Analysis

May 23, 2024

Architecture Billings Index remains soft in April

Written by Brett Linton

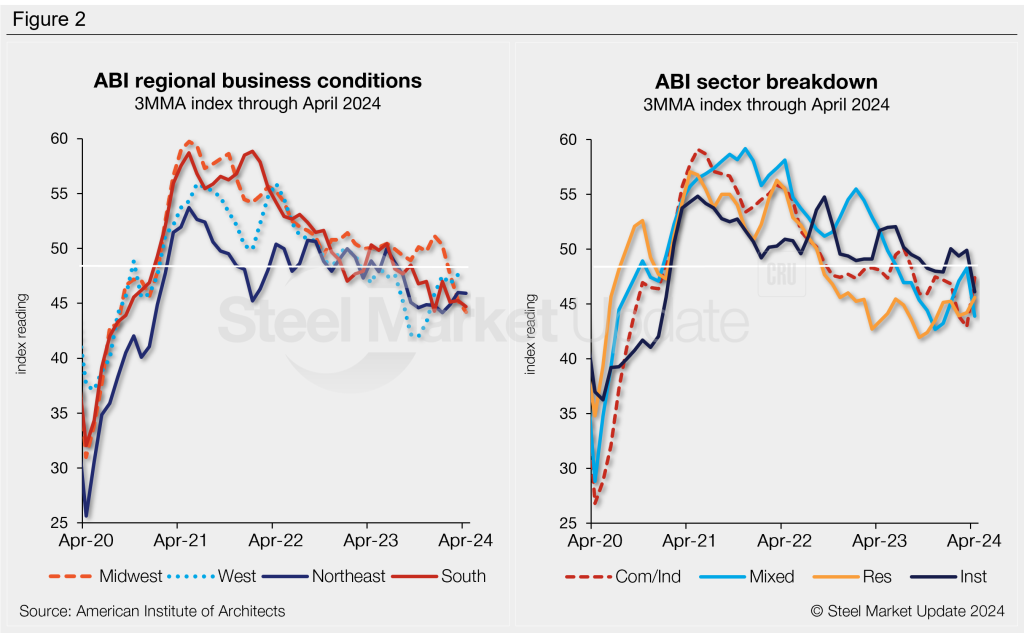

The Architecture Billings Index (ABI) from the American Institute of Architects (AIA) and Deltek indicated architecture firm billings remained soft through April. While the latest index reading does not indicate improving business conditions, it is one of the higher measures seen in recent months, suggesting the recent slowdown could be diminishing.

The April ABI score of 48.3 is now the highest rate recorded since July. The Index has remained in contraction territory since February 2023. This time last year the index was 48.1, two years prior it was 55.1.

The ABI is a leading economic indicator for nonresidential construction activity, projecting business conditions approximately 9-12 months into the future. Any score above 50 indicates an increase in billings, while a score below 50 indicates a decrease.

“These findings indicate that while there is still caution among clients, there are also positive signs with increasing inquiries into new projects,” said AIA chief economist Kermit Baker.

“Continued high interest rates make it difficult for some projects to move forward, but there is ongoing interest in pursuing these projects once conditions improve. In the meantime, design activity is expected to remain sluggish,” he added.

The project inquiries index eased 0.1 points to 54.8 in April, now down to a three-month low. The design contracts index fell 0.8 points to 49.2, the lowest score since last November.

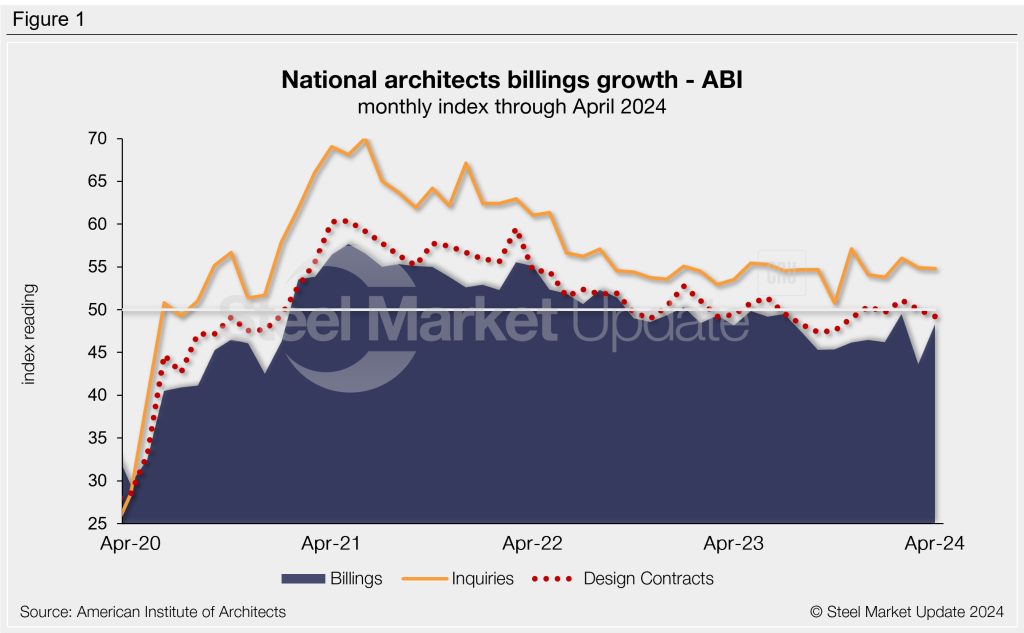

Results were overall down across the country. The Northeastern, Midwestern and Southern region indices all declined from March to April and remain in contraction territory. The Western region index saw a slight increase in April but continues to indicate declining conditions.

Changes in business conditions varied by sector from March to April, though conditions remained soft across the board. The multifamily residential and commercial/industrial sectors experienced growth month over month, while the institutional and mixed practice sectors witnessed declines.