Market Segment

September 19, 2023

Housing Starts Decline in August

Written by Becca Moczygemba

US housing starts slipped in August, according to the latest estimates from the US Census Bureau.

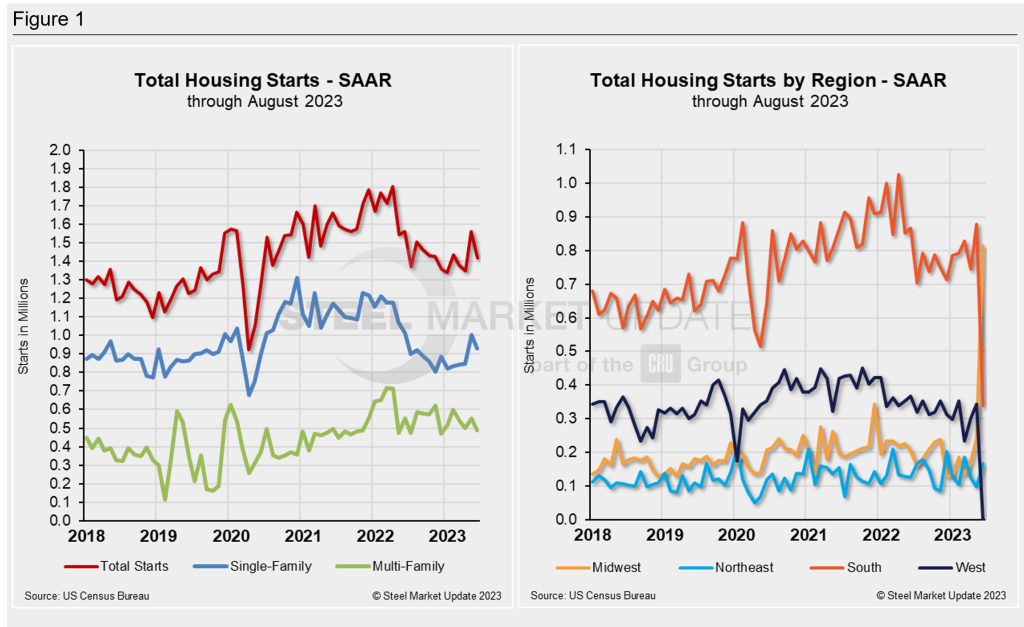

The total privately owned housing starts were at a seasonally adjusted annual rate of (SAAR) of 1,283,000 in August, Census said. August starts are down 11.3% from the revised July estimate of 1,447,000. Year over year, single-family housing starts are down 14.8% from 1,505,000 in August 2022.

Higher mortgage rates and higher construction costs have slowed single-family housing production, the National Association of Home Builders (NAHB) said.

“High mortgage rates above 7% combined with low resale inventory and higher home prices are slowing housing production, as many first-time home buyers and younger households are struggling to purchase an affordable home,” Alicia Huey, NAHB chairman, said in a statement.

Huey added that there’s currently a nationwide shortage of 1.5 million units in addition to elevated mortgage rates. “We need to increase the housing supply to get this market back into balance to meet the pent-up demand for when market conditions improve,” she said.

NAHB anticipates that mortgage rates will remain elevated. The association expects the Federal Reserve to increase rates one more time later this quarter, according to Danushka Nanayakkara-Skillington, NAHB’s assistant VP for forecasting and analysis.

Regionally, combined single-family and multi-family starts are down in all four regions, with the largest decline being the Northeast and the lowest in the South.