Market Segment

August 2, 2023

Nucor Keeps Plate Prices Flat

Written by Michael Cowden

Nucor plans to keep plate prices flat for yet another month.

“We reserve the right to review and re-quote any offers that are not confirmed with either a Nucor sales acknowledgement or written acceptance by both parties,” the Charlotte, N.C.-based steelmaker said in a letter to customers dated July 31.

Domestic plate prices have been stable compared to sheet prices on the heels of consecutive months of unchanged pricing from Nucor, one of three major US plate mills. (The others are Cleveland-Cliffs and SSAB Americas.)

Plate prices hit a 2023 peak of $1,560 per ton ($78 per cwt) in April. They have since slipped 5% to $1,485 per ton, according to SMU’s pricing tool.

Hot-rolled coil (HRC) prices also peaked in April. HRC hit a 2023 high of $1,155 per ton on April 4. It has since fallen 30% to $810 per ton.

The premium plate carries to HRC has as a result ballooned from $400 per ton in April to $675 per ton this week.

Plate could have more upside potential than sheet because it is more exposed to infrastructure spending and more widely used in big projects such as offshore wind farms.

But some market participants have questioned whether plate’s relative stability to sheet will hold as new capacity – namely, Nucor’s new plate mill in Brandenburg, Ky., – ramps up.

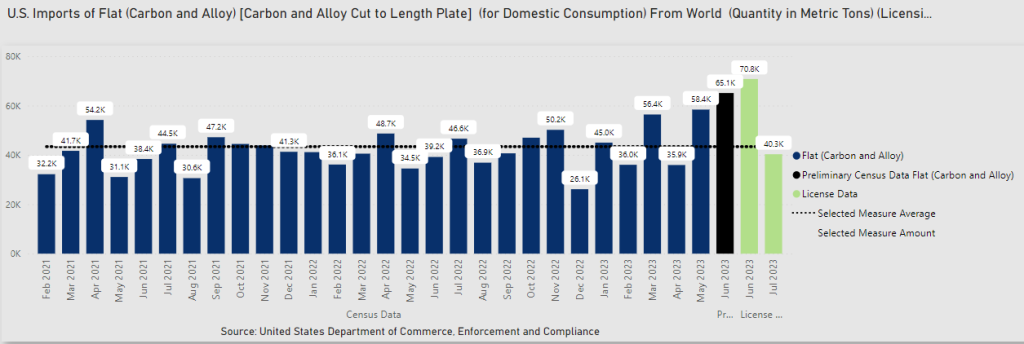

Plate imports have also been high in recent months:

The US imported 65,095 metric tons of cut-to-length plate in June, according to preliminary data from the Commerce Department. That marked the highest level of such imports since 66,375 metric tons in October 2017.

That said, plate imports decreased significantly in July, license data indicate.