Market Segment

June 21, 2024

Global steel production jumps to 14-month high in May

Written by Brett Linton

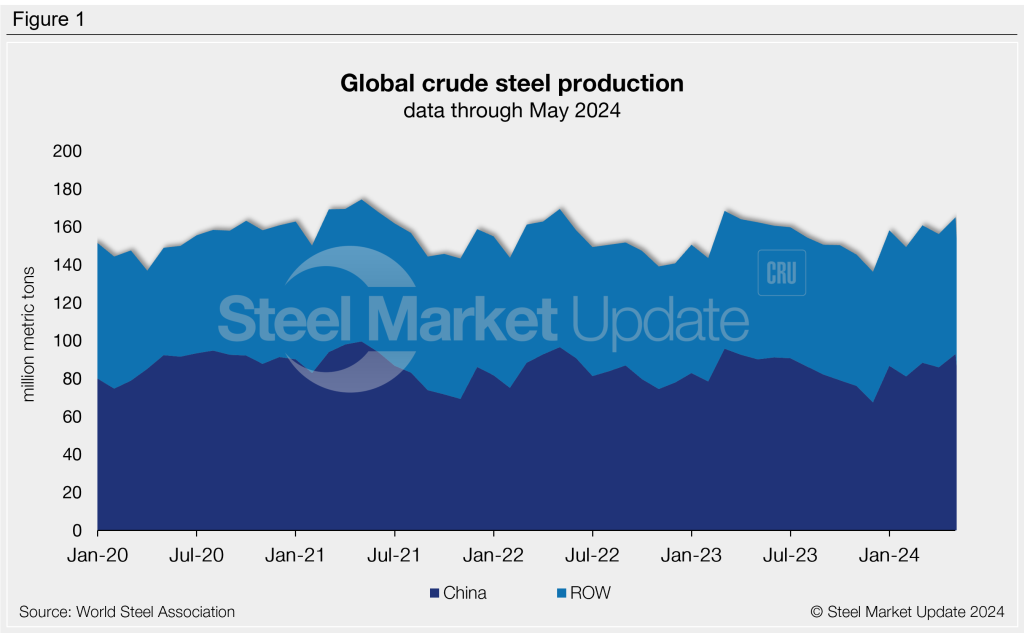

Global steel output rose 6% from April to May, and is now at the highest rate seen since March 2023, according to World Steel Association’s (worldsteel) latest release.

Steel mills around the world produced an estimated 165.1 million metric tons (mt) of steel last month. Production has averaged 157.9 million mt across the first five months of 2024, less than 1% higher than the same time period of 2023. May production is 2% greater than the same month last year.

On a three-month moving average (3MMA) basis, production rose to a 10-month high of 160.7 million mt through May, up 3% from April.

On a daily basis, May production averaged 5.33 million mt per day, 2% percent higher than April. This is now the highest daily production rate seen since last June when it was 5.35 million mt. Daily production is also 2% higher in May than the same month one year ago.

Regional breakdown

The world’s top steelmaker, China, produced 92.9 million mt last month, up 8% from April and also at a 14-month high. May production is up 3% year on year (y/y). Year-to-date production has averaged 87.0 million mt for the first five months of the year, down 1% from the same period in 2023.

Chinese production represented 56% of the world’s total output in May, up from 55% in April and in line with the same month last year.

Meanwhile, steel output in the rest of the world (ROW) increased 3% from April to May. Production in these regions totaled 72 million mt for the month, flat y/y. ROW production has averaged 71 million mt so far in 2024, down from 70 million mt compared to the same period last year.

Looking at production by country, Indian mills held the number two spot in May, producing 12 million mt of steel. Next up was Japan and the US at 7 million mt, respectively, followed by Russia at 6 million mt.