Prices

June 8, 2023

May Import Licenses Steady, Flat-Rolled at 9-Month High

Written by Laura Miller

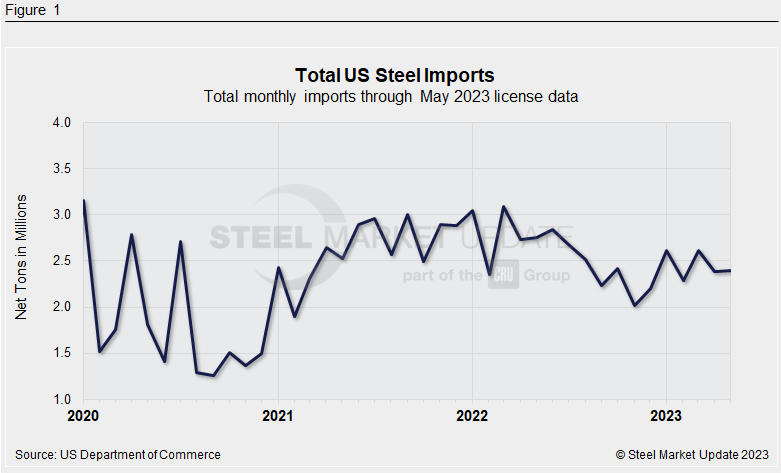

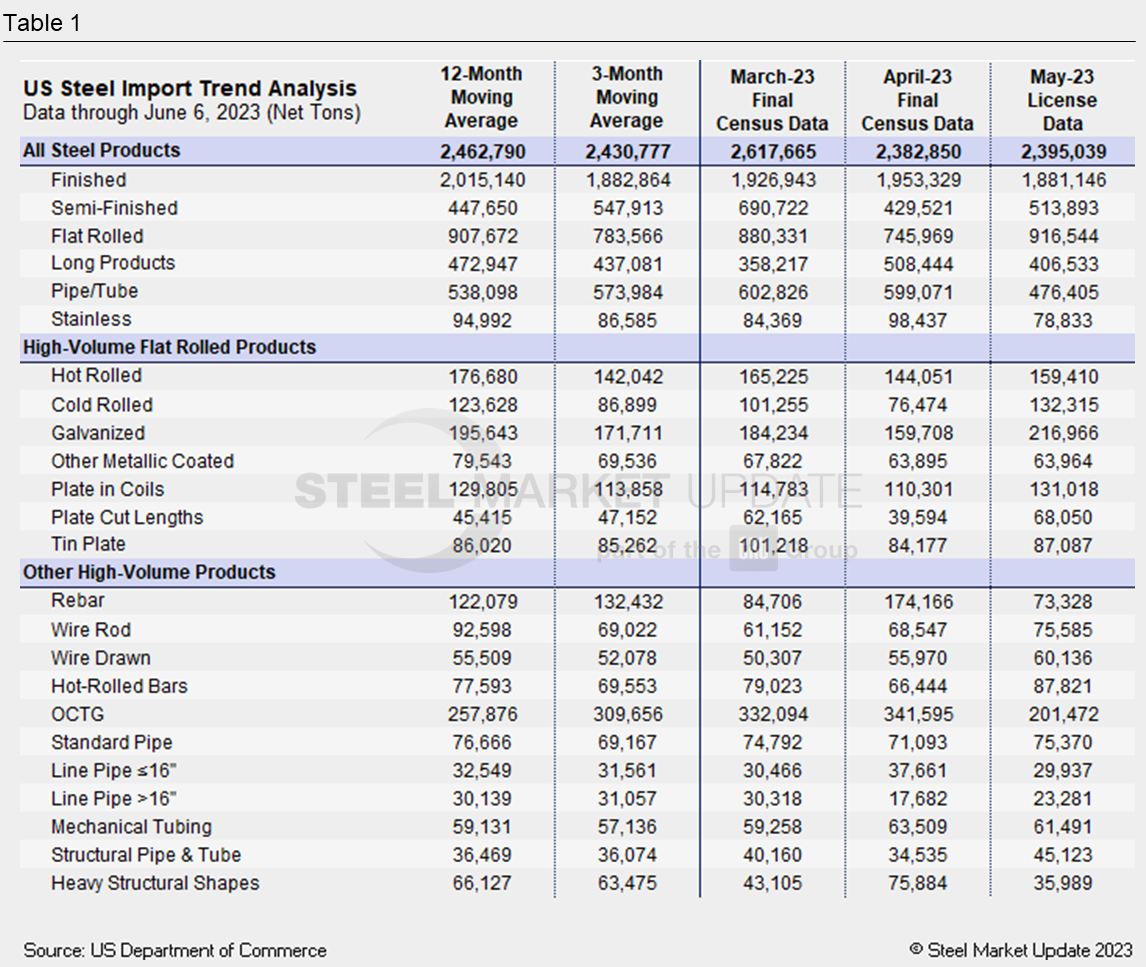

US steel imports were steady from April to May, according to the latest data from the US Department of Commerce.

May’s import license count – a first look at import figures for a given month, at 2,395,039 net tons – was just 0.5% higher than April’s final count of 2,382,580 tons.

Compared to the same month last year, however, May licenses were 12.9% lower. Recall that in 2022, the highest months for imports, in order, were March, January, June, and then May.

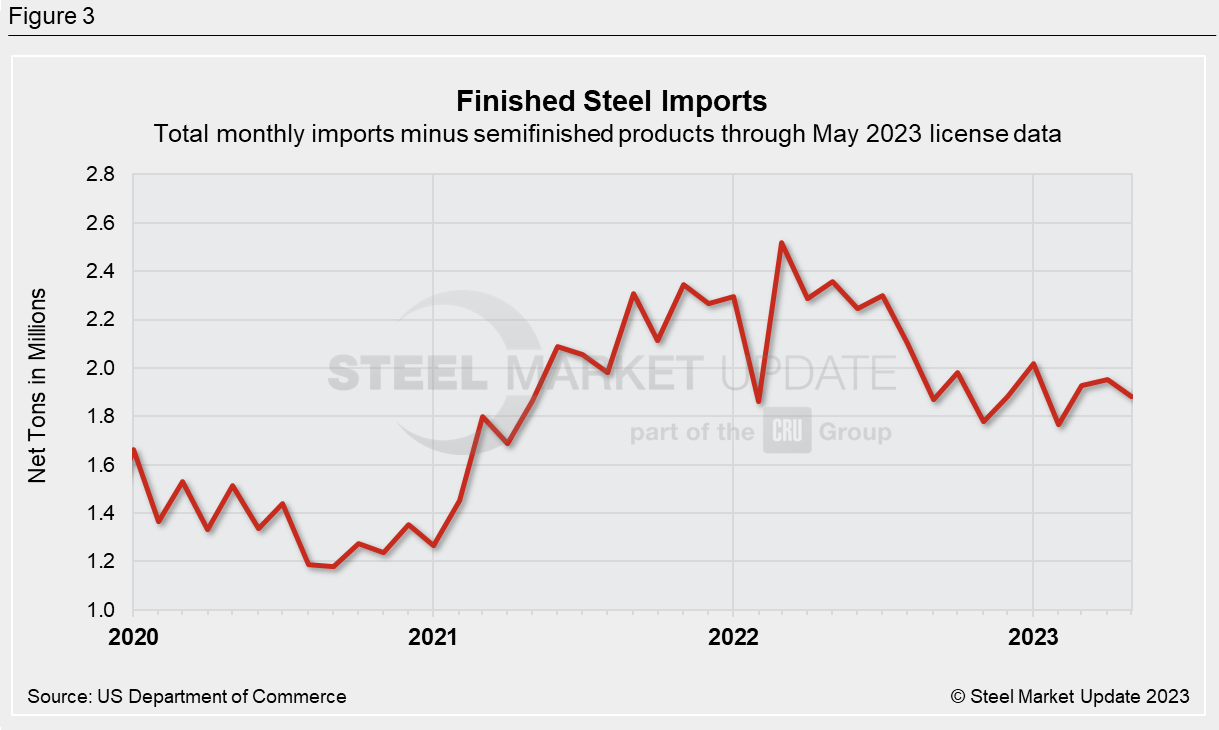

A deeper look at the import figures reveals flat-rolled and semifinished steel imports were notably higher month-over-month (MoM), while big declines were seen in long products, pipe and tube, and stainless products.

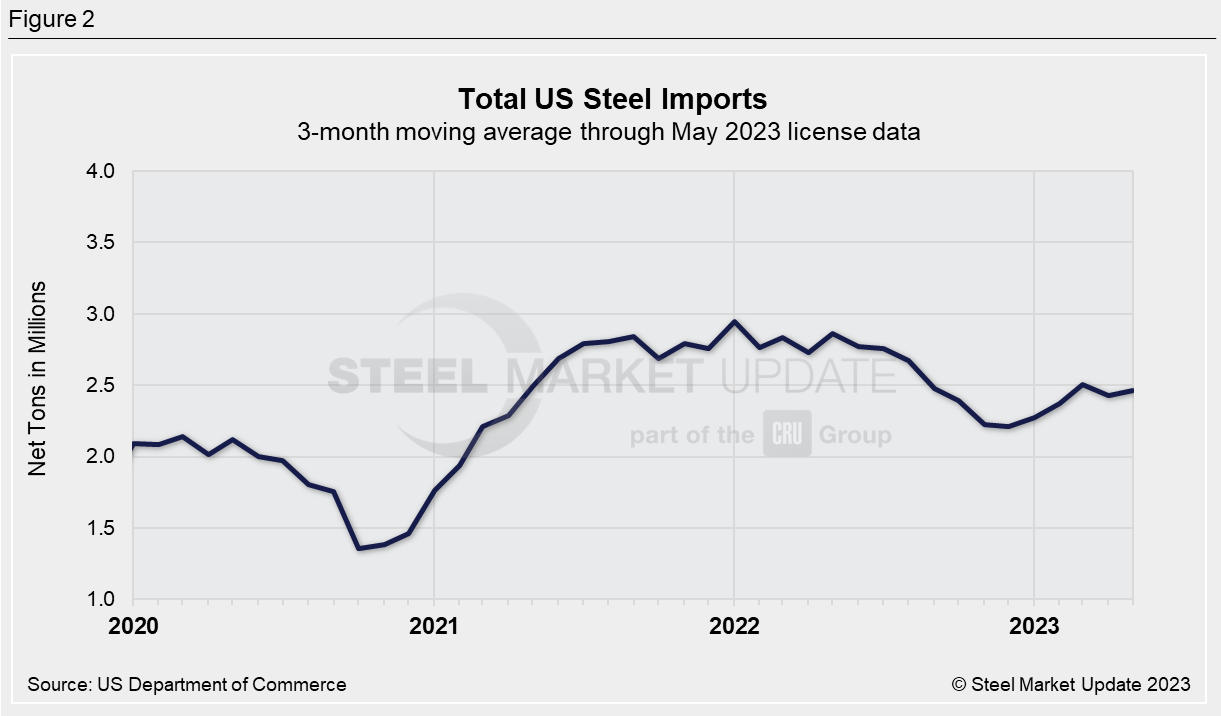

Looking at the three-month moving average of imports (see Fig. 2), which smooths out the large month-to-month swings in imports of semis, shows imports so far this year are trending below the elevated levels seen from mid-2021 through mid-2022.

Semifinished steel imports jumped 20% from April to May, and with overall imports flat, this resulted in a 4% decline in finished steel imports (see Fig. 3).

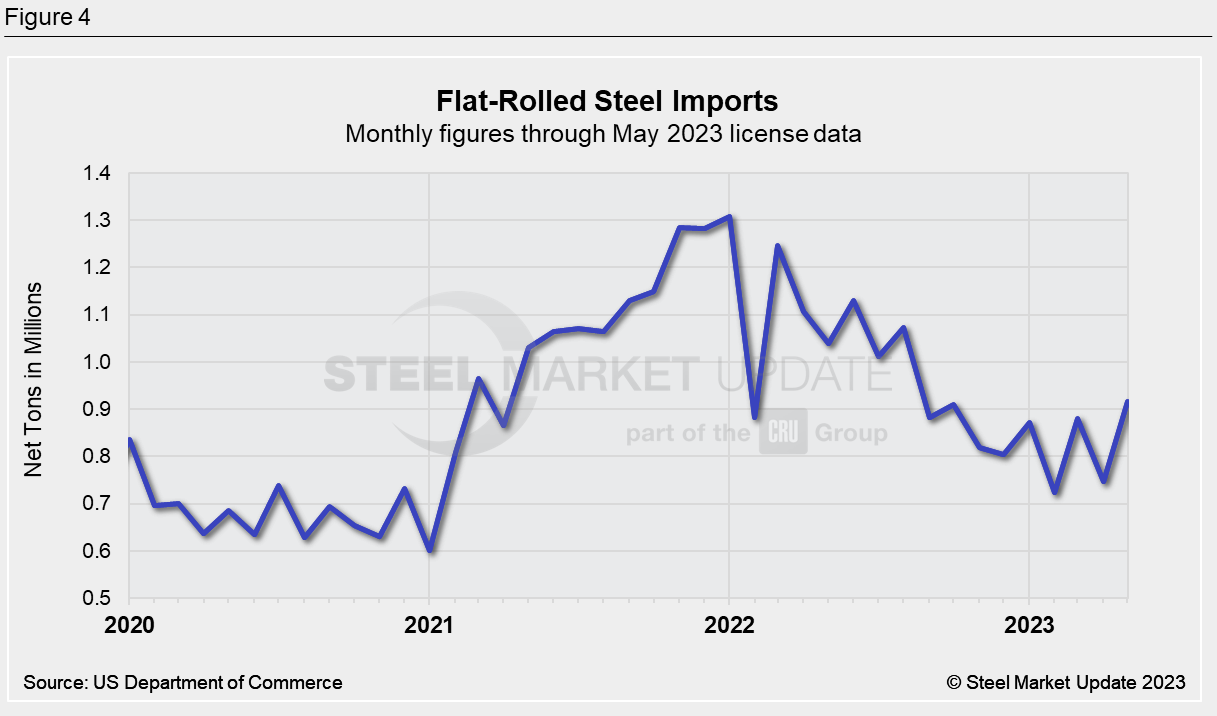

Flat-rolled steel imports have been oscillating month-to-month this year (see Fig. 4).

The high-volume flat-rolled imports tracked by SMU all rose from April to May, based on May’s license figures, with cold-rolled and cut plate imports spiking significantly. Cold-rolled imports were at a six-month high thanks to a rise in licenses from Australia, while cut-to-length plate imports were at their highest monthly amount since January 2019, with a high number of license applications for the product from Australia and Italy.

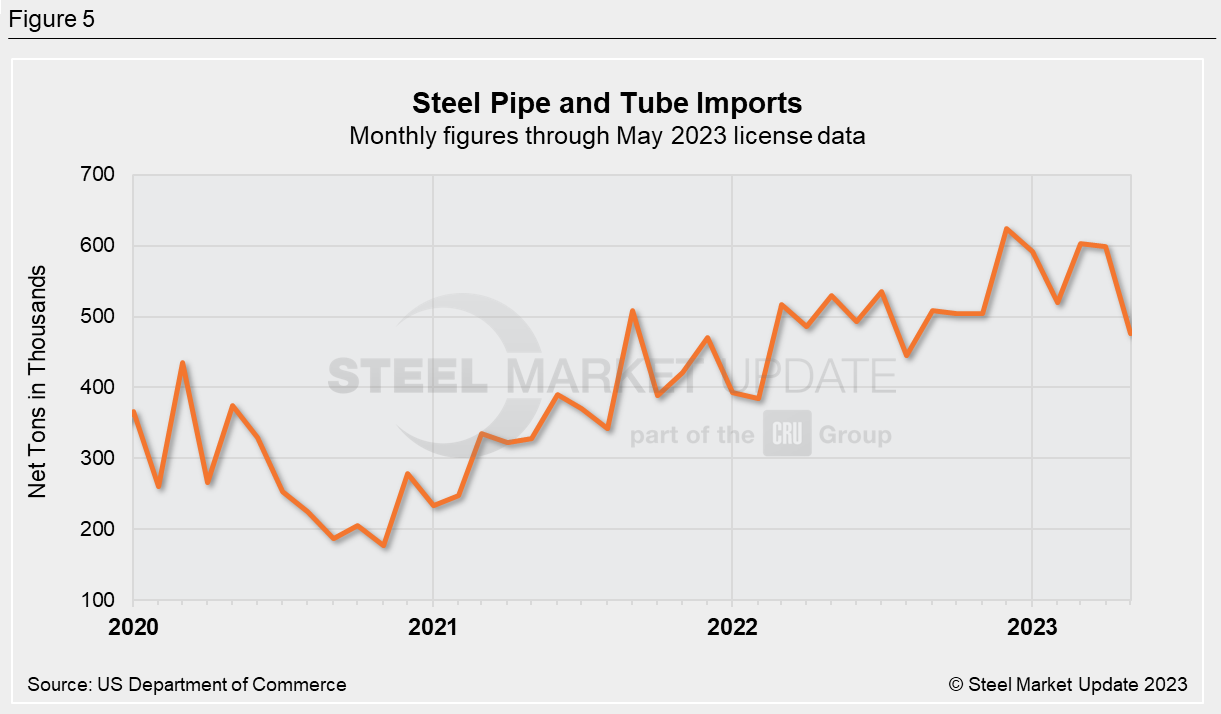

Pipe and tube imports plummeted 20% MoM to a 9-month low (see Fig. 5), led by a 41% drop in OCTG imports. OCTG licenses were down for the product from most major Asian suppliers, including South Korea, Taiwan, Thailand, and Japan.

The chart below provides further detail into imports by product, highlighting high-volume steel products.

You can use our interactive graphing tool, available here, to explore historical import data.

By Laura Miller, laura@steelmarketupdate.com