Prices

January 3, 2023

SMU Price Ranges: Sheet Starts '23 Moving Up

Written by Michael Cowden

Sheet prices entered 2023 moving upward on expectations of higher prime scrap prices, and on a modest uptick in activity as some buyers looked to get ahead of anticipated higher steel prices as well.

The gains also came on the heels of a price increase of $50 per ton ($2.50 per cwt) initiated last month by Cleveland-Cliffs. Other major mills didn’t publicly follow that price hike but are now quietly enforcing higher prices, market participants said.

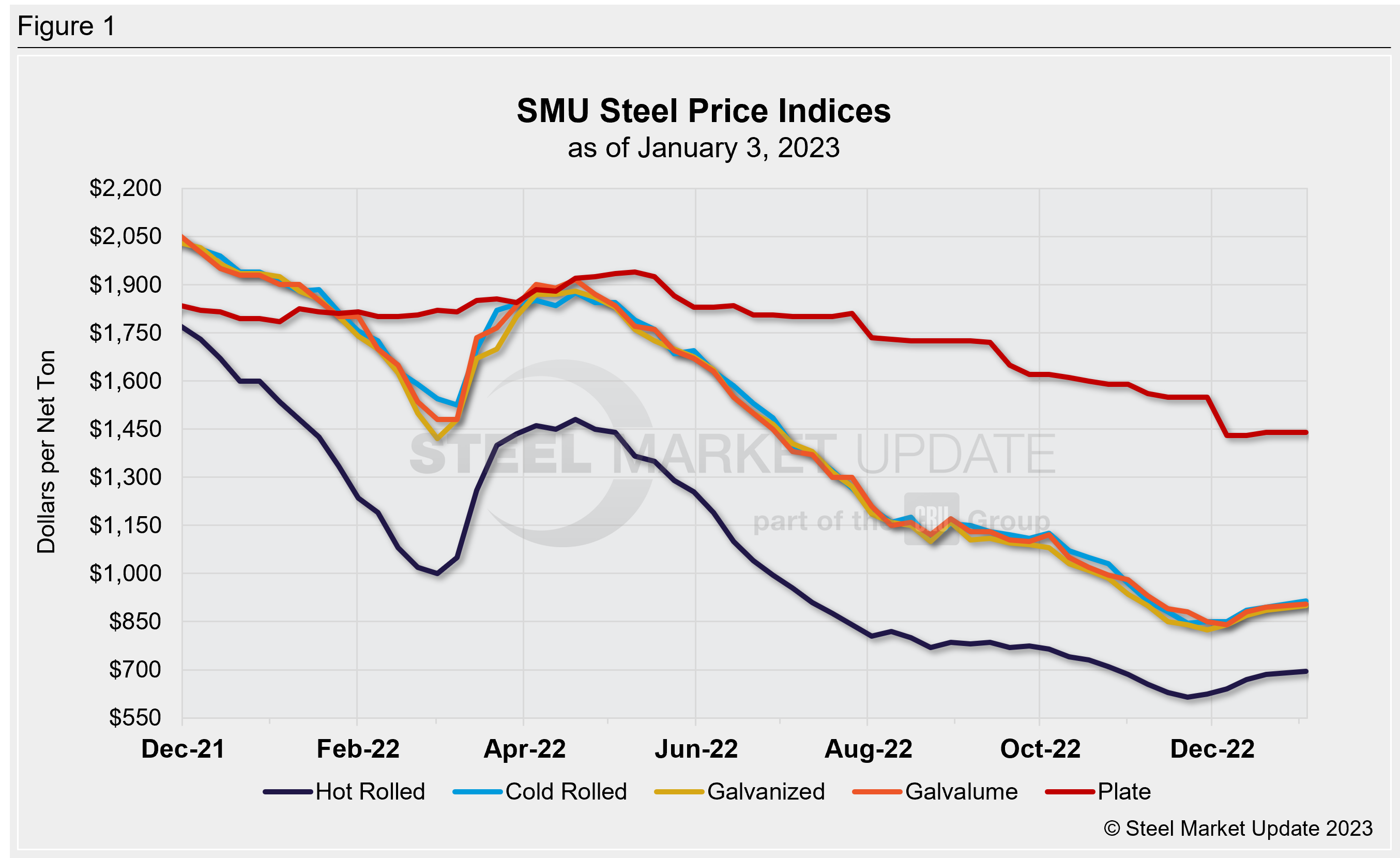

All told, SMU’s benchmark hot-rolled coil price stands at $695 per ton, up $10 per ton from before the holidays and up $80 per ton from a 2022 low – recorded before Thanksgiving – of $615 per ton.

Cold-rolled and coated products saw similar gains, with cold rolled recording the biggest (+$20/ton) jump since our prior assessment.

Mills have announced price hikes totaling $110 per ton since Thanksgiving. Recall that domestic mills also announced a round of $60-per-ton price increases after the November holiday.

Our sheet momentum indicators remain pointing upward. We’re holding our plate momentum indicator at neutral following Nucor’s announcement that it would keep plate prices unchanged.

Hot-Rolled Coil: The SMU price range is $650–740 per net ton ($32.50–37.00/cwt), with an average of $695 per ton ($34.75/cwt) FOB mill, east of the Rockies. Both the lower and upper ends of our range increased $10 per ton compared to two weeks ago. Our overall average is up $10 per ton from two weeks ago. Our price momentum indicator on hot-rolled steel points to Higher, meaning we expect prices to increase over the next 30 days.

Hot-Rolled Lead Times: 3–7 weeks* (preliminary ranges from our ongoing market survey, final lead times data will be released on Thursday)

Cold-Rolled Coil: The SMU price range is $860–970 per net ton ($43.00–48.50/cwt) with an average of $915 per ton ($45.75/cwt) FOB mill, east of the Rockies. Both the lower and upper ends of our range increased $20 per ton compared to two weeks ago. Our overall average is up $20 per ton from two weeks ago. Our price momentum indicator on cold-rolled steel points to Higher, meaning we expect prices to increase over the next 30 days.

Cold-Rolled Lead Times: 5–9 weeks*

Galvanized Coil: The SMU price range is $860–940 per net ton ($43.00–47.00/cwt) with an average of $900 per ton ($45.00/cwt) FOB mill, east of the Rockies. The lower end of our range increased $40 per ton compared to two weeks ago, while the upper end decreased $10 per ton. Our overall average is up $15 per ton from two weeks ago. Our price momentum indicator on galvanized steel points to Higher, meaning we expect prices to increase over the next 30 days.

Galvanized .060” G90 Benchmark: SMU price range is $957–1,037 per ton with an average of $997 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 4–8 weeks*

Galvalume Coil: The SMU price range is $880–930 per net ton ($44.00-46.50/cwt) with an average of $905 per ton ($45.25/cwt) FOB mill, east of the Rockies. The lower end of our range increased $50 per ton compared to two weeks ago, while the upper end decreased $30 per ton. Our overall average is up $10 per ton from two weeks ago. Our price momentum indicator on Galvalume steel points to Higher, meaning we expect prices to increase over the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1,174–1,224 per ton with an average of $1,199 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 7–8 weeks*

Plate: The SMU price range is $1,400–1,480 per net ton ($70.00–74.00/cwt) with an average of $1,440 per ton ($72.00/cwt) FOB mill. Both the lower and upper ends of our range remained unchanged compared to two weeks ago. Our overall average is unchanged from two weeks ago. Our price momentum indicator on steel plate points to Lower, meaning we expect prices to decrease over the next 30 days.

Plate Lead Times: 3–7 weeks*

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com.

By Michael Cowden, Michael@SteelMarketUpdate.com