SMU Price Ranges: Sheet sees modest increase, plate jumps

Sheet prices continue to grind higher on tight supply and 'okay' demand. Plate finally saw some movement after weeks of stability as price increases begin to stick.

Sheet prices continue to grind higher on tight supply and 'okay' demand. Plate finally saw some movement after weeks of stability as price increases begin to stick.

Nucor’s consumer spot price (CSP) for hot-rolled coil increased to $990 per short ton (st), up $10/st from last week.

Participants in the domestic sheet market say they experienced lighter inquiries and fewer orders than in previous weeks, rendering domestic mill price increases for spot-market hot- and cold-rolled coils irrelevant.

The spread between domestic hot-rolled coil and prime scrap prices widened slightly in February. It has been trending in that direction since October.

The galvanized steel market is navigating price increases and longer lead times with a surer footing than in prior months.

Hot rolled and galvanized lead times are about half a week longer than they were three months ago, while production times for cold rolled, Galvalume, and plate products are one to two weeks longer.

Since late 2025, mills have begun to hold a firmer stance on prices, tightening their grip at the start of this year and holding on since

Three of SMU’s price indices increased this week, while two remained steady, all holding at multi-month highs.

A narrow range has emerged, suggesting the market’s repricing of downside risk is starting to stick.

Hot-rolled coil hovering near $970 per ton could push toward $1,000, but Timna Tanners cautioned at the Tampa Steel Conference that anything “much above that” becomes difficult to sustain. Still, she argued that mills’ slow, disciplined price increases are working in their favor.

SMU’s sheet price indices inched up to new multi-month highs this week, while plate prices held steady.

Nucor’s consumer spot price (CSP) for hot-rolled coil increased to $975 per short ton (st), up $5/st from last week.

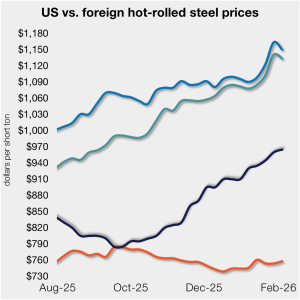

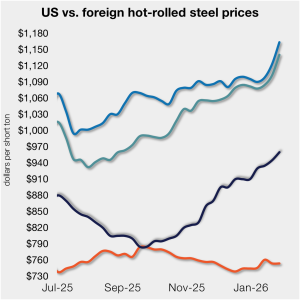

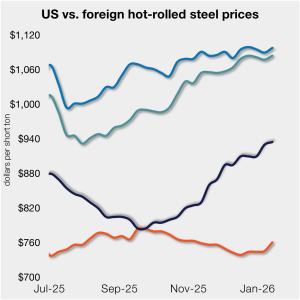

The price gap between US hot-rolled coil and landed offshore product narrowed this week, as price movements stateside and abroad diverged.

One third of the steel buyers responding to our market survey this week reported that domestic mills are negotiable on new spot order pricing. Mills began to hold a firmer stance on prices towards the end of last year, tightening their grip in early January and holding it since.

Steel mill lead times marginally declined on sheet products this week but edged higher on plate, according to responses from SMU’s latest market survey. Overall, lead times remain one to two weeks longer than levels seen three months ago.

Flat-rolled steel prices inched upward again this week as mixed demand appeared to be offset by limited supplies.

Nucor’s consumer spot price (CSP) for hot-rolled coil increased to $970 per short ton, up $5/st from last week.

The price gap between US hot-rolled coil and landed offshore product inched higher, even as prices stateside and abroad mostly moved in tandem vs. last week.

What do SMU's latest survey results show about the current market take on tariffs and where HRC prices are going?

Sheet prices mostly continued their uneven but steady march higher this week, according to SMU’s latest check of the market.

Nucor’s consumer spot price (CSP) for hot-rolled coil increased to $965 per short ton (st), up $5/st vs. the prior week.

The price gap between US hot-rolled coil (HR) and landed offshore product has been relatively flat to begin the year.

SMU’s sheet price indices climbed to new multi-month highs this week, while plate prices marginally declined.

Nucor’s consumer spot price (CSP) for hot-rolled coil increased to $960 per short ton (st), up $10/st vs. the prior week.

US service centers’ flat-rolled steel supply recovered in December, after trending lower from September to November.

The price spread between domestic hot-rolled coil and prime scrap widened for a fourth consecutive month in January, based on SMU’s most recent pricing data.

The majority of SMU’s sheet and plate price indices rose this week, with multiple products climbing to new multi-month highs

Nucor’s consumer spot price (CSP) for hot-rolled coil remains unchanged at $950 per short ton (st) for the fourth consecutive week.

Sources in the domestic hot-rolled sheet market say they are standing by for an uptick in customer demand. These service center market participants, located in various regions of the US, expect to handle an influx of customer orders this month.

Mill spot price negotiation rates have tumbled across all products SMU tracks, according to our latest survey data.