Analysis

January 10, 2025

Active rig counts slip in US, rise in Canada

Written by Brett Linton

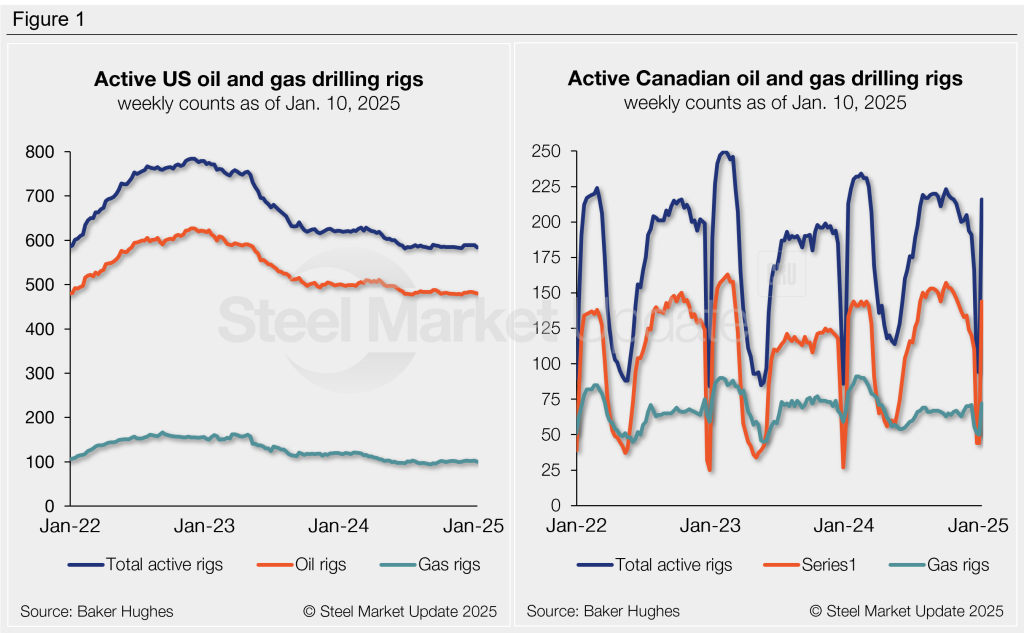

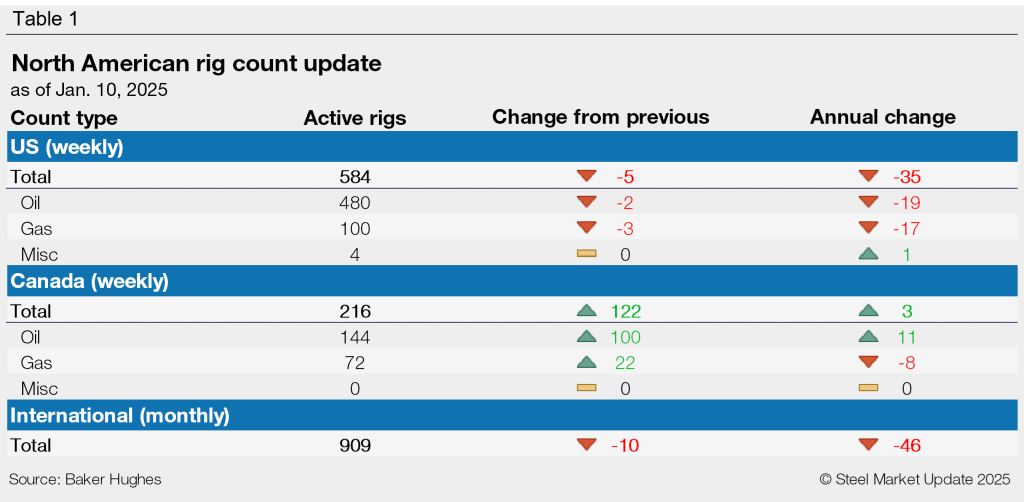

Oil and gas drilling activity declined in the US through this week, while Canadian rig counts rebounded, according to the latest data from Baker Hughes.

US rig counts have remained within nine rigs of a multi-year low since last June. The latest count as of Jan. 8 marks the lowest level seen since November. In June 2024, we saw a two-and-a-half-year low of 581 rigs, while the highest count last year was 629 rigs in March.

The rebound in Canadian activity this week comes after the typical seasonal downturn seen around the end of each year. Canadian counts typically soar in January and February, then begin to ease as warmer spring weather approaches and thawing ground conditions limit access to roads and sites.

The international rig count (updated monthly rather than weekly) decreased to 909 in December. This is 10 rigs fewer than the November count and 46 fewer than the same month one year prior.

The Baker Hughes rig count is important to the steel industry because it is a leading indicator of demand for oil country tubular goods (OCTG), a key end market for steel sheet. A rotary rig rotates the drill pipe from the surface to either drill a new well or sidetrack an existing one.

For a history of the US and Canadian rig counts, visit the rig count page on our website.