Market Data

April 16, 2025

SMU Survey: Buyers' Sentiment Indices fall

Written by Ethan Bernard

SMU’s Buyers’ Sentiment Indices both declined this week, according to our most recent survey data.

Every other week, we ask steel industry executives how they rate their companies’ current chances of success, as well as business expectations three to six months down the road. We use this data to calculate our Current and Future Steel Buyers’ Sentiment Indices, metrics we have measured since 2009.

Current Sentiment

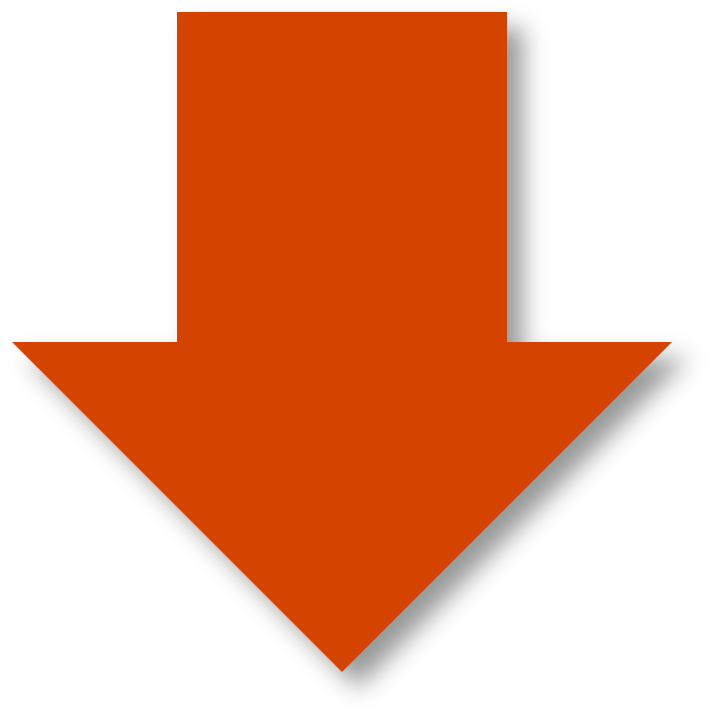

Our Current Sentiment Index dropped six points to +42 this week compared to two weeks earlier. It has fallen in every successive survey since reaching a 2025 high of +66 on Feb. 19.

Though still optimistic, it appears tariff uncertainty shows buyers are less confident about current business conditions (Figure 1) than they had been at the beginning of this presidential administration.

Future Sentiment

Our Future Buyers’ Sentiment Index also ticked lower, albeit slightly (Figure 2). It stands at +52, off one point from the previous survey. Still, this marks the lowest reading so far in 2025. The highest was +68 at the beginning of the year.

What SMU survey respondents had to say:

“The elevated prices are increasing our margins, but sales seem to be slowing.”

“The current administration is creating too much uncertainty and risks. They are undermining our economy and the world’s.”

“Just too much uncertainty. Nobody is buying.”

“We have products in our line-up that have historically been recession proof.”

“We seem to buy wisely and manage/move inventory well.”

“It could get worse in six months.”

“Economic success in 2025 will be dictated by policy.”

“Potential slight recession.”

Sentiment trends

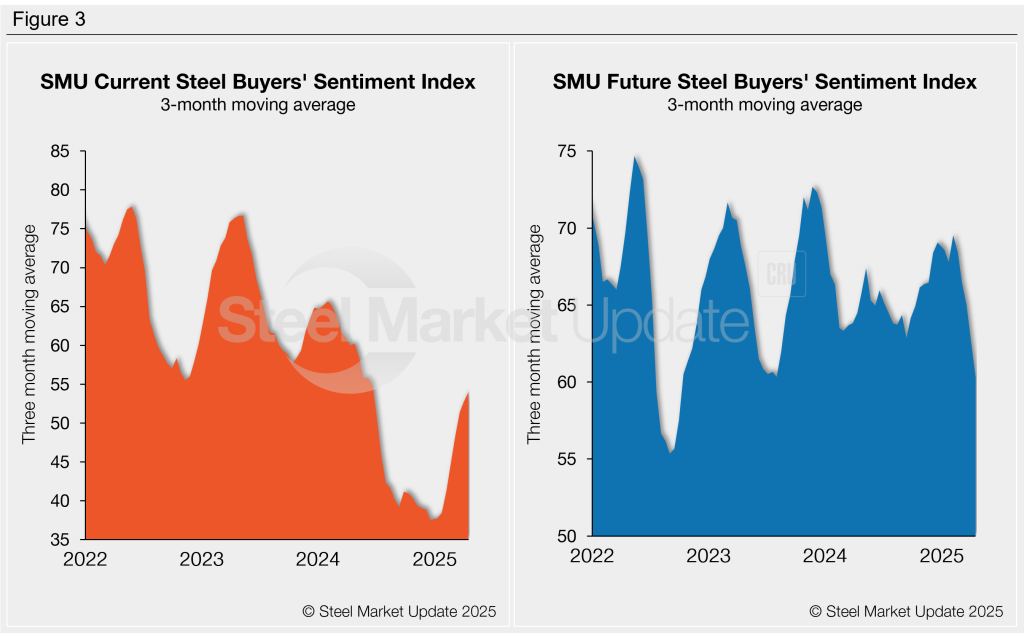

When viewed on a three-month moving average, our Sentiment Indices continued to move in different directions this week (Figure 3).

The Current Sentiment 3MMA continues to trend upward. It increased to 53.97 this week vs +52.76 at the previous market check.

The Future Sentiment 3MMA, however, fell to +60.28, compared with+62.60 two weeks earlier.

The Current Sentiment 3MMA has been trending up since just before Christmas, while the Future Sentiment 3MMA started to fall in early February.

About the SMU Steel Buyers’ Sentiment Index

The SMU Steel Buyers Sentiment Index measures the attitude of buyers and sellers of flat-rolled steel products in North America. It is a proprietary product developed by Steel Market Update for the North American steel industry. Tracking steel buyers’ sentiment is helpful in predicting their future behavior. A link to our methodology is here. If you would like to participate in our survey, please contact us at info@steelmarketupdate.com.