Analysis

August 22, 2025

SMU Survey: Current Sentiment tumbles on tariffs, uncertainty, soft demand

Written by Brett Linton

SMU’s Steel Buyers’ Sentiment Indices moved in opposing directions this week. Our Current Steel Buyers’ Sentiment Index dropped to one of the lowest levels recorded in over five years, while Future Buyers’ Sentiment inched higher.

Both indices continue to reflect optimism among steel buyers for their companies’ chances of current and future success, though that confidence is not nearly as strong as it was in February and March.

Every other week, we ask thousands of steel industry executives how they rate their companies’ chances of success today, as well as three to six months down the road. We use this data to calculate our Current and Future Steel Buyers’ Sentiment Indices, metrics tracked since SMU’s 2008 inception.

Current Sentiment

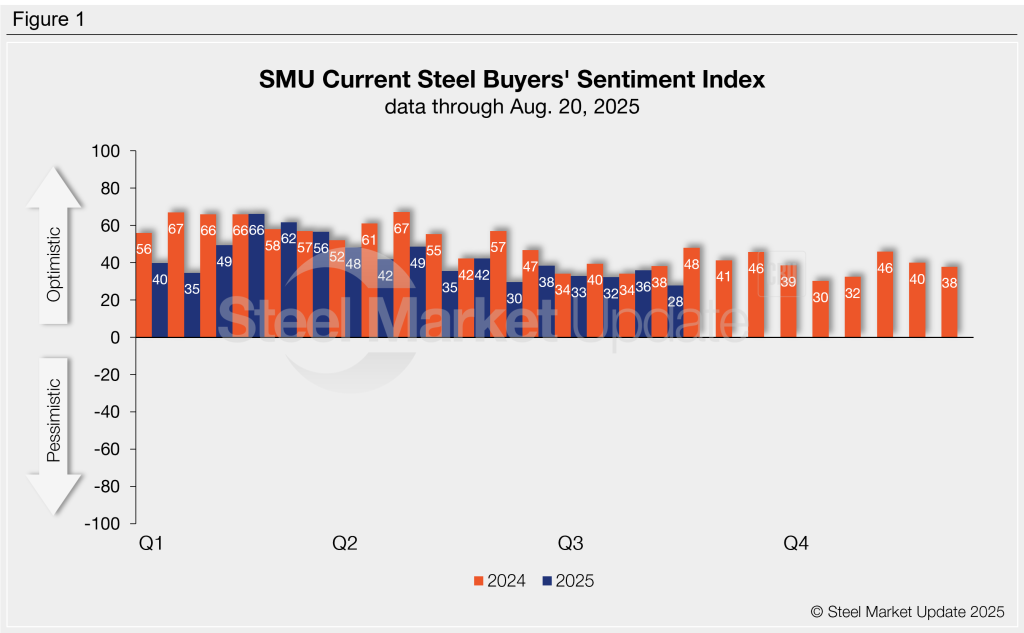

SMU’s Current Buyers’ Sentiment Index fell eight points this week to +28, surpassing the five-year low of +30 seen back in June and now the lowest reading since May 2020 (Figure 1). Aside from our early August survey, Sentiment has overall trended lower since March, consistently registering at or below year-ago levels since then.

Future Sentiment

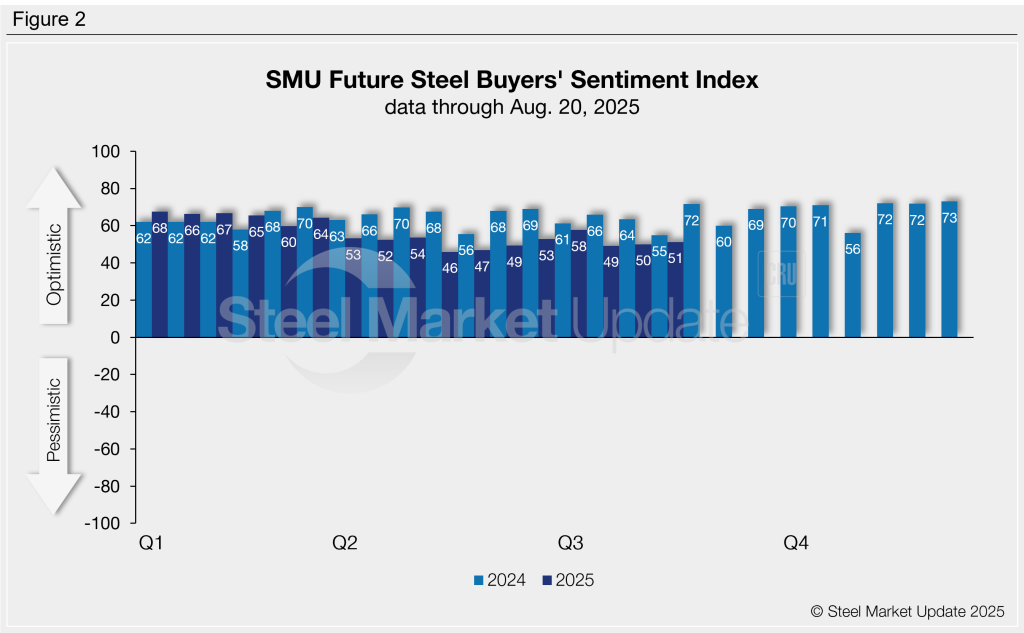

Following the nine-point drop recorded in late July, Future Sentiment has marginally increased each of our past two surveys, rising one point this week to +51 (Figure 2). Like Current Sentiment, Future Sentiment has remained at or below 2024 levels since March. Future Sentiment has averaged +56 so far this year and was slightly higher one year ago at +55.

What SMU survey respondents had to say:

“Too much headwind due to tariffs.”

“We seem to do well enough in all markets, but perhaps a little less so now that things are so slow.”

“Steady as she goes and we have some wind in our sails.”

“Fierce competition from Asian countries.”

“Just too much unknown out there in the immediate term.”

“It is hard to project too far out, but if prices hold up we will be in good shape.”

“We must climb out of the state we are in at some point, and in six months I see that happening.”

“I expect prices to tick up eventually and all the service centers will be the beneficiaries of that uptick.”

“Positive change once uncertainty begins to lift.”

Sentiment trends

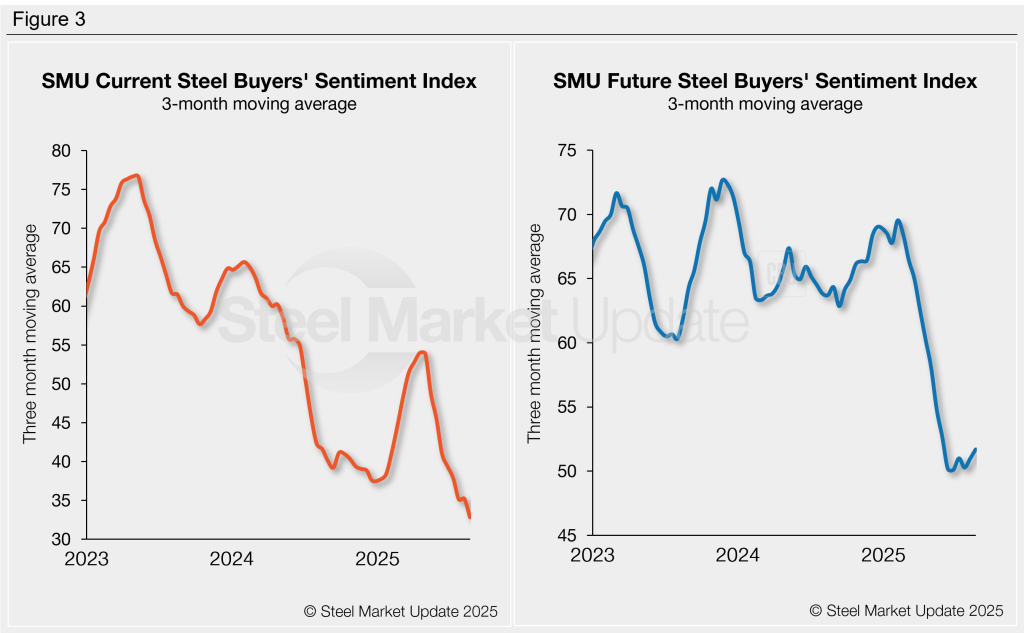

Sentiment Indices can be analyzed on a three-month moving average (3MMA) basis to smooth out survey-to-survey variations and better highlight trends.

The Current Sentiment 3MMA fell this week to a five-year low of +32.81, surpassing late July’s previous low (Figure 3, left). Recall that back in April the 3MMA had reached a nine-month high of +53.97 after trending upwards since the beginning of the year.

The Future Sentiment 3MMA marginally improved for the second survey in a row this week, rising to a 12-week high of +51.70. While up, this rate is less than two points higher than the late June 3MMA of +50.11, which was the lowest measure seen since 2020 (Figure 3, right).

About the SMU Steel Buyers’ Sentiment Index

The SMU Steel Buyers’ Sentiment Index measures the attitude of buyers and sellers of flat-rolled steel products in North America. It is a proprietary product developed by Steel Market Update for the North American steel industry. Tracking steel buyers’ sentiment is helpful in predicting their future behavior. View our methodology here. If you would like to participate in our survey, please contact us at info@steelmarketupdate.com.