Market Data

January 7, 2025

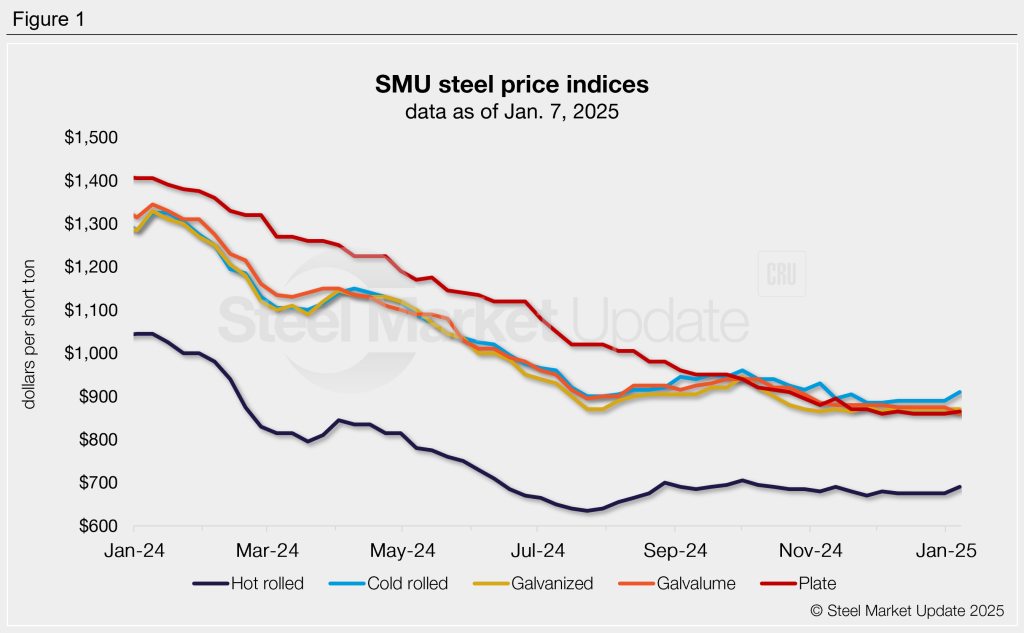

SMU price ranges: Sheet, plate begin 2025 mixed amid limited spot activity

Written by Michael Cowden

Steel prices didn’t start the new year with a bang – but they didn’t bust, either, according to SMU’s first survey of 2025.

The price

All told, SMU assesses spot hot-rolled (HR) coil prices at $690 per short ton (st) on average, up $15/st from our prior check of the market. When it comes to tandem products, cold-rolled coil stands at $910/st, up $20/st from our last check. Galvanized base prices were unchanged at $870/st. And Galvalume tags slipped $15/st to settle at $860/st on average.

Plate, meanwhile, was little changed at $865/st, up $5/st from our prior assessment. That stability on the price side does not reflect concerns in some corners about unusually short lead times at certain mills and weak demand.

What people are saying

On the sheet side, market participants generally predicted that prices should move higher this year on the coated trade petition and widely anticipated tariffs under President-elect Trump. But most buyer sources weren’t eager to load up given the uncertain timing and scope of the potential tariffs. They also cited increasing domestic capacity and modest demand.

Another factor: The spot market to date has been thin. That’s sometimes the case immediately after the holidays. And that typical spot slowness has been amplified by attractive contract pricing.

Recall that most contract prices in January are based on discounts to December numbers. When it comes to current spot prices, Nucor is officially seeking $750 per short ton (st) for HR. Cliffs is officially trying to fetch $800/st for spot HR. (See SMU’s price announcement calendar for reference.) But most SMU survey respondents reported spot numbers in the mid-$600s to low $700/st. And contract tons were generally available in the low $600s, sources said.

On the coated side, sources noted that at least two EAF producers were offering material in the low $800s. They also pointed out that one of those producers had shorter lead times for coated products than for HR at some of its mills. (Coated lead times are typically longer than those for HR.)

Momentum indicators

While buyers expect flat-rolled steel prices to move higher in 2025, few seem willing to place big bets on when that inflection point higher might come. SMU as a result is keeping its momentum indicators for sheet and plate at neutral.

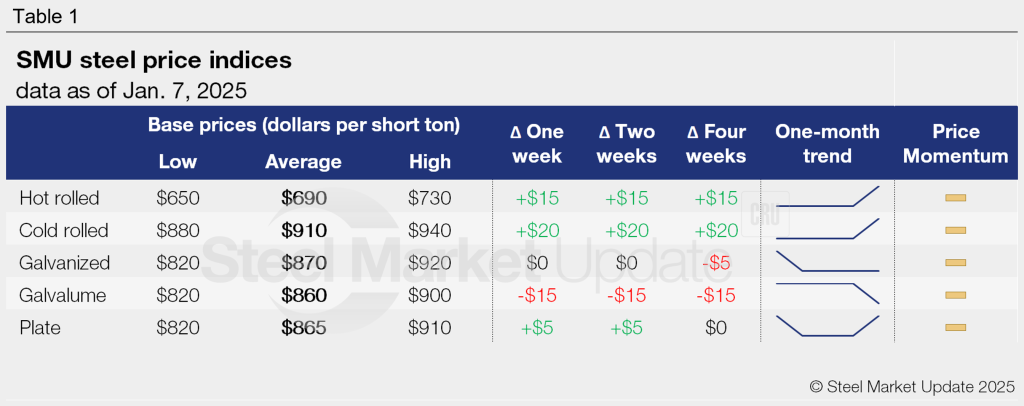

Refer to Table 1 for the latest SMU steel price indices and how prices have moved in recent weeks.

Hot-rolled coil

The SMU price range is $650-730/st, averaging $690/st FOB mill, east of the Rockies. The lower end of our range is unchanged week over week (w/w), while the top end is up $30/st w/w. Our overall average is up $15/st w/w. Our price momentum indicator for hot-rolled steel remains at neutral, meaning we see no clear direction for prices over the next 30 days.

Hot rolled lead times range from 3-6 weeks, averaging 4.8 weeks as of our Dec. 18 market survey. We will publish updated lead times on Thursday.

Cold-rolled coil

The SMU price range is $880–940/st, averaging $910/st FOB mill, east of the Rockies. Our entire range shifted up $20/st w/w. Our price momentum indicator for cold-rolled steel remains at neutral, meaning we see no clear direction for prices over the next 30 days.

Cold rolled lead times range from 5-9 weeks, averaging 6.5 weeks through our latest survey.

Galvanized coil

The SMU price range is $820–920/st, averaging $870/st FOB mill, east of the Rockies. The lower end of our range is down $20/st w/w, while the top end is up $20/st w/w. Our overall average is unchanged w/w. Our price momentum indicator for galvanized steel remains at neutral, meaning we see no clear direction for prices over the next 30 days.

Galvanized .060” G90 benchmark: SMU price range is $917–1,017/st, averaging $967/st FOB mill, east of the Rockies.

Galvanized lead times range from 5-9 weeks, averaging 6.8 weeks through our latest survey.

Galvalume coil

The SMU price range is $820–900/st, averaging $860/st FOB mill, east of the Rockies. The lower end of our range is down $30/st w/w, while the top end is unchanged w/w. Our overall average is down $15/st w/w. Our price momentum indicator for Galvalume steel remains at neutral, meaning we see no clear direction for prices over the next 30 days.

Galvalume .0142” AZ50, grade 80 benchmark: SMU price range is $1,114–1,194/st, averaging $1,154/st FOB mill, east of the Rockies.

Galvalume lead times range from 6-8 weeks, averaging 7.0 weeks through our latest survey.

Plate

The SMU price range is $820–910/st, averaging $865/st FOB mill. The lower end of our range is down $20/st w/w, while the top end is up $30/st w/w. Our overall average is up $5/st w/w. Our price momentum indicator for plate remains at neutral, meaning we see no clear direction for prices over the next 30 days.

Plate lead times range from 2-7 weeks, averaging 3.9 weeks through our latest survey.