Analysis

July 25, 2025

CRU: Downstream tariffs will not change the stainless market, but domestic expansion will

Written by Brett Reed

The analysis above was first published by CRU. To learn about CRU’s global commodities research and analysis services, visit www.crugroup.com.

US tariff expansion to stainless material in imported downstream products will not be enough on its own to incentivize capital investment. Imports of appliances will face headwinds as the Chinese Haier Group expands in the US.

On June 4, US Section 232 tariffs on steel and aluminum doubled from 25% to 50% and extended to steel derivative products. Such expansion will not be enough on its own to incentivize capital investment because it does not cover a significant share of the product’s value.

At the same time, we have seen growing investment in the household appliance sector from the Chinese Haier Group. This company emerged as a US domestic producer via acquisition (of GE Appliances) and is expanding its US footprint even as US trade policy works against supply from China.

Asia and Mexico dominate US imports of household goods

The US tariffs on steel and aluminum doubled to 50% and were extended downstream to cover the steel and stainless steel used in derivative products like appliances. The list of these products covers a wide range of consumer and industrial appliances, including refrigerators, washing machines, tumble dryers, freezers, cooking stoves, kitchen waste disposals, and welded wire racks.

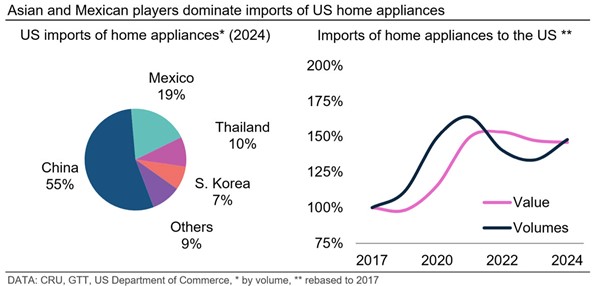

We estimate that the above extension will cover $14.9 billion of imports, which is about 15% of annual US domestic home appliances sales of over $100 billion, based on 2024 data. Most of the above products are imported from countries in Asia – China, South Korea, and Thailand – as well as Mexico.

Import volumes have been growing since 2017 and peaked in 2022, post-COVID, supported by strong demand, growing disposable income on the consumer side, and supply disruptions from the domestic supply. After peaking in 2022, the volumes of imported home appliances remained elevated compared to pre-COVID levels but had slower growth.

The effect of tariff expansion downstream will be limited

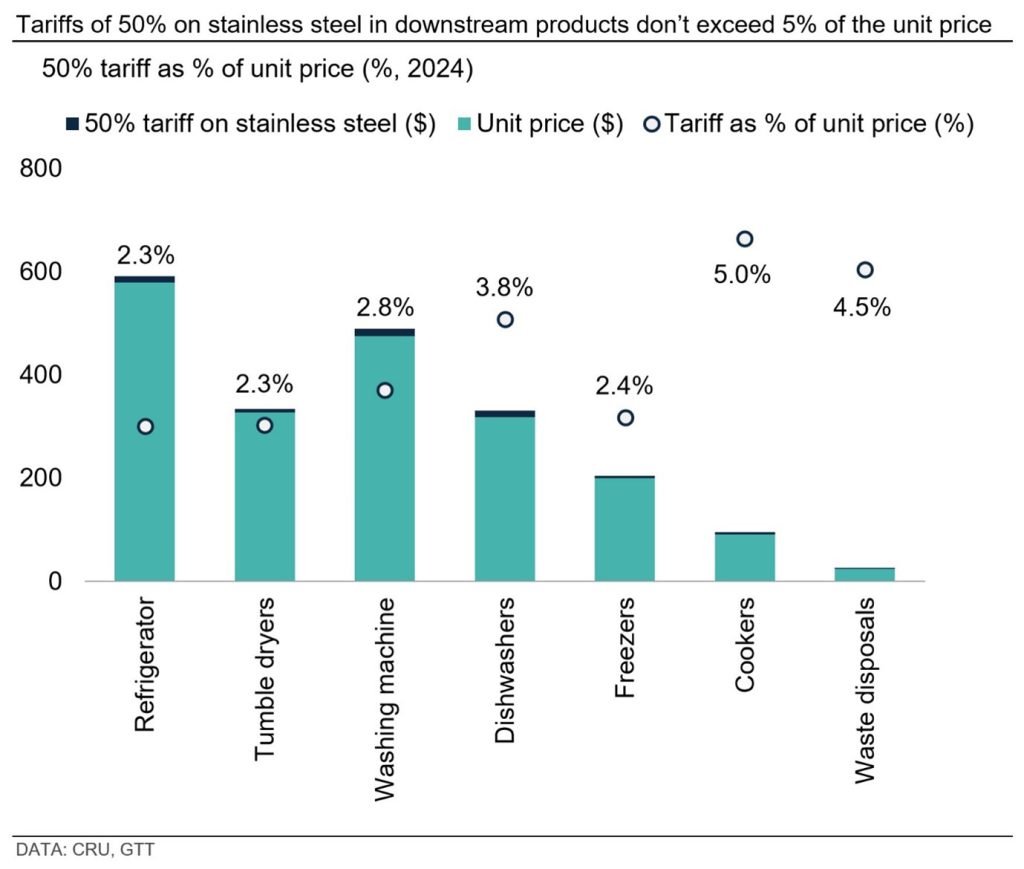

At this stage, tariffs apply only to the steel content of an item and not its entire value. This is a small amount vs. the total price of the product. We estimate that a 50% tariff on stainless steel in downstream products will not exceed 5% of the total product cost. Therefore, while supportive, we see this as insufficient to justify capital allocation decisions within the home appliance industry.

In our recent Insight on US tariffs (US stainless prices to rise on expanded S232 tariffs), we considered further tariff expansion onto the entire product. If tariffs evolve further towards that state, they would be much more likely to justify such decisions.

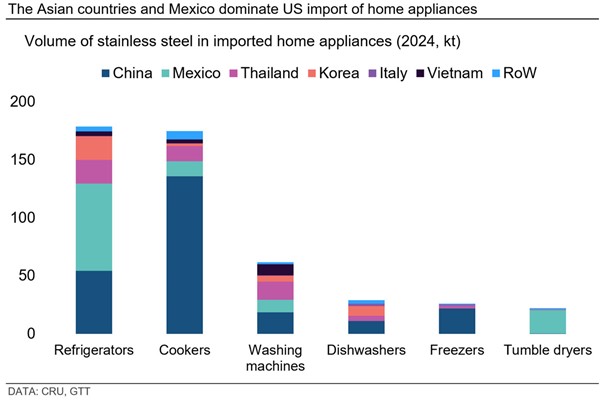

China is exposed the most, but little affected

China accounts for the bulk of US import of home appliances. We estimate the volume of stainless cold-rolled coil (CR) used in all Chinese home appliances exported to the US at below 0.3 metric tons (2024) or 1.4% of the estimated Chinese 2024 CR production. Other key exporters include Mexico, Thailand, Vietnam, and South Korea. Some imports will be excluded from tariffs, provided the steel used was melted and poured in the US. In practice, this would exclude most of the Mexican exports of home appliances to the US.

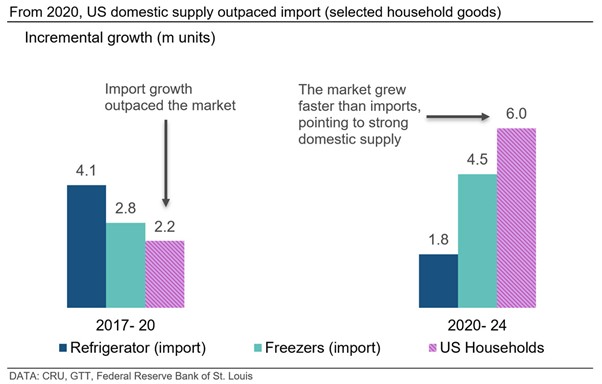

Haier/GE Appliances expands domestically, capping import growth

After peaking in 2021, imports of home appliances to the US grew more slowly than the domestic supply. We compared the growth of imports for home appliances with the household penetration levels close to 100% (refrigerators and freezers) against the growth of the underlying market (number of households). Between 2017 and 2020, the number of imported refrigerators and freezers exceeded the number of extra households, indicating imports were outpacing domestic supply. Our analysis indicates that from 2020 US domestic supply outpaced the imports, growing faster than the underlying market.

We link the recent growth in the US domestic production with the expansion of Haier Group, the new owner of US household producer GE Appliances. Since acquiring GE Appliances in 2016, the new US domestic player invested in expansion of its US-based manufacturing capacities. This expansion includes a $180 m investment in Roper Corporation cooking products plant in LaFayette, Georgia, $115 m expansion of the refrigerator plant in Decatur, Alabama and recently announced $490 m expansion of the laundry plant in Louisville, Kentucky.