Analysis

May 18, 2023

Housing Starts Showing Gradual Improvement, Still Down On-Year

Written by Laura Miller

Single-family housing starts are showing gradual improvement so far this year, according to the National Association of Home Builders (NAHB), which looked at data from the US Department of Housing and Urban Development and the US Census Bureau.

![]()

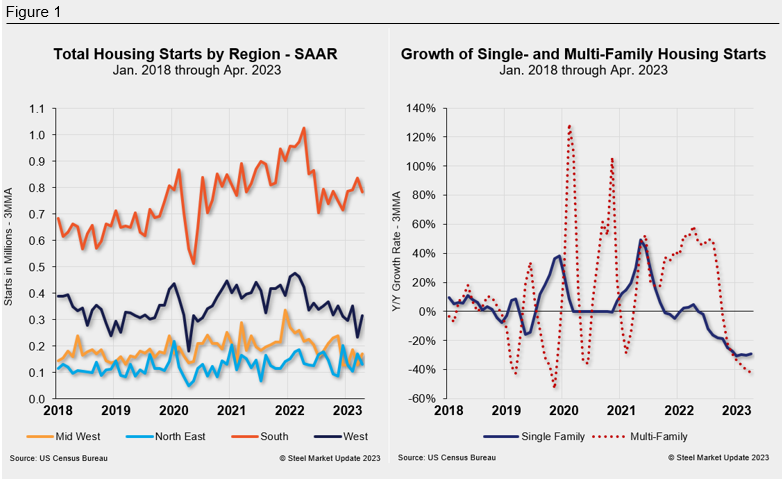

Overall housing starts, at a seasonally adjusted annual rate (SAAR) of 1.4 million units in April, were 2.2% higher than March but were 22.3% below the April 2022 annualized rate of 1.8 million units.

Single-family starts were 1.6% higher at a SAAR of 846,000 units but were 28% lower than April 2022. Multifamily starts were 3.2% higher sequentially at an annualized rate of 555,000 units.

“Single-family starts are showing gradual improvement from the beginning of the year, and this is reflected in our builder sentiment surveys, which are up for five consecutive months,” commented Alicia Huey, NAHB chairman and a custom home builder and developer in Birmingham, Ala.

“Due to a lack of inventory for resales, we expect to see further improvement for single-family production in the months ahead even as builders continue to grapple with supply-chain and labor shortages,” Huey added.

NAHB pointed out that apartments under construction, at 977,000 units, were at their highest level since 1973. Single-family homes under construction, meanwhile, were down 16% from May 2022’s peak of 831,000 units to 698,000 units in April.

“As the Federal Reserve nears the end of its tightening of financial conditions, we expect mortgage rates to moderate in the months ahead, and this will lead to a gradual improvement in single-family production,” said Robert Dietz, NAHB chief economist.

“Multifamily permits are down 23% year over year, and this indicates a slowdown for apartment construction is underway due to a tighter lending environment,” he noted.

On a year-to-date basis, total housing starts were lower in all regions: -8.9% in the Northeast, -29.5% in the Midwest, -15.9% in the South, and -29.7% in the West.

By Laura Miller, laura@steelmarketupdate.com