Market Segment

October 25, 2022

Cliffs’ Q3 Results Take a Hit, But Auto Demand Rebounds

Written by Laura Miller

Cleveland-Cliffs Inc. expects a continuation of the trend it saw in the third quarter of increasing shipments to the automotive sector. This should support steel pricing going forward, the steelmaker said in its Q3 earnings report released on Tuesday, Oct. 25.

![]() “Shipments to our automotive clients significantly improved in Q3, achieving a level among the highest in six quarters. That allowed us to hold sales volumes steady in Q3, despite much weaker service center activity,” noted Cliffs’ chairman, president, and CEO Lourenco Goncalves. “We expect this positive trend in automotive shipments to continue into Q4, with the added benefit of improved pricing from our successful renewal of contracts pertaining to the October cycle,” he added.

“Shipments to our automotive clients significantly improved in Q3, achieving a level among the highest in six quarters. That allowed us to hold sales volumes steady in Q3, despite much weaker service center activity,” noted Cliffs’ chairman, president, and CEO Lourenco Goncalves. “We expect this positive trend in automotive shipments to continue into Q4, with the added benefit of improved pricing from our successful renewal of contracts pertaining to the October cycle,” he added.

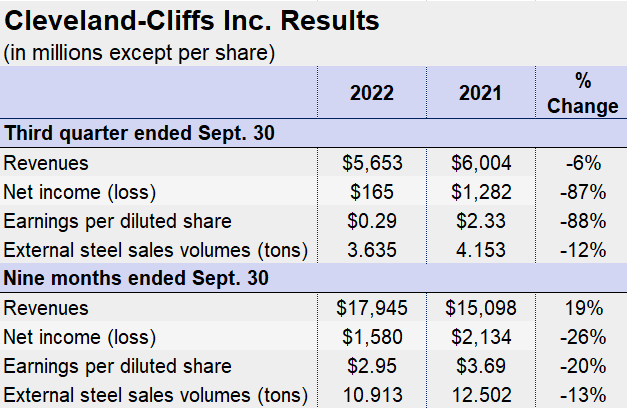

Cliffs’ external sales volumes were down 12% year-on-year (YoY) to 3.635 million tons in Q3, while revenues declined 6% to $5.635 billion. Net income, meanwhile, plummeted 87% to $165 million.

Goncalves said the Q3 results were impacted by “the delayed inventory impact of higher input costs” including natural gas, electricity, scrap, and alloys. Maintenance expenditures also affected the quarterly results, including a full reline of the No. 5 blast furnace at its Cleveland Works which was completed in August. He expects costs to decline going forward now that all major projects have been wrapped up and production levels are back to more normal levels.

Q3 steelmaking revenues totaled $5.5 billion, with 31% of direct sales going to the automotive market, 27% to distributors and converters, 27% to the infrastructure and manufacturing markets, and 15% to steel producers.

Of note during Q3, Cliffs reached new, four-year labor agreements with its United Steelworkers (USW) union represented steelworkers and mining workers and also reduced its post-retirement liabilities after successfully negotiating better healthcare rates for its retirees.

Cliffs’ outlook for the remainder of the year includes an average hot-rolled coil index price of $730 per net ton, higher slab shipments and higher production volumes, as well as lower energy and raw material costs.

By Laura Miller, Laura@SteelMarketUpdate.com