Market Data

May 2, 2025

SMU Survey: Steel Buyers’ Sentiment Indices see modest recovery

Written by Brett Linton

SMU’s Buyers’ Sentiment Indices both improved this week, reversing the decline seen two weeks ago. Despite this volatility, both indices continue to reflect optimism among steel buyers for their companies’ ability to be successful today as well as in the near future.

Our Current Sentiment Index, previously at a three-month low, snapped back this week to highest measure recorded since mid-March. While still strongly optimistic, Current Sentiment reflects that buyers are slightly less confident about their businesses prospects than they were back in February and March.

Future Buyers’ Sentiment also improved this week, ticking up from a near-two-year low. The index continues to reflect that buyers are optimistic for future business success, though not as strong as they felt in the first three months of this year.

We poll thousands of steel industry executives every other week on how they rate their companies’ chances of success today, as well as expectations three to six months in the future. We use the results to calculate our Current and Future Steel Buyers’ Sentiment Indices, metrics tracked since 2009.

Current Sentiment

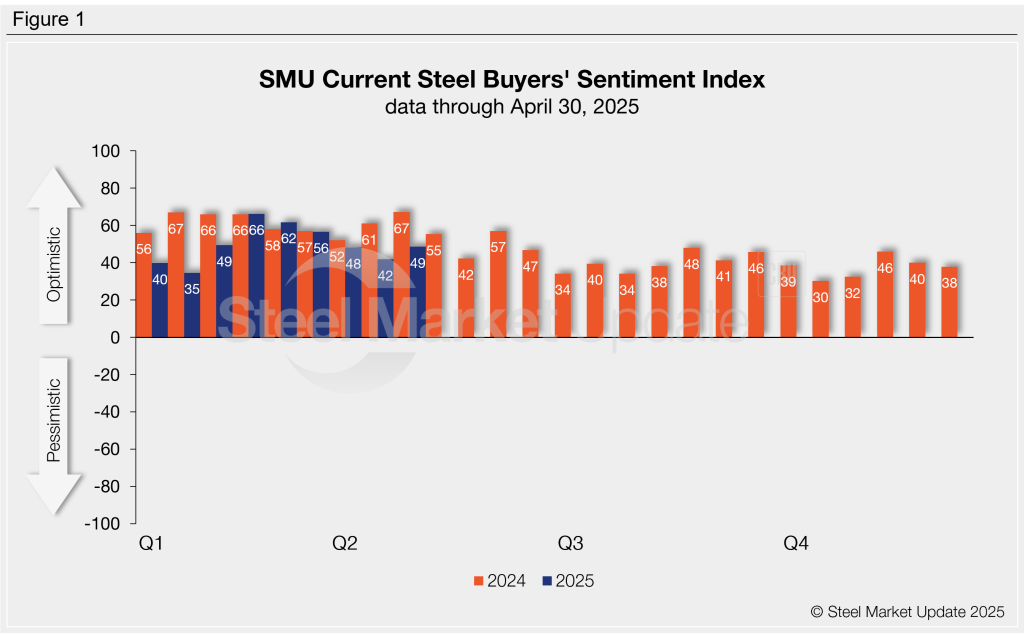

SMU’s Current Buyers’ Sentiment Index broke its four-consecutive survey decline streak, recovering seven points to +49 this week (Figure 1). Prior to this, Current Sentiment had been trending downward since mid-February. For comparison, Current Sentiment averaged +48 across 2024 and stood significantly stronger at +67 this time last year.

Future Sentiment

Future Sentiment increased two points this week to +54. This measure was previously at the lowest measure seen since June 2023. This index has generally trended lower since peaking late last year, but continues to indicate that buyers have an optimistic outlook for the next three to six months (Figure 2). Future Sentiment averaged +65 throughout 2024 and was much higher at +70 one year ago.

What SMU survey respondents had to say:

“Too much uncertainty and risk of slowdown/recession.”

“Assuming we don’t have a huge drop in demand and prices, we should do alright.”

“Most of our high-priced inventory is covered with sell deals.”

“We seem well positioned with about the right amount of inventory and still at below market prices.”

“50 years of experience will get us through these uncertain and sour times.”

Sentiment trends

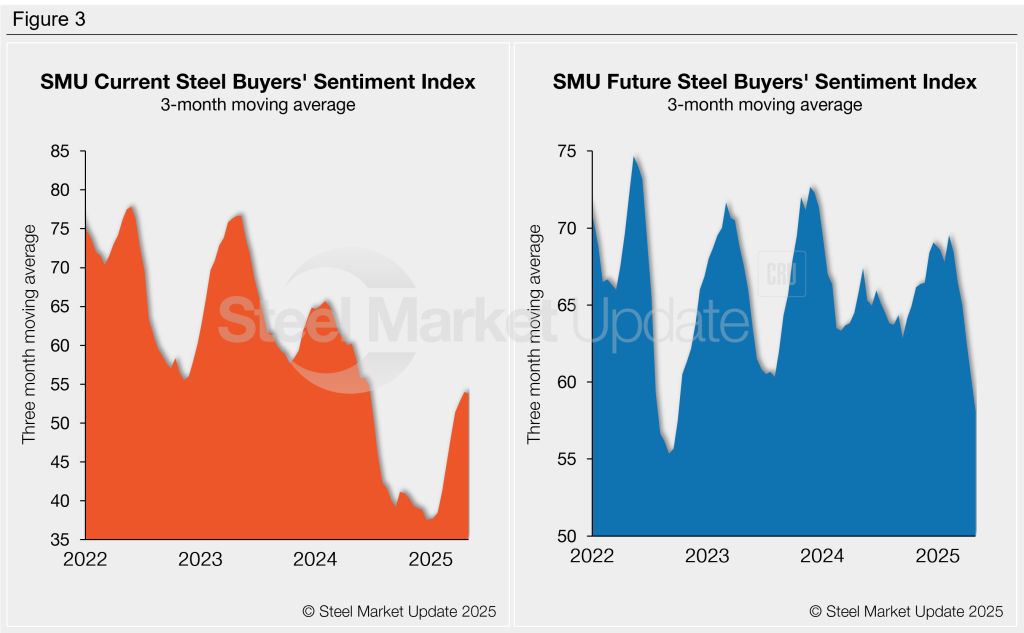

On a three-month moving average (3MMA) basis, both Sentiment Indices declined this week (Figure 3). The Current Sentiment 3MMA had trended upward since the start of the year, rising to a nine-month high in mid-April. This week the 3MMA has declined to +53.84. Meanwhile, the Future Sentiment 3MMA declined for the sixth consecutive survey, now standing at a two-and-a-half-year low of +58.09.

About the SMU Steel Buyers’ Sentiment Index

The SMU Steel Buyers Sentiment Index measures the attitude of buyers and sellers of flat-rolled steel products in North America. It is a proprietary product developed by Steel Market Update for the North American steel industry. Tracking steel buyers’ sentiment is helpful in predicting their future behavior. A link to our methodology is here. If you would like to participate in our survey, please contact us at info@steelmarketupdate.com.