CRU

August 1, 2025

CRU: Pushing EU imports back to 15% would be a big task

Written by Matthew Watkins

The analysis above was first published by CRU. To learn about CRU’s global commodities research and analysis services, visit www.crugroup.com.

Several EU member states have published a ‘non-paper’ that puts forward proposals for a post-safeguard trade measure. Much of this is not new, but the lobbying effort is fresh and coincides with the EU itself becoming subject to firmer trade barriers in the US. It includes:

- Start it early: call for 1 January 2026

- Limit imports to 15% of flats and stainless demand and 5% of longs demand

- Increase out-of-quota duty to 50%

- Reduce quota volumes by 40-50% from today

- No exemptions for developing countries

- No growth in quotas (‘liberalization’) or carry-over of unused volumes

- ‘Contemplate implementing’ melted and poured

- Some additional products have been brought into scope, and ‘monitor’ imports of steel-containing goods to extend the measures also to those.

Notably, the authoring countries do not include Germany, the Netherlands, or the Nordic countries. As was the case with the Chinese EV anti-subsidy case, there may not be full alignment within the EU on the direction or magnitude of trade policy.

Some of these calls would, if enacted, move the EU to a closer alignment with US trade policy. This may, anyway, be a consequence of moves towards any common external barrier, or trade club.

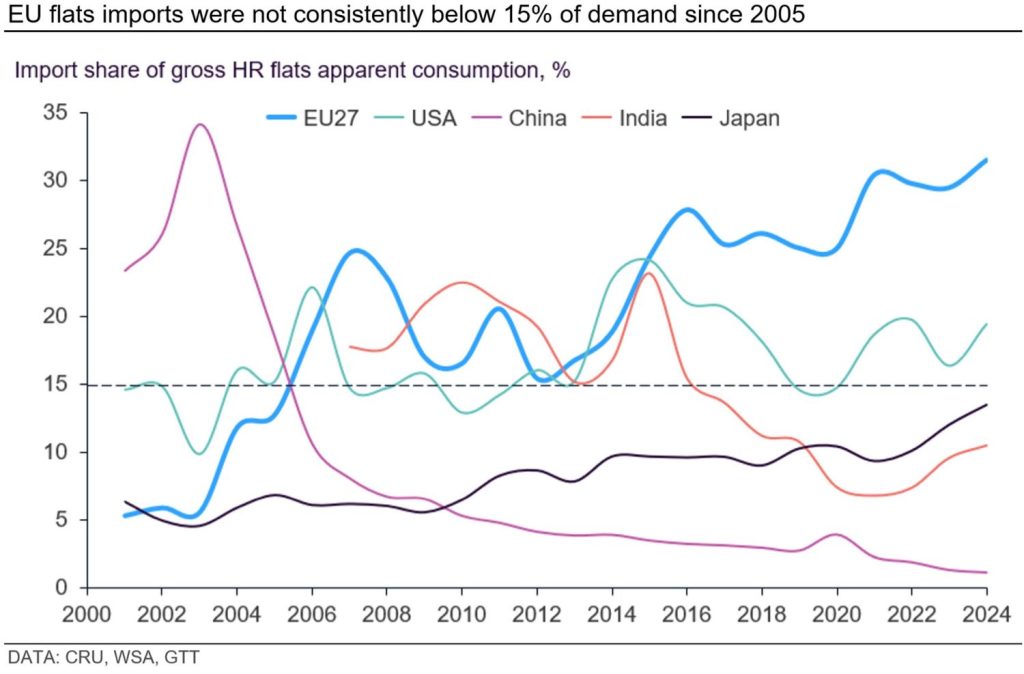

As highlighted in CRU’s current Steel Sheet Market Outlook, the call to push imports back to no more than 15% of demand (in the case of carbon flats) would be a huge change for the EU. Imports have been consistently higher than this level for almost 20 years.

The more aggressive trade policy of the US has kept imports more limited than in Europe, though still largely above 15% over the past decade. Interestingly, the import share of demand is rising in Japan and now approaches 15%, despite the country being one of the world’s largest steel exporters.

We do expect EU trade policy to become more restrictive on steel imports, but we do not expect it to entirely mirror the US approach. As such, we expect imports to cede some ground to domestic supply in Europe, though probably not all the way back to 15% of demand.