels continue to drop?

I ask that because we’ve also seen the prospect of a nation-wide rail strike back in the news. I have a hard time understanding how we have enough capacity to move stuff – whether it be steel, scrap, cement or grain – at the height of harvest season with two major modes of transportation potentially compromised.

I hope that you all are right about the situation on the rivers and that I’m wrong. A surprise bit of good news would be a welcome change of pace.

SMU Events

Logistics will be the focus of a panel at our Tampa Steel Conference on Feb. 5-7. Last year, the theme was ports chaos given that it was almost impossible to dock and unload vessels. What will the theme be this year: drought on the Mississippi, a rail strike, or yet another Black Swan?

Whatever it is, you’ll want to hear the latest from leading experts across trucking, shipping and rail. You can learn more about the event and register here.

By Michael Cowden, Michael@SteelMarketUpdate.com