Prices

December 19, 2022

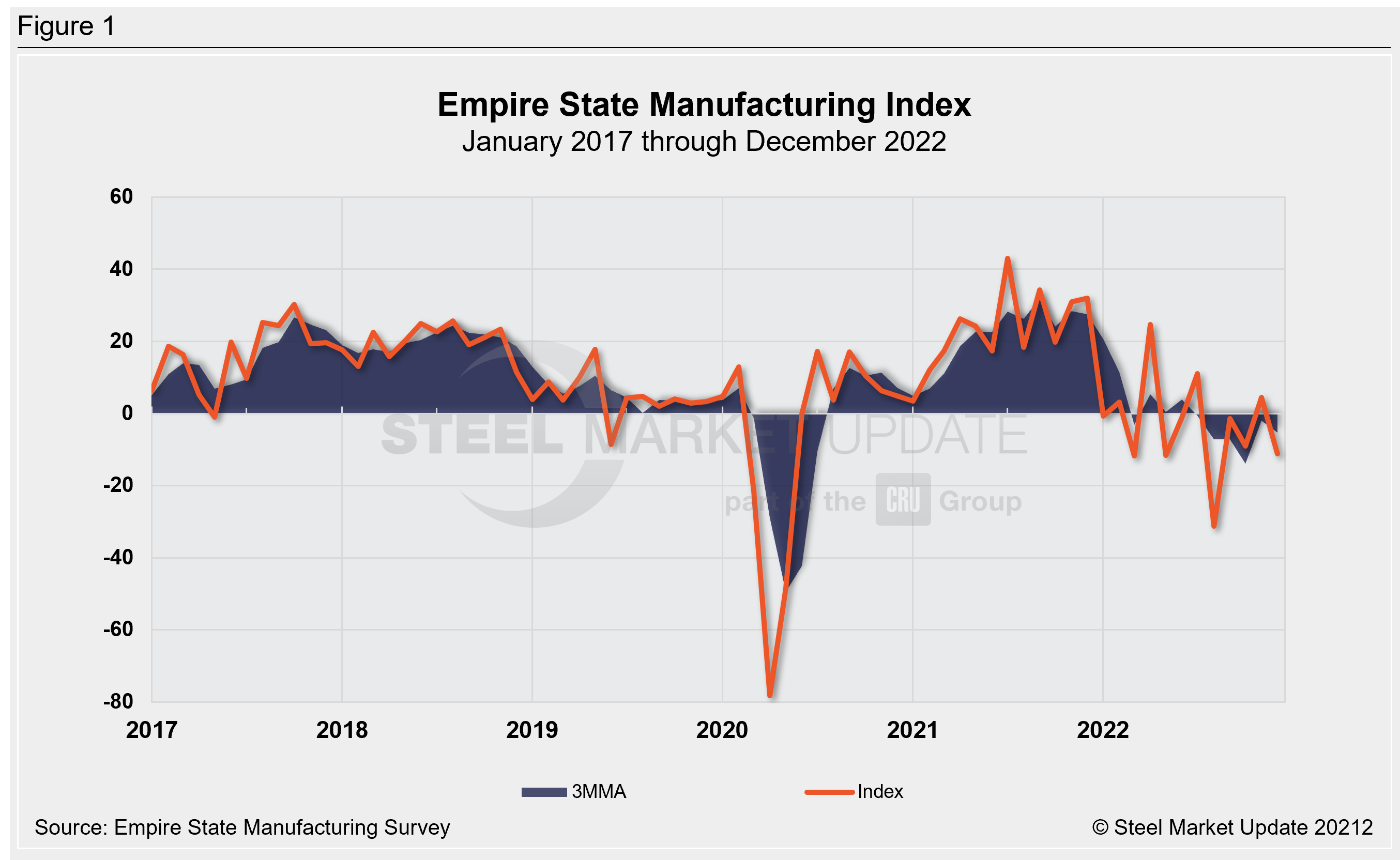

Empire State Manufacturing Index Down in December

Business activity declined in New York state in December, according to firms responding to the December Empire State Manufacturing Survey.

The New York Fed’s Empire State headline general business conditions index—a gauge of manufacturing activity in the state—fell sixteen points to -11.2, down 15.7 points from 4.5 in November.

![]() In December, 23.1% of respondents reported conditions had improved during the month, while 34.3% said conditions had worsened.

In December, 23.1% of respondents reported conditions had improved during the month, while 34.3% said conditions had worsened.

New orders dipped in December, with 30.3% seeing lower orders vs. 26.7% seeing higher orders, while shipments edged higher, with 28.7% seeing higher shipments and 23.4% lower, respectively.

The December general index for new orders stood at -3.6 compared to -3.3 in November, a decline of 0.3 points. For shipments, the December general index was 5.3, down 2.7 from 8.0 in November.

The index for delivery times was 1.9 in December, down 1.0 from 2.9 the previous month, and inventories stood at 3.7, a 12.8.-point decline from November’s 16.5.

Despite the overall decline in activity, the index for number of employees edged up to 14.0 from 12.2 the previous month, marking another month of employment gains, the survey said.

However, the index for the average employee workweek declined to -4.5 from 6.9 in November, down 11.4 points.

The index for future business improvement climbed 12.4 points, “but remained subdued at 6.3, suggesting that firms expect little improvement over the next six months.”

“The indexes for future new orders and shipments climbed above zero, indicating that small increases are anticipated, and employment is expected to continue to increase,” the survey said.

An interactive history of the Empire State Manufacturing Index is available on our website. If you need assistance logging into or navigating the website, please contact us at info@SteelMarketUpdate.com .

By Ethan Bernard, Ethan@Steelmarketupdate.com