Market Data

September 14, 2023

Mill Negotiation Rate Soars

Written by Ethan Bernard

The overall steel mill negotiation rate jumped 14 percentage points this week vs. the last market check, with plate’s rate rising by eight percentage points, according to SMU’s most recent survey data.

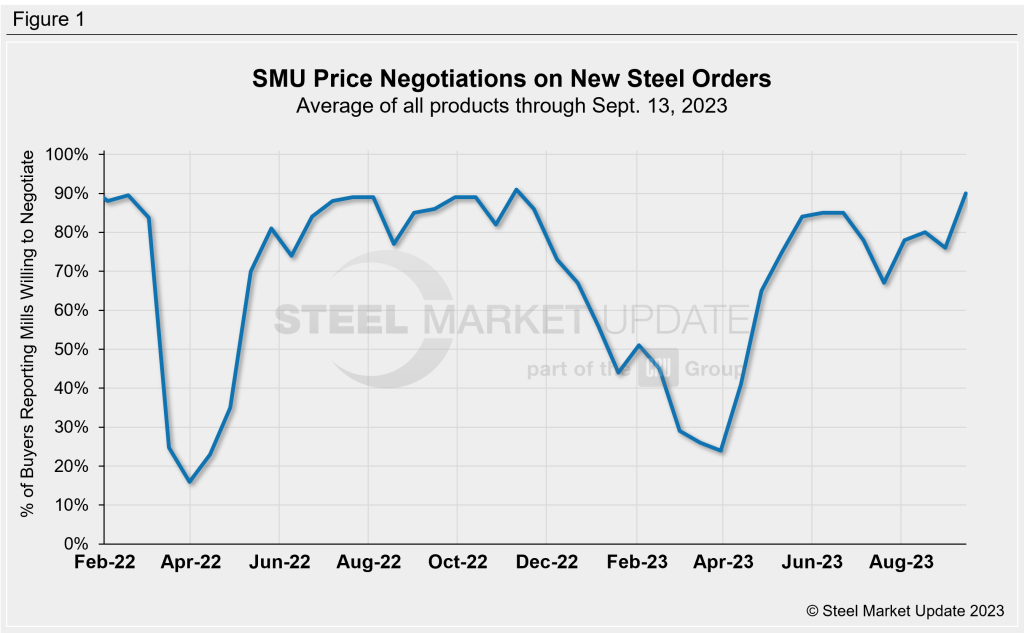

Every two weeks, SMU asks steel buyers whether domestic mills are willing to negotiate lower spot pricing on new orders. This week, 90% of participants surveyed by SMU reported mills were willing to negotiate price on new orders, rising from 76% from two weeks earlier (Fig. 1). This marks the first time the rate has hit the 90% mark since early November of last year.

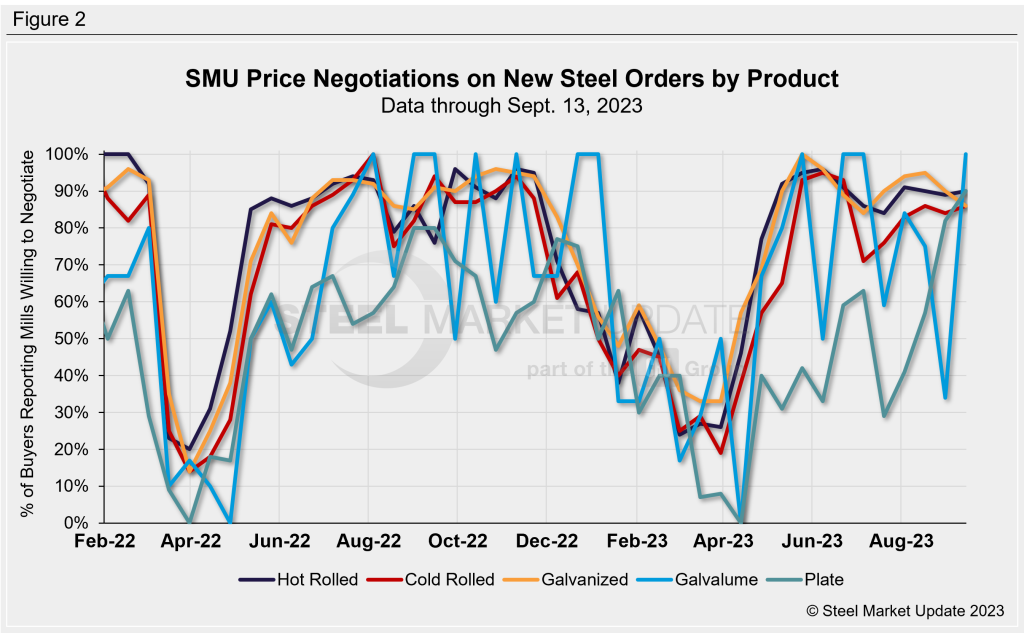

Fig. 2 below shows negotiation rates by product. Hot rolled rose one percentage point from two weeks earlier to 90% of buyers saying mills are more willing to negotiate price; cold rolled stood at 86% (+2 pts); and Galvalume at 100% (+66 pts). Recall that Galvalume can be more volatile because we have fewer survey participants there.

The percentage of plate buyers reporting mills were willing to talk price stood at 90% this week, up from 82% two weeks earlier.

The only product tracked by SMU to notch a decline was galvanized. It fell four percentage points to 86% in the same comparison.

Here’s what some survey respondents had to say:

–“(Mills are willing to negotiate on spot plate pricing), but quietly.”

–“If there are tons, mills will entertain.”

–“(Mills are willing to negotiate on hot rolled) if large enough order.”

-“While we aren’t bringing in any coil-stock from mills, we continue to get calls from reps fishing for tons. That always tells me things are bleak.”

Note: SMU surveys active steel buyers every other week to gauge the willingness of their steel suppliers to negotiate pricing. The results reflect current steel demand and changing spot pricing trends. SMU provides our members with a number of ways to interact with current and historical data. To see an interactive history of our Steel Mill Negotiations data, visit our website here.