Analysis

February 8, 2024

Imports decline for a second consecutive year in 2023

Written by Laura Miller

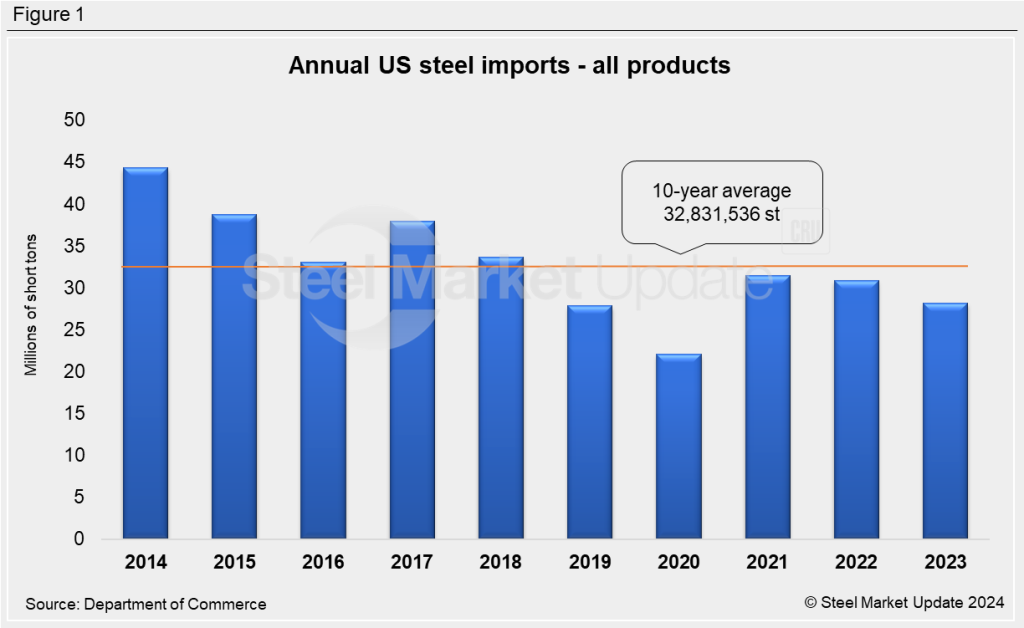

2023 was the third-lowest year for steel imports in the last decade, according to an SMU analysis of data from the US Department of Commerce.

Steel imports into the US declined for the second year in a row, falling 9% from 2022 and 32% from 2021 to 28,187,800 short tons (st) in 2023. This includes semi-finished and finished carbon, alloy, and stainless steel products.

Over the past 10 years, only 2020 and 2019 saw fewer imports, with 22,081,660 st and 27,868,850 st, respectively.

2023’s imports were 14% below the last decade’s annual average of 32,831,536 st.

Figure 1 below shows import levels were lower in the latter half of the decade.

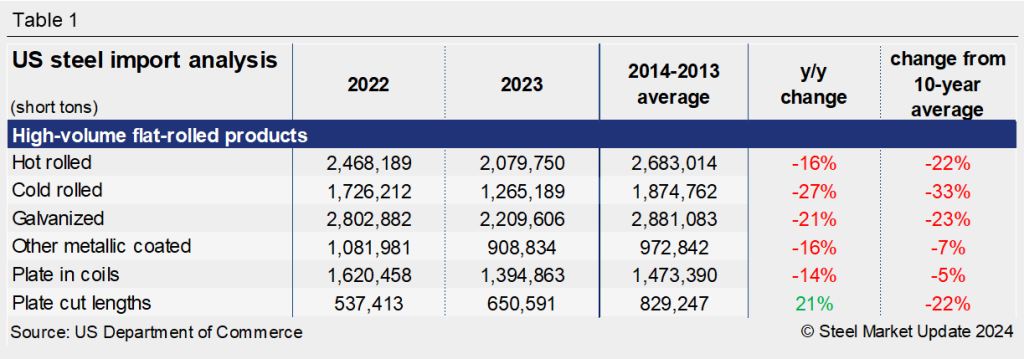

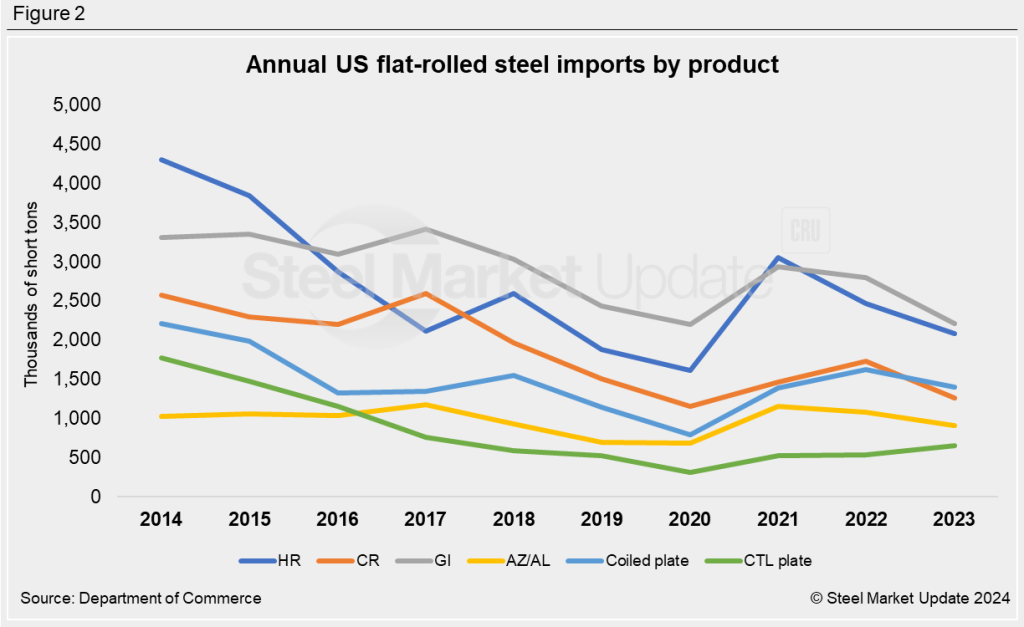

When looking at flat-rolled steel imports, 2023 was not a special year. Of the six major flat-rolled steel categories, all were lower year over year (y/y), except for cut-to-length (CTL) plate.

While the other categories saw double-digit y/y declines, cut plate imports rose 21% to a five-year high of almost 650,600 st. Canada and South Korea were the top suppliers, supplying 37% and 34%, respectively, of total CTL plate imports in 2023. Malaysia was the next at 5%, followed by Sweden and Australia, both at 4%.

Compared to their 10-year averages, imports of all the major flat rolled categories were lower (Table 1).