Plate

July 11, 2023

SMU Price Ranges: Sheet and Plate Post Modest Gains

Written by Michael Cowden

Sheet prices inched up this week on less discounting from major mills and on expectations that activity could improve in the coming weeks as OEMs return to the market following widespread summer shutdowns in early July.

SMU’s hot-rolled coil price stands at $890 per ton ($44.50 per cwt), up $10 per ton from last week and continuing a pattern of largely stable HRC pricing levels that we’ve seen since late June.

It was a similar story in value-added products, with cold rolled up $25 per ton week over week, galvanized up $5 per ton, and Galvalume up $5 per ton. Plate also posted a modest gain of $5 per ton.

Some market participants said they had initially expected price declines. Several chalked up firming HRC prices to an outage on the hot end of SDI’s steel mill in Sinton, Texas. That at the very least tightened up availability at SDI’s mill in Columbus, Miss., they noted, which will have to provide substrate to Sinton, whose downstream lines are still running.

Others said that Sinton had not been running full even before the outage and that the stability in prices probably reflected typical seasonal trends – namely, end users getting back into the market.

There was also continued chatter of another round of price hikes. But with the market mostly sideways over the last few weeks, we are keeping our price momentum indicators for all products at neutral until a clear up or down pattern emerges.

Hot-Rolled Coil: The SMU price range is $840–940 per net ton ($42.00–47.00 per cwt), with an average of $890 per ton ($44.50 per cwt) FOB mill, east of the Rockies. The bottom end of our range was up $10 per ton vs. one week ago, while the top end was up $10 per ton week on week (WoW). Our overall average is up $10 per ton WoW. Our price momentum indicator for hot-rolled coil remains at neutral, meaning direction is unclear over the next 30 days in light of the latest round of mill price hikes.

Hot-Rolled Lead Times: 3–7 weeks

Cold-Rolled Coil: The SMU price range is $1,050–1,100 per net ton ($52.50–55.00 per cwt), with an average of $1,075 per ton ($53.75 per cwt) FOB mill, east of the Rockies. The lower end of our range moved higher by $50 per ton WoW, while the top end was unchanged compared to a week ago. Our overall average is up $25 per ton WoW. Our price momentum indicator on cold-rolled coil remains at neutral, meaning direction is unclear over the next 30 days in light of the latest round of mill price hikes.

Cold-Rolled Lead Times: 5–9 weeks

Galvanized Coil: The SMU price range is $990–1,080 per net ton ($49.50–54.00 per cwt), with an average of $1,035 per ton ($51.75 per cwt) FOB mill, east of the Rockies. The lower end of our range was up $30 per ton vs. last week, while the top end of our range edged down $20 per ton vs. one week ago. Our overall average is up $5 per ton vs. the prior week. Our price momentum indicator on galvanized steel remains at neutral, meaning direction is unclear over the next 30 days in light of the latest round of mill price hikes.

Galvanized .060” G90 Benchmark: SMU price range is $1,087–1,177 per ton with an average of $1,132 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 3–10 weeks

Galvalume Coil: The SMU price range is $1,000–1,160 per net ton ($50.00–58.00 per cwt), with an average of $1,080 per ton ($54.00 per cwt) FOB mill, east of the Rockies. The lower end of the range was sideways vs. last week, while the top end was up $10 per ton WoW. Our overall average increased $5 per ton when compared to one week ago. Our price momentum indicator on Galvalume steel remains at neutral, meaning direction is unclear over the next 30 days in light of the latest round of mill price hikes.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1,294–1,454 per ton with an average of $1,374 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 6–8 weeks

Plate: The SMU price range is $1,450–1,570 per net ton ($72.50–78.50 per cwt), with an average of $1,510 per ton ($75.50 per cwt) FOB mill. The lower end of our range was unchanged compared to the prior week, while the top end of our range was $10 per ton higher WoW. Our overall average was up $5 per ton vs. the prior week. Our price momentum indicator on steel plate remains at neutral, meaning we are unsure of what direction prices will go over the next 30 days.

Plate Lead Times: 4–9 weeks

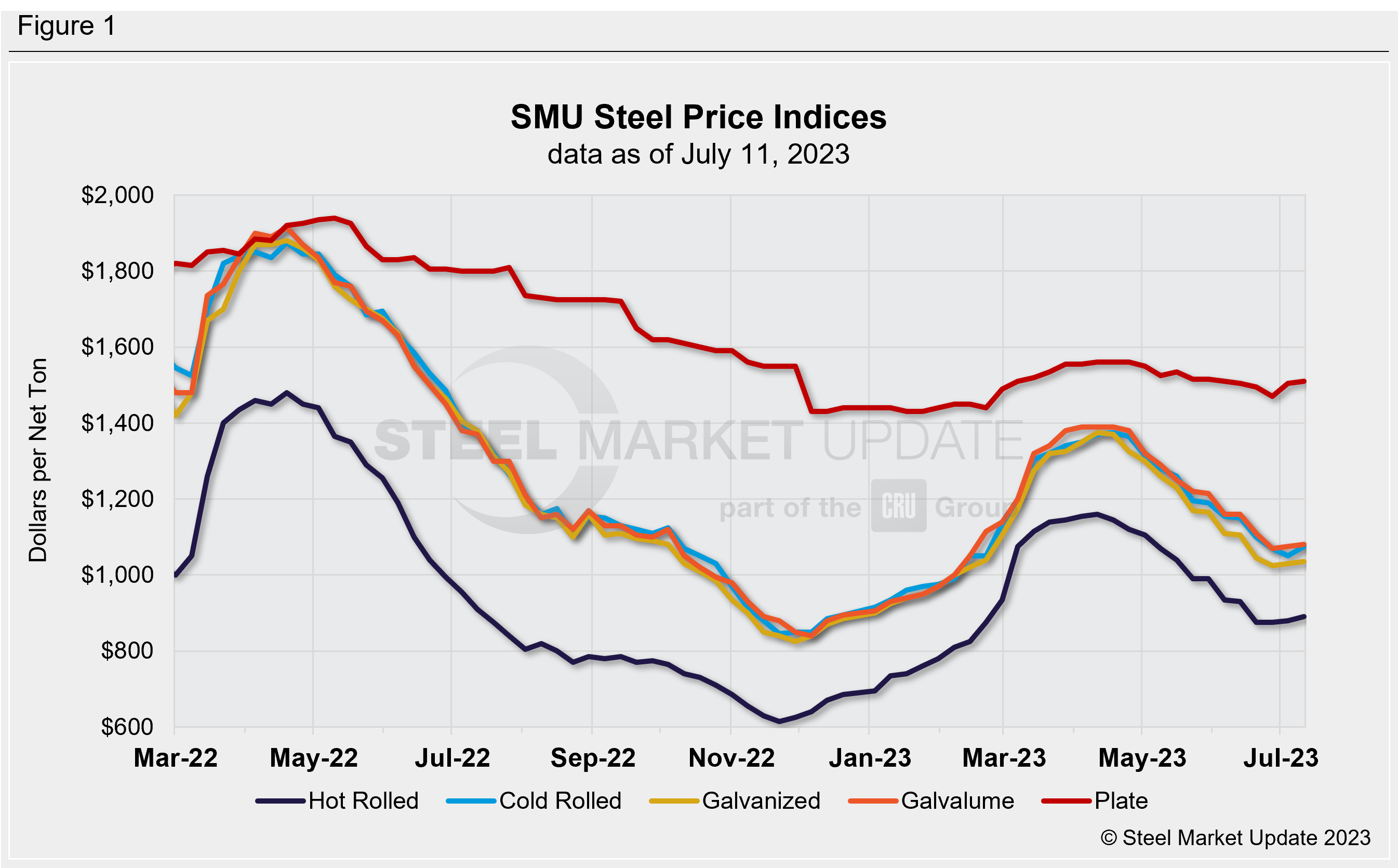

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@steelmarketupdate.com.

By Michael Cowden, michael@steelmarketupdate.com