CRU

September 5, 2023

CRU: Turkish Scrap Prices Stabilize Due to Limited Buying Activity

Written by Rosy Finlayson

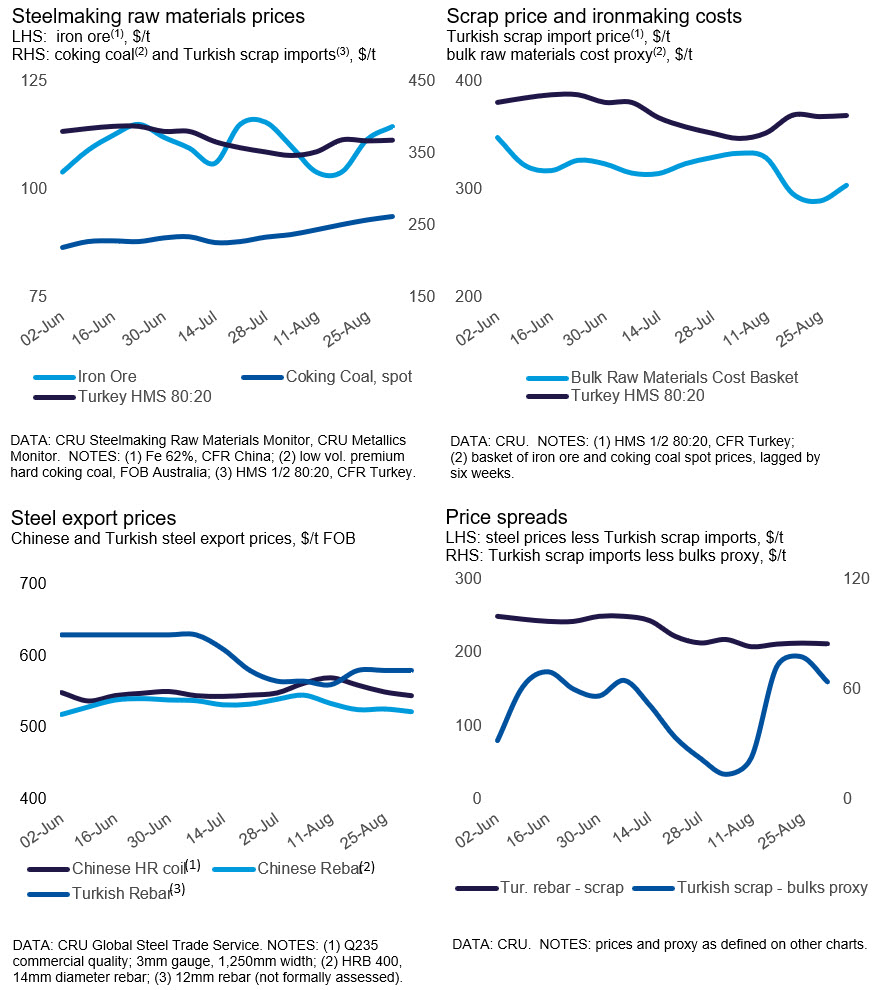

Turkish scrap import prices have remained relatively stable over the past two weeks due to slow trade activity. This was partly due to the holiday on August 30. CRU’s latest price assessment for HMS1/2 80:20 is $368 /metric ton CFR, up $1 /metric ton week-over-week (WoW) and up $21 /metric ton month-over-month (MoM).

The holiday on August 30 was partly the reason for slow trade last week. This has also meant that Turkish finished steel prices have been flat over the past few weeks. Turkish rebar is currently priced at $580 /metric ton, while HR coil is priced at $625 /metric ton.

Meanwhile, in the Asian scrap market, prices picked up slightly in South Asia and Taiwan, China but have remained unchanged in Southeast Asia due to weak demand. Containerized scrap to Taiwan, China is up by ~$5 /metric ton to $370-375 /metric ton CFR, while offers for H2 and deep-sea bulk HMS1/2 80:20 shipments to Vietnam are stable at $390 /metric ton CFR and $400 /metric ton, respectively.