Analysis

December 9, 2024

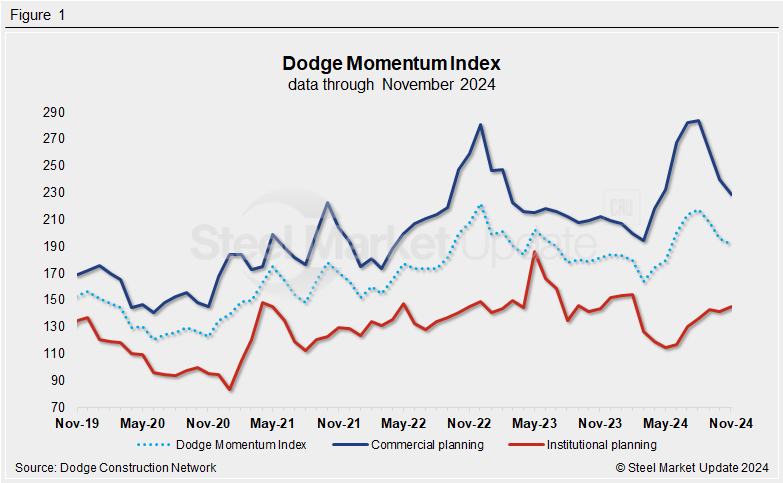

Slowing data center, warehouse planning drives decline in Dodge index

Written by Laura Miller

The Dodge Momentum Index (DMI) slid further in November as planning for data centers and warehouses continued to decline.

The Dodge Construction Network (DCN) reported a DMI reading of 191.5 for November, down from October’s revised reading of 196.0. The index has slid each month since hitting a 20-month high of 217.7 in August.

The DMI tracks the value of nonresidential construction projects entering the planning stages. It typically leads construction spending by about 12 months.

Institutional planning fell sharply from February to March and registered a more than three-year low of 115.0 in May. It has since been trending upward, ticking up to 145.3 in November, the third-highest reading of the year after January and February.

Meanwhile, commercial planning has seen an inverse trend this year. It hit a 22-month low of 194.3 in March, then rose rapidly to a high of 283.6 in August. It’s since tumbled by more than 50 points, falling to 239.9 in October and then 228.9 in November.

Sarah Martin, associate director of forecasting at DCN, explained: “Throughout 2024, we’ve seen robust growth in nonresidential planning activity – but labor shortages and high construction costs have prevented those projects from moving through the planning process at a normal pace. The current backlog may be constraining demand for commercial planning in the short-term.”

On the commercial side, slower data center, warehouse, office, and retail planning were responsible for most of November’s decline, DCN said. At the same time, education planning drove growth on the institutional side.

Year-over-year increases of 13% in commercial and 8% in institutional planning resulted in November’s DMI showing a 12% on-year rise.

DCN pointed out the significant influence of data centers this year: “If we remove all data center projects in 2023 and 2024, commercial planning would be down 6% from year-ago levels, and the entire DMI would be down 1%.”

Looking to next year, Martin said, “Overall, easing monetary policy will help alleviate the backlog of projects in the planning queue throughout 2025 and spur more demand for projects in the coming months.”

Dodge is the leading index for commercial real estate. It uses the data of planned nonresidential building projects to gauge spending in this important steel-consuming sector for the next 12 months. An interactive history of the DMI is available on our website.