Market Data

September 25, 2024

September energy market update

Written by Brett Linton

This Premium analysis covers oil and natural gas prices, drilling rig activity, and crude oil stock levels in North America. Energy prices and rig counts are advance indicators of demand for oil country tubular goods (OCTG), line pipe, and other steel products.

The Energy Information Administration (EIA) released its September Short-Term Energy Outlook (STEO) earlier this month. It forecast crude oil prices to tick higher through the remainder of the year. In line with its previous forecast, it attributed the predicted rise to increased inventory draws and production cuts. Natural gas prices are expected to increase through the beginning of next year as US export demand outweighs production.

Explore the full STEO report covering energy spot prices, production, and inventories here.

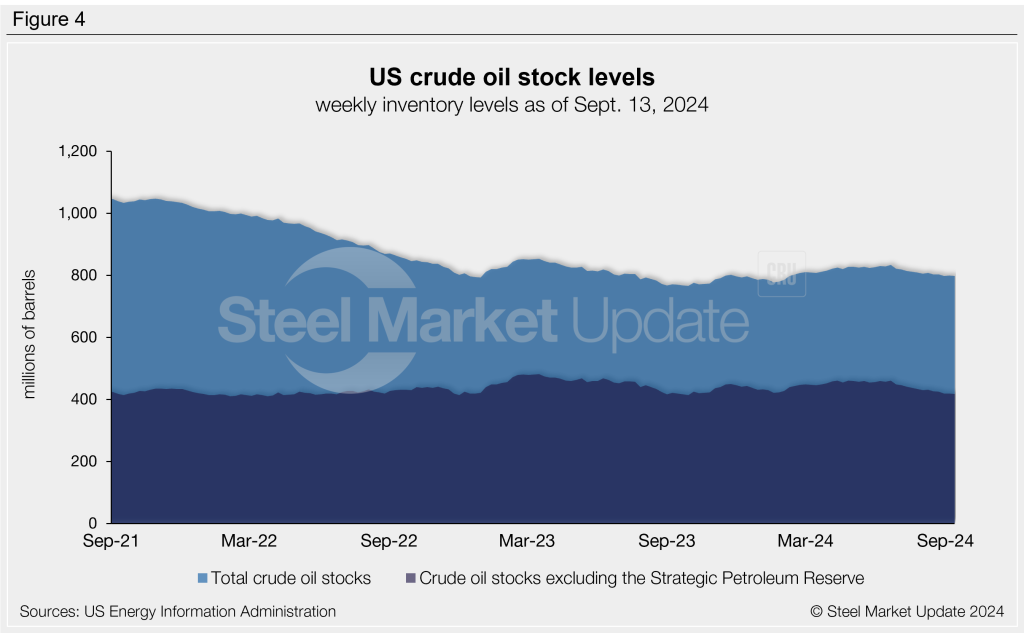

Oil and gas spot prices

The weekly West Texas Intermediate oil spot market price has remained rangebound for the last two years, hovering between $70-90 per barrel (b). The spot price has moved lower across the last two months, falling to $68.82/b through the week of Sept. 13 (Figure 1). This is now the lowest weekly spot price recorded since December 2021.

In its latest forecast, the EIA expects spot oil prices to recover and average $82/b in the fourth quarter, down from prior estimates. Its 2025 forecast has been revised downwards to $84/b.

Following historical lows seen earlier this year, natural gas spot prices rose in May and June but have since edged back down. Recall that, in March, prices fell to a 25-year low of $1.40 per metric million British thermal units (mmBtu). The EIA attributed these low prices to historically high inventory levels due to reduced winter consumption. Following a three-month low of $1.88/mmBtu in August, natural gas prices are beginning to increase. Prices reached a one-month high of $2.13/mmBtu through the week of Sept. 13.

The September STEO forecasts natural gas prices to climb in the coming months and to reach an estimated $3.25/mmBtu by early next year. EIA forecasts natural gas prices from November through March to average $3.10/MMBtu, following regular seasonal patterns. This rise is supported by higher seasonal heating demand and higher gas exports from new facilities in Texas and Louisiana.

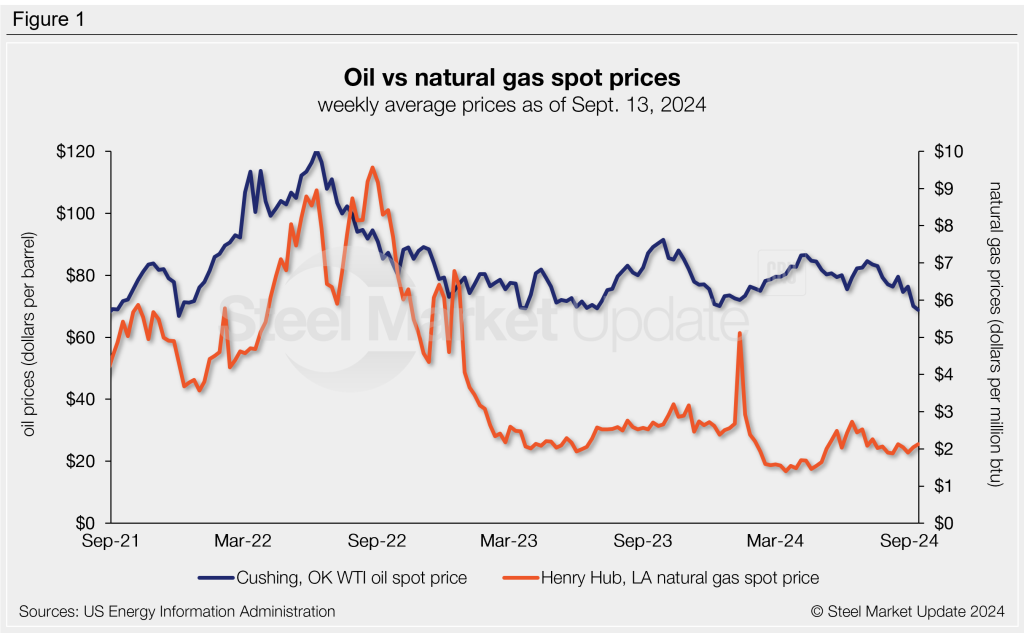

Rig counts

The number of active drilling rigs operating in the US remains near multi-year lows, territory they have been in for the last three months (Figure 2). The latest US count is 588 active drill rigs as of Sept. 20, according to Baker Hughes. Active US rig counts are 7% below year-ago levels.

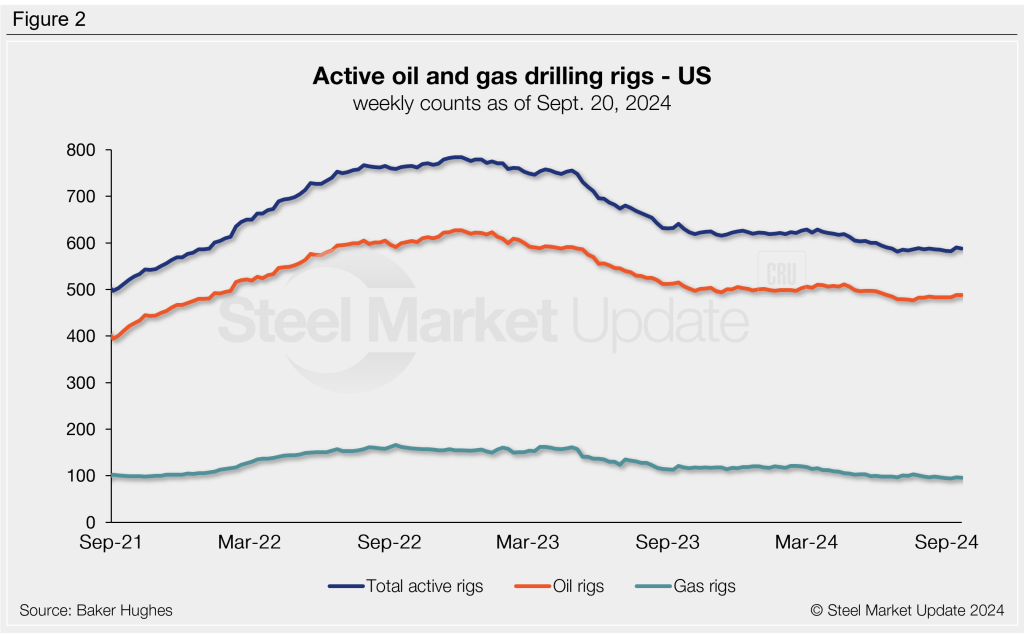

Drilling activity in Canada has declined over the past two weeks but is still up 11% from a year ago. The active rig count was 211 rigs last week, declining from a six-month high earlier this month (Figure 3).

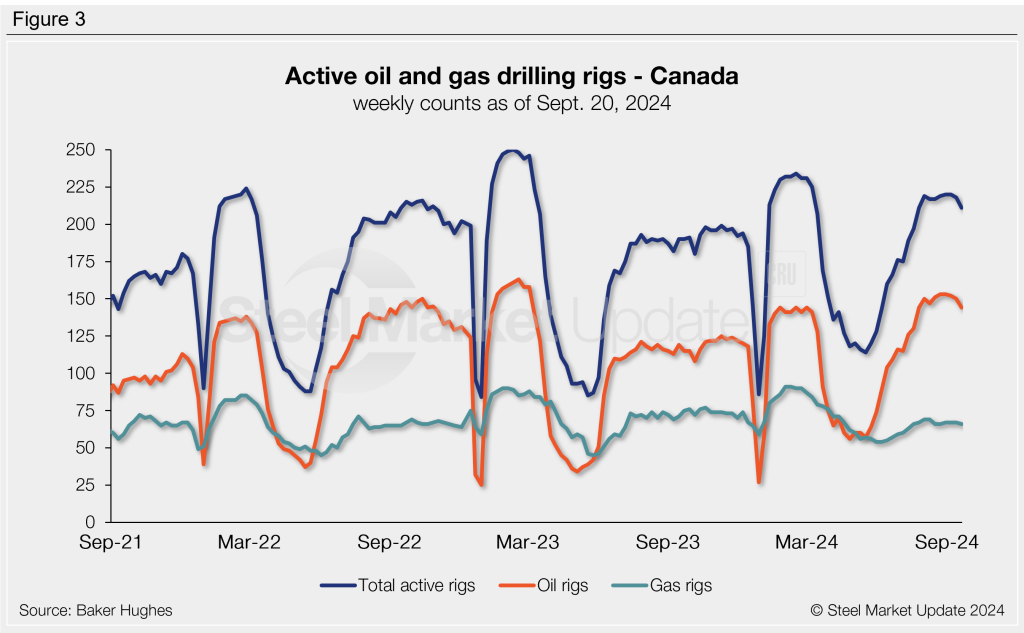

Stock levels

US crude oil stocks have eased in the past three months, following a 14-month high in June. As of Sept. 14, the US stock level declined to almost a seven-month low of 798 million barrels. September stocks were still 1% higher than at the start of the year and 4% higher than last year (Figure 4).