Product

January 17, 2023

Final Thoughts

Written by Michael Cowden

Cleveland-Cliffs has announced a sheet price hike of $50 per ton ($2.50 per cwt) and new base prices for hot-rolled coil of $800 per ton ($40 per cwt).

The big question now is not whether prices will continue to go up one or two weeks from now, but whether a price rally that began after Thanksgiving can continue deeper into the first quarter.

That rally has seen hot-rolled coil prices rise from a 2022 low of $615 per ton before Thanksgiving to $740 per ton in our most recent check of the market. That’s an impressive $125-per-ton gain in less than two months, according to our pricing tool.

The criticism of the upswing is twofold: 1) It’s been largely momentum based. Consumers buying ahead of the next anticipated price increase. And, 2) It isn’t supported by underlying demand, which could slow later in the year as the impact of higher interest rates becomes more pronounced on financing for everything from big construction projects to new cars and trucks.

In other words, the concern is less about current demand than about future demand. In construction, for example, work already underway will be completed. But how many new projects can be financed at current high interest rates?

Another big question: If mills really think this rally has legs – and some seem very proud of their latest increases – why is capacity utilization only at 71.7%? That’s down from nearly 80% a year ago, according to figures from the American Iron and Steel Institute (AISI).

If mills really think higher prices are here to stay, why aren’t we seeing more hours being added, more output from electric-arc furnace (EAF) mills, or maybe even an integrated producer restarting a blast furnace?

Let’s set aside those longer-term question for a moment and take a look at preliminary results from our flat-rolled market trends survey. (This is a sneak peek. We will release final results on Friday.)

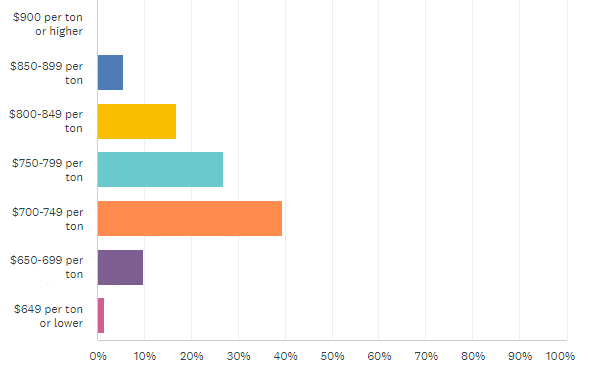

We asked steel market participants, as we do in each survey, where they think prices will be two months from now. Here are the latest results:

Nearly 23% of survey respondents think HRC prices will be above $800 per ton two months from now, up from only 5% at the beginning of January. Only 11% think tags will fall below $700 per ton two months from now, down from 25% in our last survey.

So there is a decent chance $800-per-ton HRC is in the cards, right? Perhaps. But sentiment captured in response to our question about future steel prices was decidedly mixed.

Here are a few responses that I found noteworthy. They’re roughly in order from most bullish to most bearish:

“The latest Cliffs increase is asking for $800/ton, and we do not see that buyers have options in the near term.”

“Service center stocking and end-use demand will keep the price firm to up.”

“There is very little offshore metal coming in, and demand is decent.”

“Over-inventoried companies are going back to the market, fueling higher demand. Also, winter slowdowns are ending.”

“There remains some room to head higher, but Cliffs’ claim of ‘minimum base price for hot rolled steel is now $800 per net ton’ seems like wishful thinking.”

“The market is not on solid ground.”

“The market is rebounding from the bottom and typically overcorrects before it settles. Demand is still not robust enough to support sustained increases over $750/ton.”

“Mills always push the numbers up in Q1, hope to hold through Q2, and give up July 1 and chase each other to the bottom!”

“While the upward price trend has some momentum, economic headwinds from inflation and demand destruction will cap and reverse any short-term positive trends.”

Does that match what you’re hearing in the market? If not, let us know. Our survey aims to capture a snapshot of the market as it is. So don’t just read our data, see your company’s experience reflected in it! Email us at info@steelmarketupdate.com if you’d like to participate.

By Michael Cowden, Michael@SteelMarketUpdate.com