Analysis

April 11, 2025

Rig counts decline again in US and Canada

Written by Brett Linton

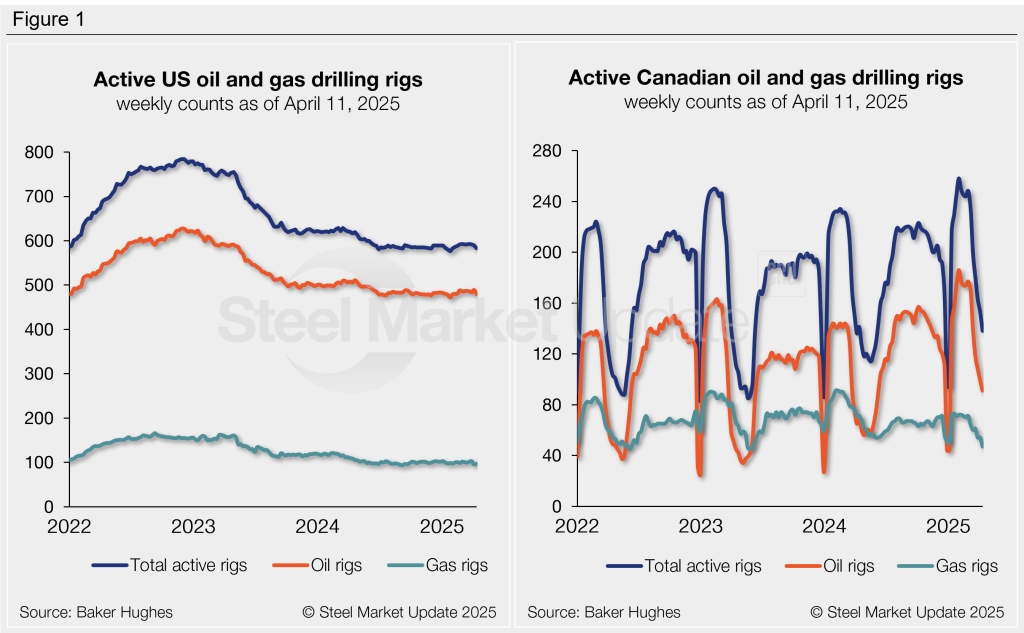

Oil and gas drilling activity eased for the third consecutive week in both the US and Canada this week, according to Baker Hughes. US rig counts remain just above multi-year lows, while Canadian activity continues its seasonal slowdown.

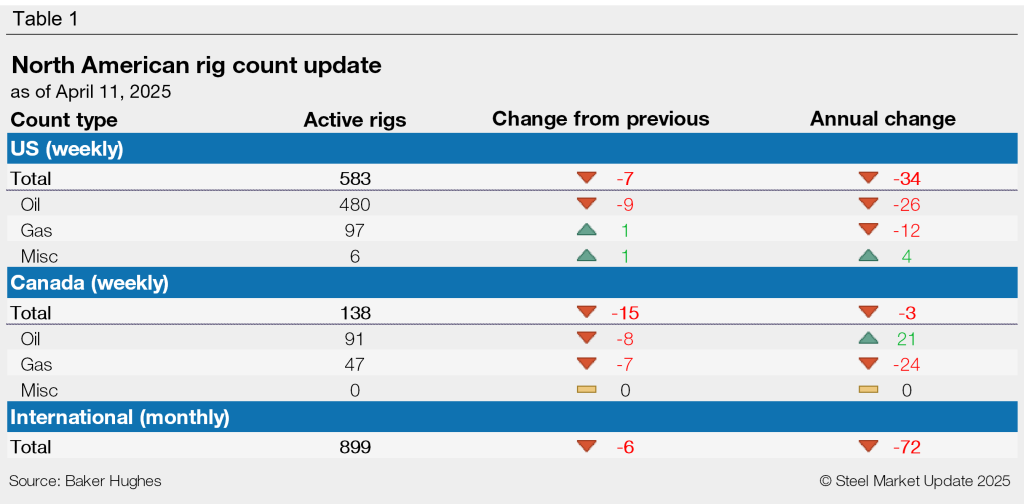

US drilling activity slipped by seven to 583 rigs this week, the lowest weekly rate seen since January. Drilling activity has remained at reduced levels for the past 10 months, recently slipping to a three-year low of 576 rigs in January.

Canadian drilling continues to decline seasonally following its winter peak. Total oil and gas rig counts fell by 15 this week to 138. Canadian activity typically surges in January and February, then declines through April as thawing ground conditions limit access to roads and drilling sites.

The international rig count is reported monthly at the start of each month. The March count was 899 rigs, down six from February and 72 fewer than one year prior.

The Baker Hughes rig count is significant for the steel industry because it is a leading indicator of oil country tubular goods (OCTG) demand, a key end market for steel sheet.

For a history of the US and Canadian rig counts, visit the rig count page on our website.