Market Data

May 16, 2023

Service Center Shipments and Inventories Report for April

Written by Estelle Tran

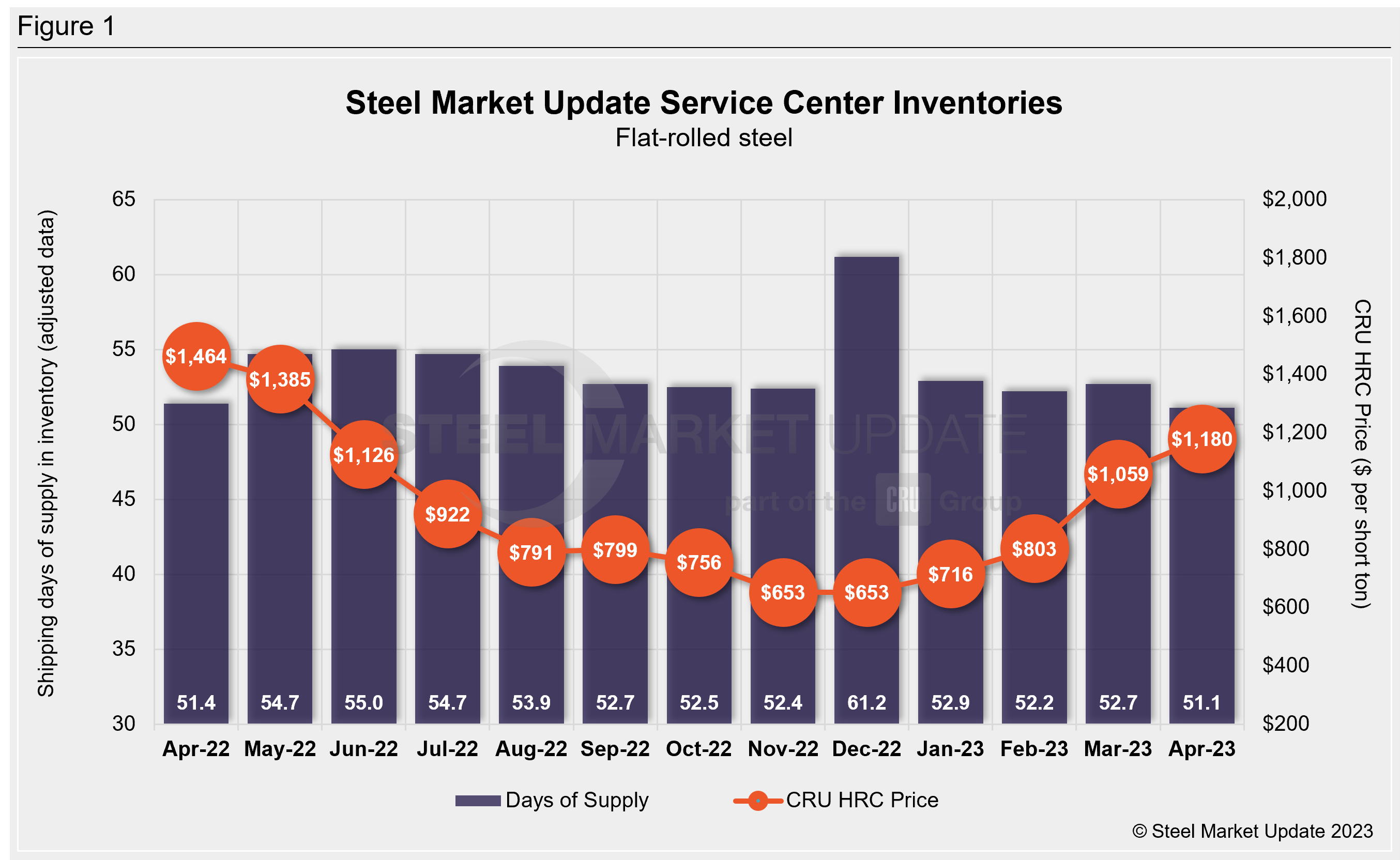

Flat Rolled = 51.1 Shipping Days of Supply

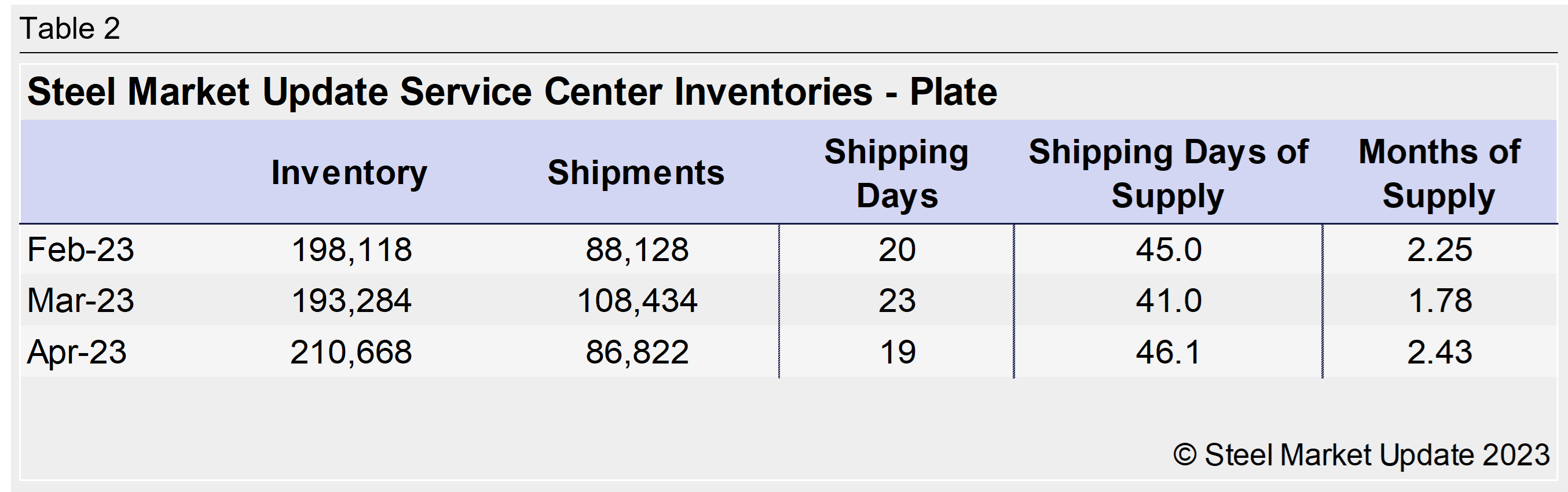

Plate = 46.1 Shipping Days of Supply

Flat Rolled

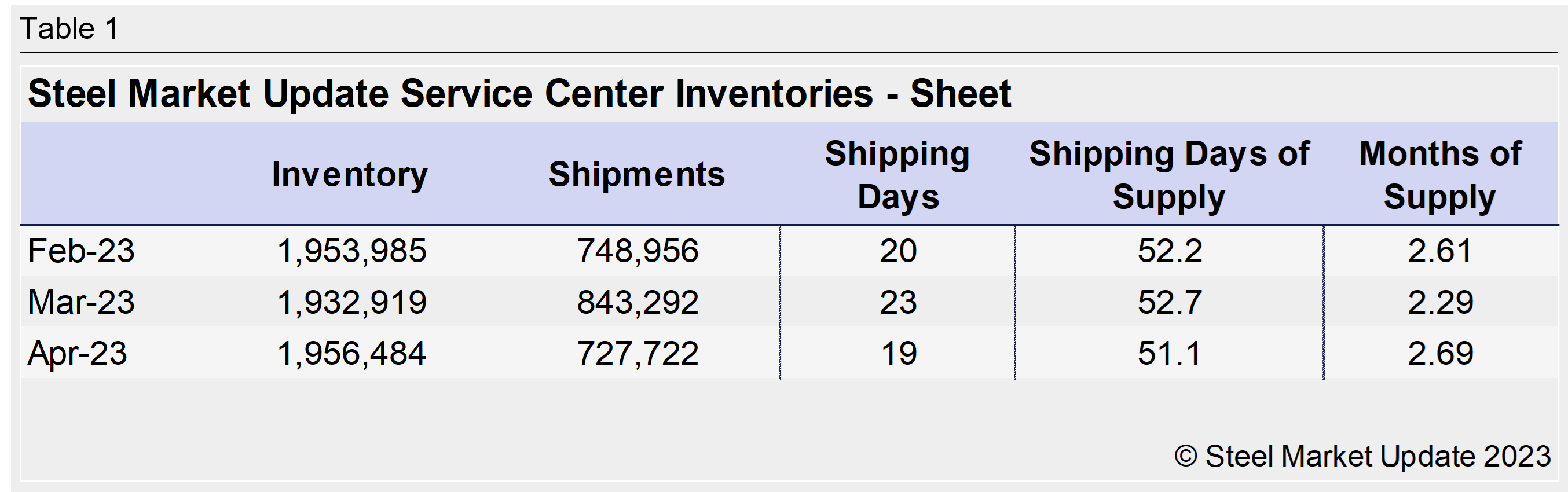

US service center flat-rolled steel inventories in April increased in terms of months of supply, according to SMU data. At the end of April, service centers had 2.69 months of flat-rolled steel on hand on an adjusted basis, up from 2.29 months of supply in March.

There is some noise in the data because April was a short month with 19 shipping days, compared to March’s 23. Furthermore, more than half of service centers surveyed did not observe Good Friday as a holiday and thus had 20 April shipping days. Last month, service centers had 51.1 shipping days of supply, a decrease from 52.7 shipping days in March. However, with 20 shipping days used in the calculation, the total amount of flat-rolled steel would have represented an increase with 53.8 shipping days.

Outbound shipments were higher than expected in April, even with the shorter month. Flat-rolled steel intake increased at the same time outbound shipments remained strong, possibly suggesting more trade among service centers.

Service centers have reported that they are still largely maintaining inventories. The April 26 survey showed 81% of service centers were maintaining inventories, down from 88% in the April 12 survey. Meanwhile, 14% of service centers said they were reducing inventories in the latest survey, an increase from 8% in the April 12 survey.

Material on order eased for the second month but remains high compared to 2022 levels. With the high level of material on order and shipments starting to slow, inventories look to be on the heavier side. This has already caused a slowdown in new mill orders. The percentage of flat-rolled steel inventory on order was 77.3% in April, down from 81.9% in March. The number of shipping days of supply on order edged down in April vs. March.

Meanwhile, flat-rolled steel prices and lead times peaked in April. The April 26 SMU survey reported HRC lead times at 6 weeks, down from 6.68 weeks on March 30. With high levels of material on order, service centers have pulled back on new orders.

Plate

US service center plate inventories in April rebounded from a deficit but remain low. At the end of April, service centers carried 46.1 shipping days of supply, up from 41 shipping days in March on an adjusted basis. In terms of months on hand, plate supply represented 2.43 months of supply in April, up from 1.78 months in March.

Plate inventories surprised to the upside with more inbound material and shipments slowing. The daily shipping rate in April eased back 3%. Anecdotally, we have heard that some service center customers requested their April orders to be shipped early. The March shipping rate was particularly strong and the highest rate seen since before the pandemic.

While mills have struggled to raise prices, they are seeing longer lead times. SMU’s April 26 survey showed plate mill lead times to be 6.75 weeks, up from 6.1 weeks in the March 30 survey.

This is also evident in the elevated on-order data. Plate on order at the end of April represented 103.9% of service center inventories, down from 116.4% in March. The amount of plate on order in April is down vs. March.

Even with the high level of material on order, inventories for plate may remain in a deficit with demand holding steady. Import offers have been attractive, particularly for plate from Asia. We expect that this could be a contributor to the high level of material on order now and in the near future.

By Estelle Tran, estelle.tran@crugroup.com