Market Data

March 4, 2025

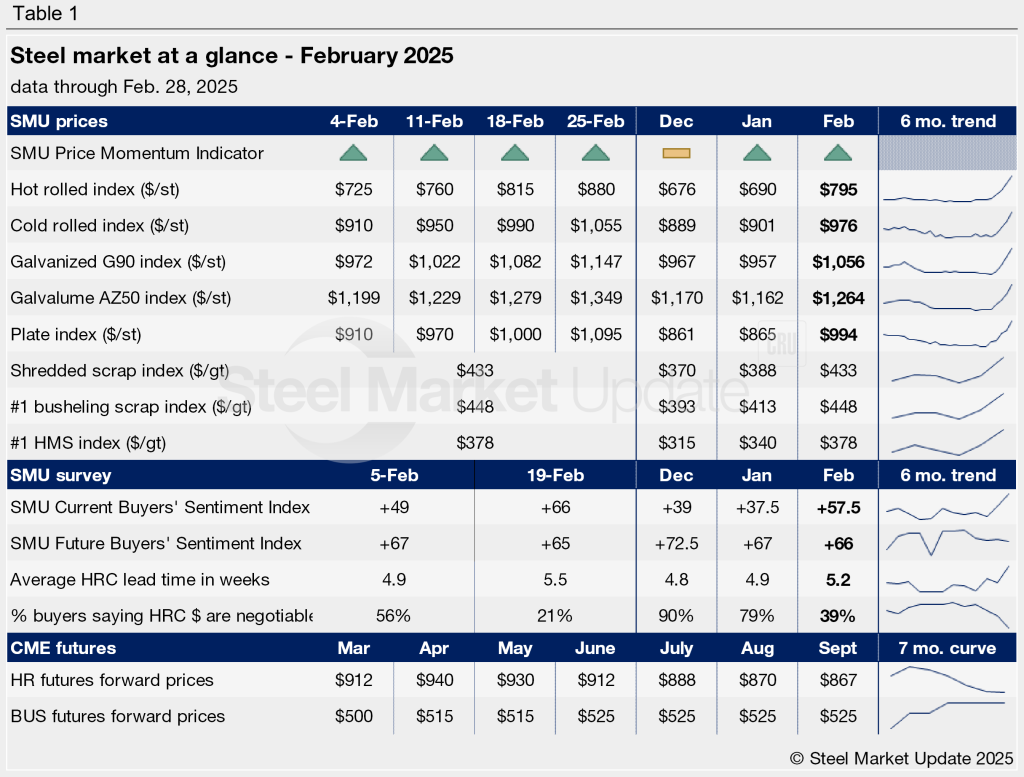

SMU's February at a glance

Written by Brett Linton

SMU’s Monthly Review summarizes key SMU steel market metrics for the previous month, with the latest data through Feb. 28.

Steel prices surged across February, as we witnessed some of the most significant weekly gains in over a year. In late January, we adjusted the SMU Price Momentum Indicators for both sheet and plate products from Neutral to Higher, where they remained pointed throughout February.

Following a recovery in January, ferrous scrap prices soared again in February, with the largest monthly increase in over a year. The spike was driven by tightening supply and recovering mill demand, pushing prices to one-year highs. Buyers remain bullish that this rally will continue into March, anticipating another significant rise in prices.

Our Steel Buyers Sentiment Index climbed across February to reach a nine-month high, indicating that buyers are optimistic about their companies’ chances of success. Our Future Sentiment Index saw less movement in February but remained strong, showing buyers have a positive outlook for the year’s first half.

Steel mill lead times stretched out across the month for all five sheet and plate products we track to the longest they’ve been in 10 months. Production times have primarily extended from frenzied buying in response to tariffs, not so much due to end-use demand.

Most steel buyers no longer report that mills are willing to negotiate on pricing for new spot orders. In late February, negotiation rates plummeted across all sheet and plate products we track to the lowest levels we have seen in nearly two years.

See the table below for other key February metrics (click to expand). You can also view historical monthly review tables on our website.