Market Segment

February 16, 2023

HR Futures Move Higher, Inflation or Demand Driving Price Hikes?

Written by Jack Marshall

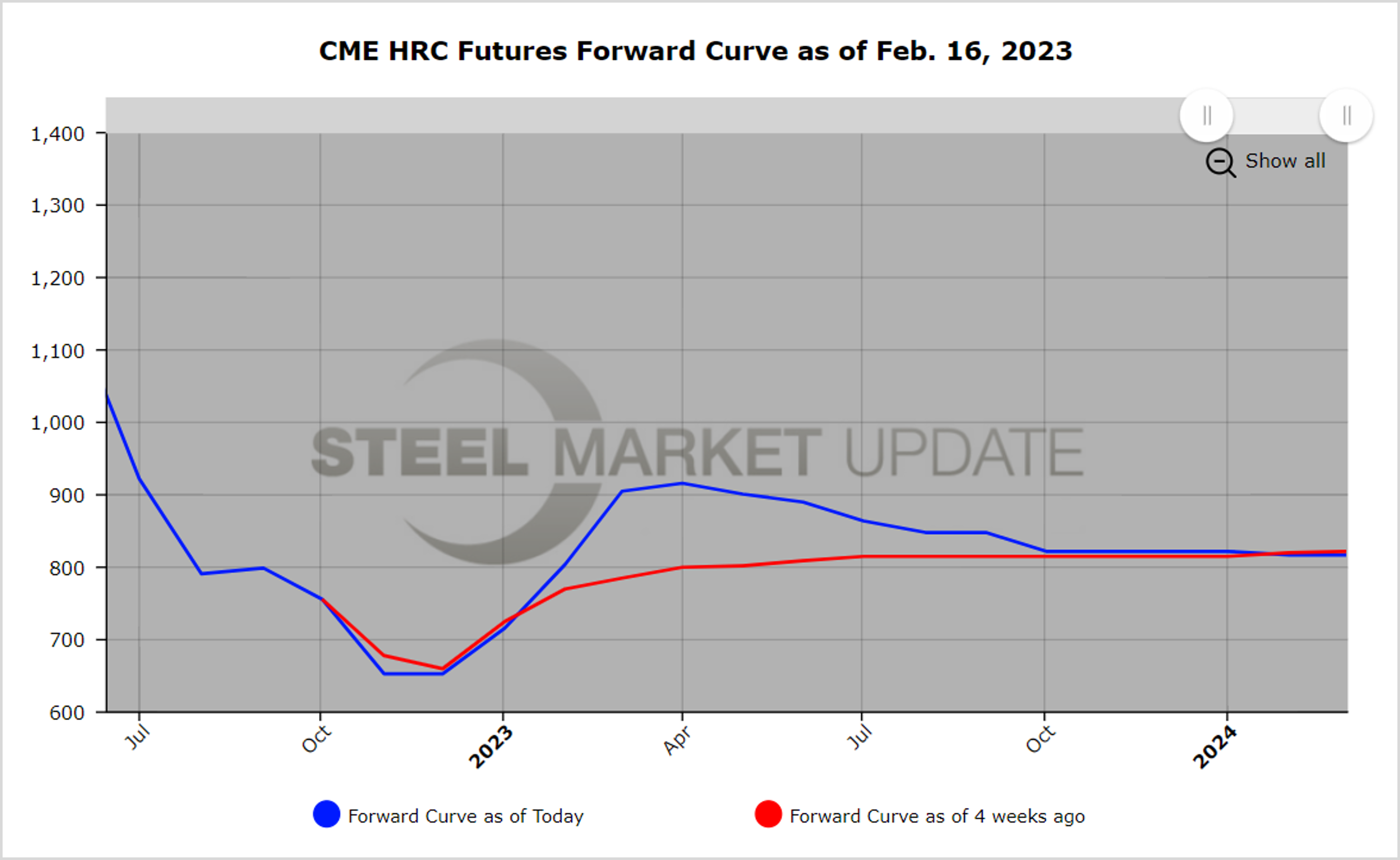

Inflation indeed! Hot-rolled (HR) spot indexes have risen about $40 per short ton (ST) since the beginning of February. HR futures settlements for the period between Feb. 1 and Feb. 16 also reflect rising prices. The average weighted price for Q2’23 is up over $108/ST to $902/ST; Q3’23 up $65/ST to $853/ST; and Q4’23 up $32/ST to $822/ST. This is quite a quick shift higher in the HR futures curve. It also reflects the lagging nature of the index to the physical prices available as recent multiple mill price increase announcements have outpaced the index. A number of mills are asking $900/ST for base HR.

The HR indexes ended 2022 at roughly $665/ST, and have risen $145/ST as of the latest push to approximately $810/ST. Declining HR imports and still low but improving capacity utilization numbers support the current Mar’23 HR future. This reflects the expectation the mills will get their latest published prices.

While the open interest in HR futures has increased about 2,000 contracts since the beginning of the month, the market has yet to decide whether this is due to actual increases in physical demand, or potentially just a short squeeze on futures risk positions. Generally, physical HR hedgers have been rather quiet of late after a busy January turn. A number of them have cited expectations of softer demand in the middle quarters due to the effects of further rate increases. This is reflected in the increasing backward slope of prices between Mar’23 and Mar’24.

In comparing Feb. 1 to Feb. 16 settles of the Mar’23 vs. Mar’24, HR futures widened from -$23/ST ($805/ST vs $782/ST) to -88/ST ($905/ST vs. $817/ST).

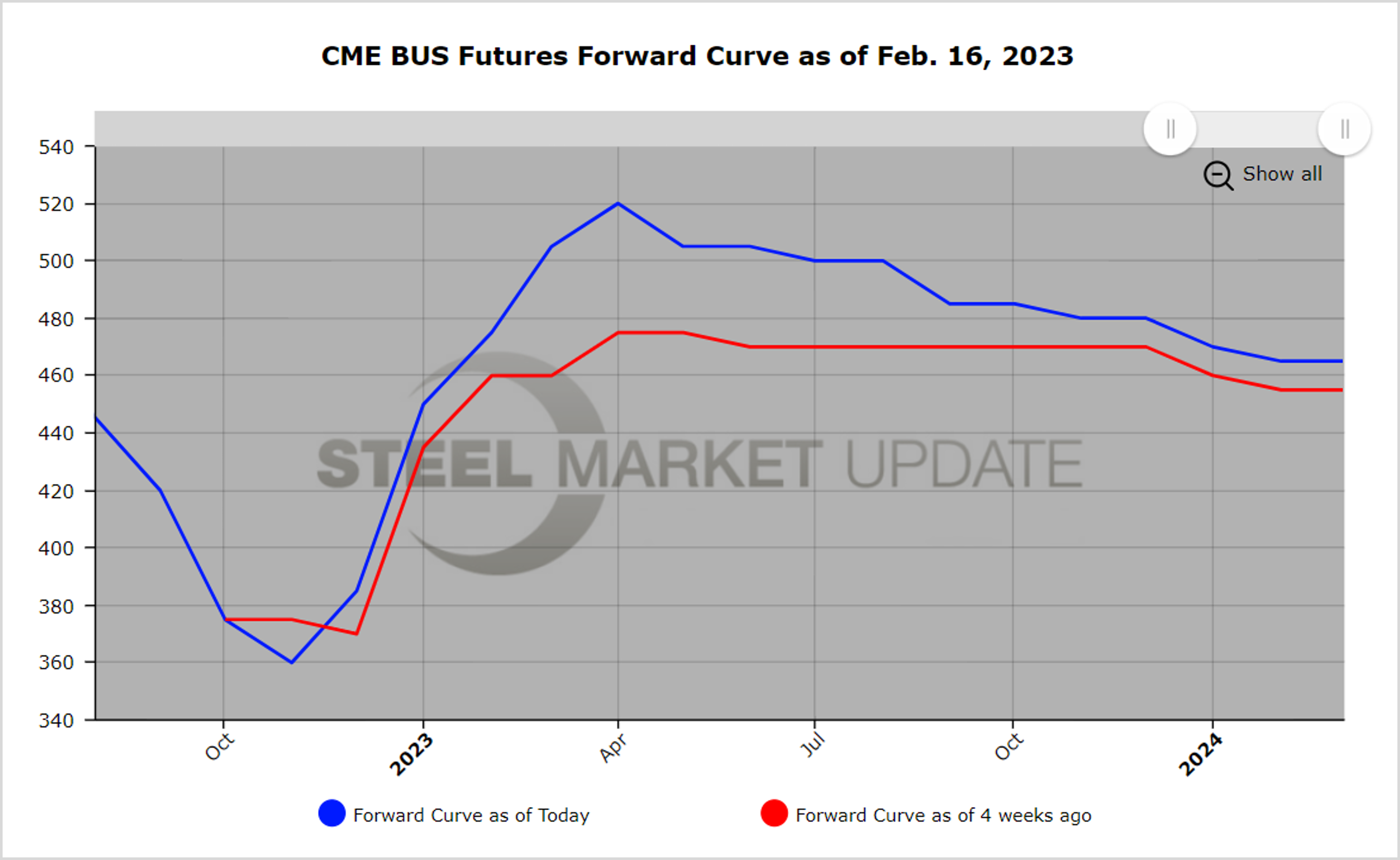

BUS futures prices are being pulled higher in the wake of the multiple HR price hikes. Surprisingly, the February BUS settlement was up $26.19 to $475.25/GT. February is typically an off month. The latest BUS futures activity has Mar’23 BUS trading north of $500/GT, with the 2H’23 BUS offered at $485/GT. BUS futures activity has been somewhat muted at the higher settlement prices along the futures curve.

Earthquakes in Turkey likely will lead to some temporary softness for export of 80/20 scrap in the near term. The latest US export cargo prices are down slightly. That, along with warmer spring weather, should also help to improve scrap flows. This might be offset by steadily increasing production from the lower current capacity utilization and the increase in the production from new electric-arc furnace (EAF) plants.

By Jack Marshall of Crunch Risk LLC