Market Segment

June 27, 2023

SMU Prices: HRC Holds Steady Amid Rumors of More Hikes

Written by Michael Cowden

A round of price increases announced by domestic mills in mid-June appears to have stabilized pricing for hot-rolled coil for the time being.

Meanwhile, rumors of another round of price hikes ping-ponged around the market on Tuesday, with sources predicting another wave of hikes sometime between this week and mid-July.

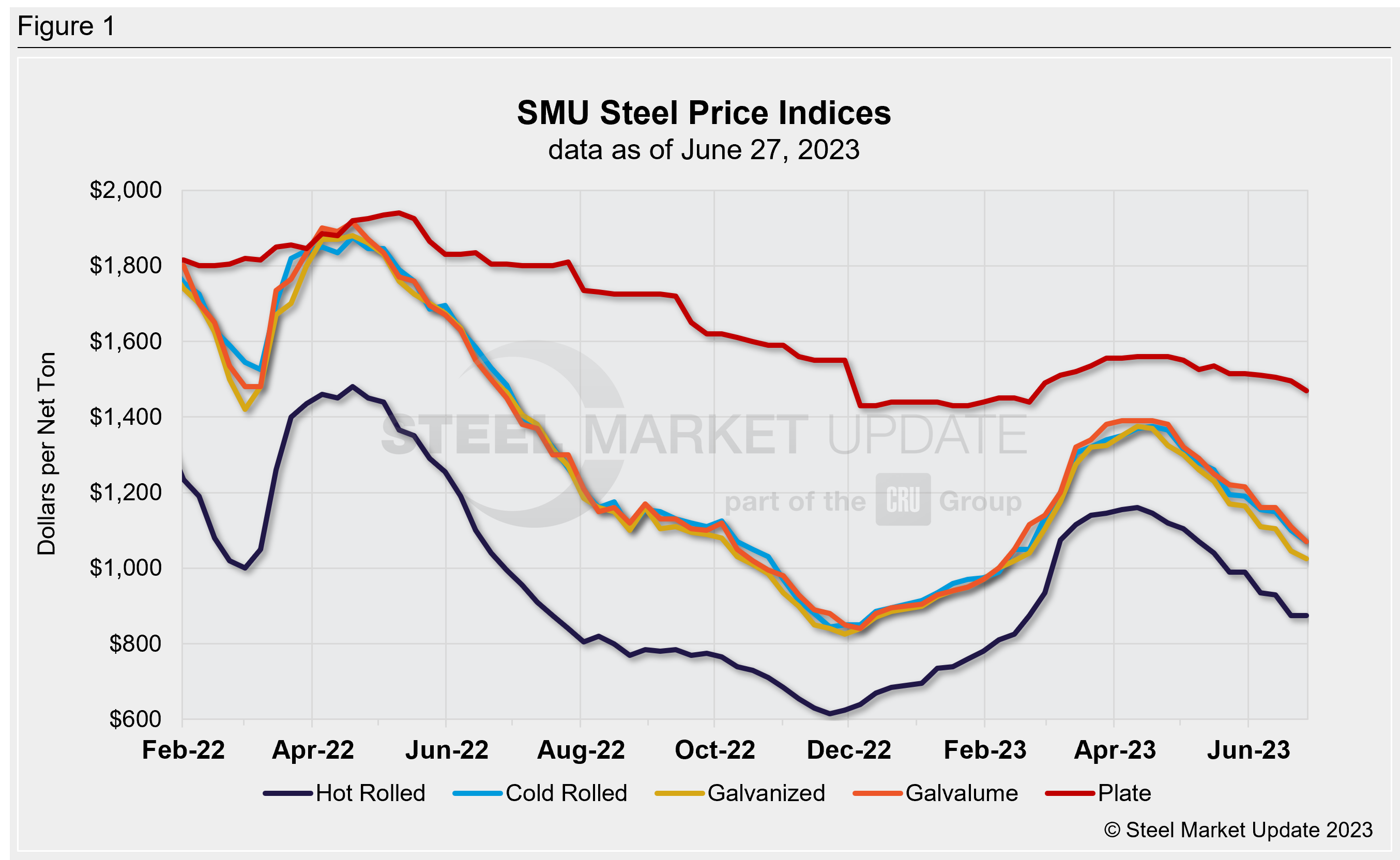

SMU’s average HRC prices stands at $875 per ton ($43.75 per cwt), unchanged from a week ago. The bottom end of our range moved up $10 per ton to $830 per ton while the top end slipped $10 per ton to $920.

That was in line with commentary from market participants who said that the increases had put at least a temporary floor under HRC. They also said mills had found few takers for target HRC prices of as high as $950 per ton.

Cold-rolled and coated prices continued to slide with cold-rolled down $30 per ton, galvanized down $20 per ton, and Galvalume down $40 per ton. But prices for value-added products might stabilize along with HRC on a modest lag, some market participants said. Note that cold-rolled and coated prices often follow HRC both up and down.

Our plate price slipped to $1,470 per ton, down $25 per ton from a week ago. Sources continue to report varied sentiment and prices. While mills are still holding their line and mostly keeping prices at the top end of our range, there are scattered reports of mills discounting as well as lower service center transaction prices.

Our sheet price momentum indicators remain at neutral. We will keep them there until it is clear whether the latest round of price hikes has succeeded.

Our plate price momentum indicator also remains at neutral.

Hot-Rolled Coil: The SMU price range is $830–920 per net ton ($41.50–46.00 per cwt), with an average of $875 per ton ($43.75 per cwt) FOB mill, east of the Rockies. The bottom end of our range inched up $10 per ton vs. one week ago, while the top end was down $10 per ton week on week (WoW). Our overall average is unchanged WoW. Our price momentum indicator for hot-rolled coil remains at neutral, meaning direction is unclear over the next 30 days in light of the latest round of mill price hikes.

Hot-Rolled Lead Times: 3–7 weeks

Cold-Rolled Coil: The SMU price range is $1,00–1,100 per net ton ($52.00–55.00 per cwt), with an average of $1,070 per ton ($53.50 per cwt) FOB mill, east of the Rockies. The lower end of our range moved lower by $10 per ton WoW, while the top end was down $50 per ton compared to a week ago. Our overall average is down $30 per ton WoW. Our price momentum indicator on cold-rolled coil remains at neutral, meaning direction is unclear over the next 30 days in light of the latest round of mill price hikes.

Cold-Rolled Lead Times: 5–9 weeks

Galvanized Coil: The SMU price range is $970–1,080 per net ton ($48.50–54.00 per cwt), with an average of $1,025 per ton ($51.25 per cwt) FOB mill, east of the Rockies. The lower end of our range was down $50 per ton vs. last week, while the top end of our range edged uo $10 per ton vs. one week ago. Our overall average is down $20 per ton vs. the prior week. Our price momentum indicator on galvanized steel remains at neutral, meaning direction is unclear over the next 30 days in light of the latest round of mill price hikes.

Galvanized .060” G90 Benchmark: SMU price range is $1,067–1,177 per ton with an average of $1,122 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 3–10 weeks

Galvalume Coil: The SMU price range is $1,000–1,140 per net ton ($50.00–57.00 per cwt), with an average of $1,070 per ton ($53.50 per cwt) FOB mill, east of the Rockies. The lower end of the range fell $85 per ton vs. last week, while the top end was up just $5 per ton WoW. Our overall average declined $40 per ton when compared to one week ago. Our price momentum indicator on Galvalume steel remains at neutral, meaning direction is unclear over the next 30 days in light of the latest round of mill price hikes.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1,294–1,434 per ton with an average of $1,364 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 6–8 weeks

Plate: The SMU price range is $1,380–1,560 per net ton ($69.00–78.00 per cwt), with an average of $1,470 per ton ($73.50 per cwt) FOB mill. The lower end of our range was down $40 per ton compared to the prior week, while the top end of our range was down $10 per ton WoW. Our overall average was down $25 per ton vs. the prior week. Our price momentum indicator on steel plate remains at neutral, meaning we are unsure of what direction prices will go over the next 30 days.

Plate Lead Times: 4–9 weeks

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@steelmarketupdate.com.

By Michael Cowden, michael@steelmarketupdate.com