Analysis

July 16, 2025

June service center shipments and inventories report

Written by Estelle Tran

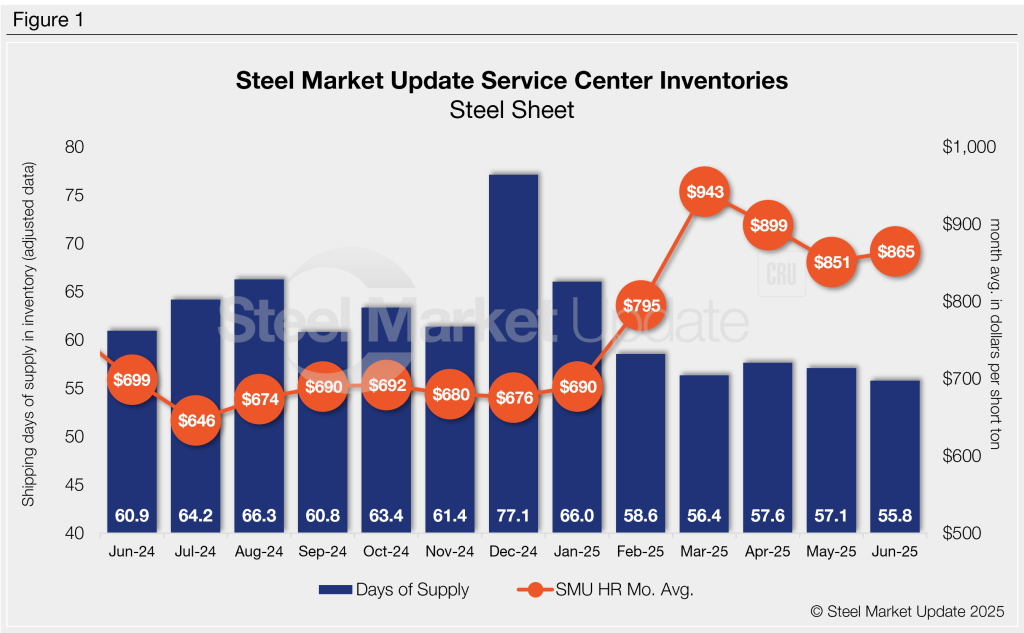

Flat rolled = 55.8 shipping days of supply

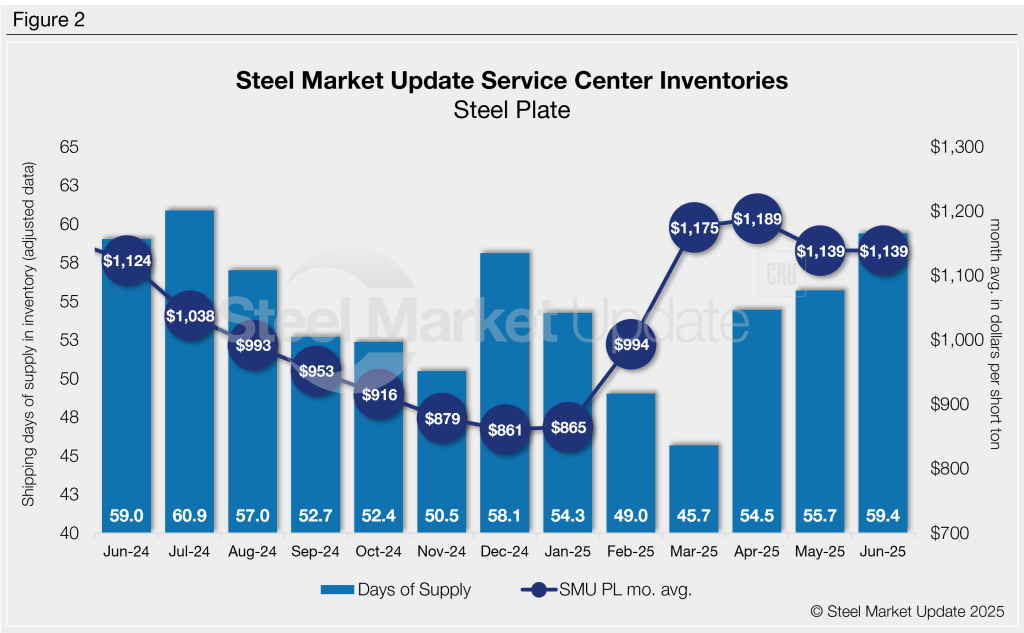

Plate = 59.4 shipping days of supply

Flat rolled

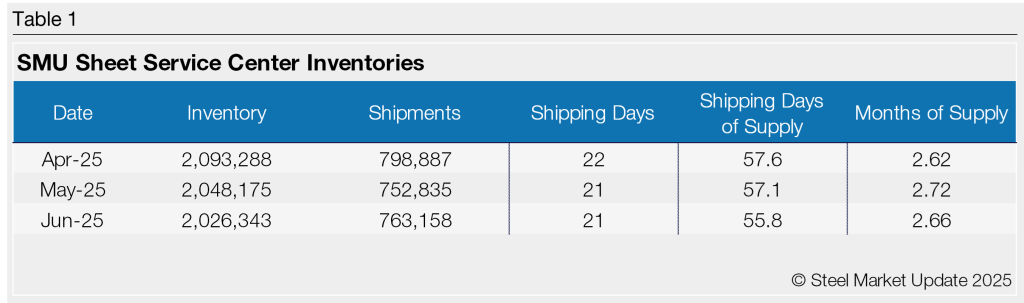

US service centers’ flat-rolled steel supply edged down in June with a modest boost to shipments month on month (m/m). At the end of June, US service centers carried 55.8 shipping days of flat roll supply, down from 57.1 shipping days in May, according to adjusted SMU data. Inventories represented 2.66 months on hand at the end of June, down from 2.72 months at the end of May. Flat roll supply is down year on year from 60.9 shipping days of supply in June 2024.

June had 21 shipping days of supply, the same number as May. Despite a rise in shipments m/m, intake also increased, putting inventories in a slight surplus. The market has been reconciling weaker business forecasts with higher tariff-fueled costs. The latest SMU survey, published on July 11, found 63% of service centers were releasing less steel than a year ago, and 50% of service centers reported their manufacturing customers were reducing orders.

At the same time, lead times have remained short, with mill hot-rolled coil lead times hovering around 4.5 weeks in the last two months, according to SMU data. With short lead times, supply easily meeting demand, and uncertain outlooks for demand and pricing, service centers pulled back on flat roll purchases in June.

Sheet on order at the end of June fell sharply from May. In terms of shipping days of supply, it was down 7% and down 13.4% from June 2024. We expect to see material on order pick up from this recent low, especially given the advantageous variable contract pricing.

The percentage of inventory on order in June was down as well.

Plate

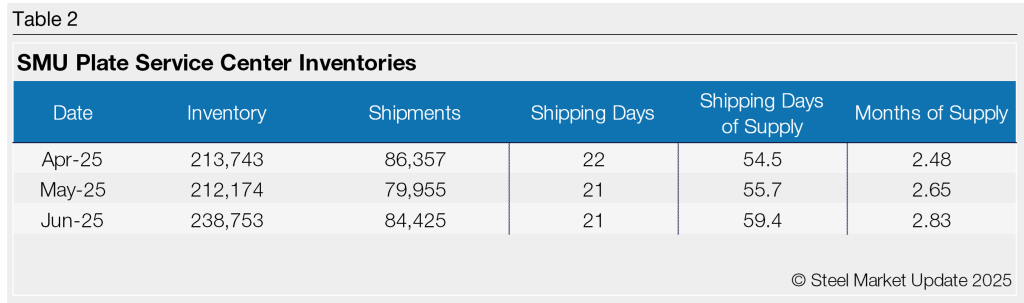

US service center plate supply rose again in June, and plate shipments also increased m/m. At the end of June, service centers carried 59.4 shipping days of plate supply, up from 55.7 shipping days in May. Plate inventories represented 2.83 months of supply in June, up from 2.65 months in May.

Plate inventories were similar to year-ago levels, when service centers stocked 59 shipping days of plate supply, representing 2.95 months of supply.

June shipments also ramped up after slowing down in April and May. However, intake also jumped 42%. At the same time, material on order edged lower. Plate on order represented in shipping days was down 9% vs. May.

Plate demand has weakened in the last couple months, according to service center contacts. While plate inventories are in surplus relative to demand, lower material on order could bring inventories back into balance, especially with the coming fall outages.

Meanwhile, mill lead times remain short with many buyers sitting on the sidelines. SMU reported plate lead times at 5.2 weeks in its most recent survey, down from 5.63 weeks the month prior.