Market Data

August 31, 2023

Sheet Products' Negotiations Rate Falls, But Plate Surges

Written by Ethan Bernard

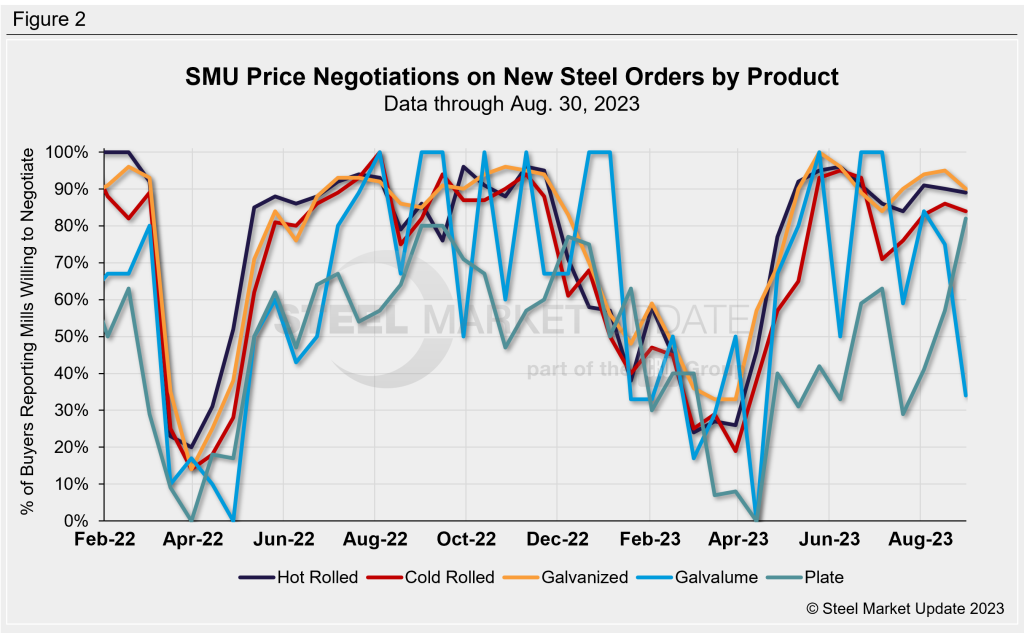

The mill negotiation rate for sheet products slipped this week, though plate jumped, rising by 25 percentage points, according to SMU’s most recent survey data.

The percentage of respondents saying steel mills were willing to talk price on plate stood at 82% this week, up from 57% two weeks earlier, while all the sheet products SMU surveys notched declines.

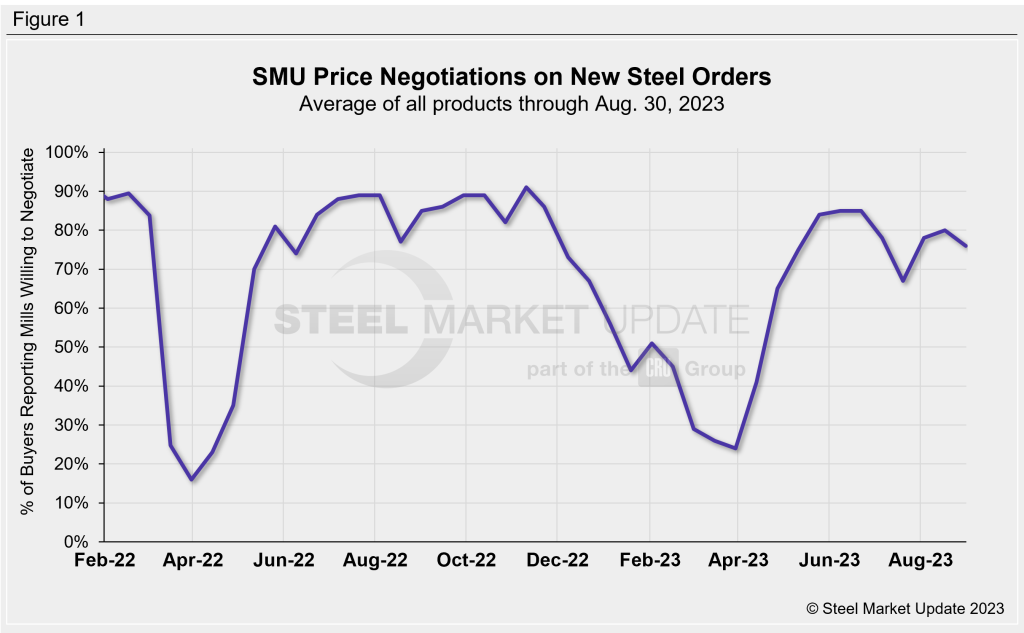

Every two weeks, SMU asks steel buyers whether domestic mills are willing to negotiate lower spot pricing on new orders. This week, 76% of participants surveyed by SMU reported mills were willing to negotiate price on new orders, down four percentage points from two weeks earlier (Fig. 1). The last market check marked the first time the reading cracked the 80% mark since late June.

Fig. 2 below shows negotiation rates by product. Hot rolled fell one percentage point from two weeks earlier to 89% of buyers reporting mills more willing to negotiate price; cold rolled stood at 84% (-2 pts); galvanized at 90% (-5 pts); and Galvalume at 34% (-41 pts). Recall that Galvalume can be more volatile because we have fewer survey participants there.

Here’s what some survey respondents had to say:

–“(Willing to negotiate on plate), depending on grade and size.”

–“UAW possible strike is an unknown risk.”

–“ With tonnage you can get sub-$700 price (on HRC).”

–“ Very few large transactions (on HRC) received. Those that were, at numbers sub $750.”

Note: SMU surveys active steel buyers every other week to gauge the willingness of their steel suppliers to negotiate pricing. The results reflect current steel demand and changing spot pricing trends. SMU provides our members with a number of ways to interact with current and historical data. To see an interactive history of our Steel Mill Negotiations data, visit our website here.