Market Data

May 16, 2025

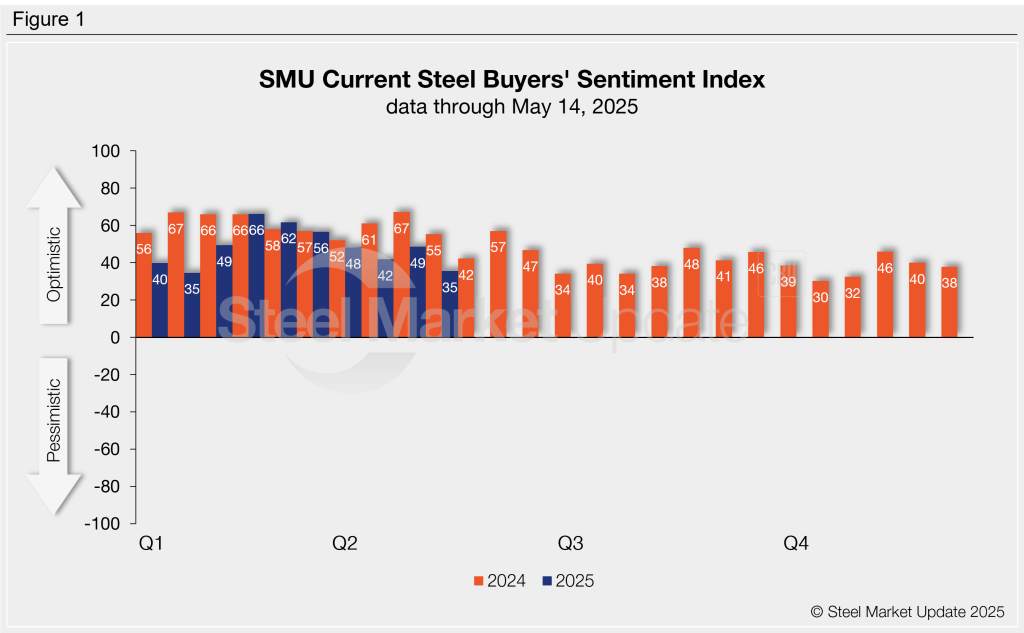

SMU Survey: Buyers’ Sentiment tumbles as caution increases

Written by Brett Linton

SMU’s Buyers’ Sentiment Indices resumed their downward trend this week, erasing the modest recovery seen two weeks ago.

Both indices continue to reflect optimism among steel buyers for their companies’ chances of current and future success, though not nearly as strongly as they did earlier this year in February and March.

Our Current Sentiment Index experienced a double-digit decline this week, tied with mid-January for the lowest measure recorded in months. Future Buyers’ Sentiment also edged lower, falling to a multi-year low.

Every other week we poll thousands of steel industry executives asking them to rate their companies’ chances of success today, as well as three to six months down the road. We use this data to calculate our Current and Future Steel Buyers’ Sentiment Indices, metrics tracked since SMU’s inception.

Current Sentiment

SMU’s Current Buyers’ Sentiment Index fell 14 points from late-April to +35 this week (Figure 1). This is one of the lowest measures recorded in 2025, equal to the Jan. 22 reading. The last time Current Sentiment was lower than this was in early November 2024. For comparison, Current Sentiment averaged +48 throughout 2024 and was significantly stronger this time last year at +55.

Future Sentiment

Future Sentiment fell by eight points to +46 this week (Figure 2). This index has now fallen below the multi-year low previously seen in mid-April, slipping to the lowest measure seen in almost three years. This index has generally trended lower since peaking late last year, though it continues to indicate that buyers maintain a positive outlook for future business conditions. Future Sentiment averaged +65 across 2024 and was much higher at +68 one year ago.

What SMU survey respondents had to say:

“The elevated prices are helping our margins.”

“Still many unknowns in the economy driven by attempted policy changes and inconsistencies.”

“Things will get more challenging as our inventory costs catch up to current pricing.”

“We expect shipments to be good through June, but beyond is looking dismal.”

Sentiment trends

On a three-month moving average (3MMA) basis, both of our Sentiment Indices declined this week for the second survey in a row (Figure 3). The Current Sentiment 3MMA had trended upward from the start of the year through mid-April to reach a nine-month high. This week the 3MMA has declined to a 10-week low of +48.71. The Future Sentiment 3MMA declined for the seventh consecutive survey, dropping to a four-and-a-half-year low of +54.83.

About the SMU Steel Buyers’ Sentiment Index

The SMU Steel Buyers Sentiment Index measures the attitude of buyers and sellers of flat-rolled steel products in North America. It is a proprietary product developed by Steel Market Update for the North American steel industry. Tracking steel buyers’ sentiment is helpful in predicting their future behavior. A link to our methodology is here. If you would like to participate in our survey, please contact us at info@steelmarketupdate.com.