Analysis

August 26, 2025

Global steel production eased again in July

Written by Brett Linton

World crude steel output declined for a second straight month in July, falling 2% from June to an estimated 150.1 million metric tons (mt), according to recent data published by the World Steel Association (worldsteel).

July’s total was the second-lowest monthly rate this year, 3% below the 2025 year-to-date (YTD) average of 155.2 million mt, and 1% lower than the same month last year. Compared to the two-year high of 166.6 million mt seen earlier this year in March, July production was 10% lower.

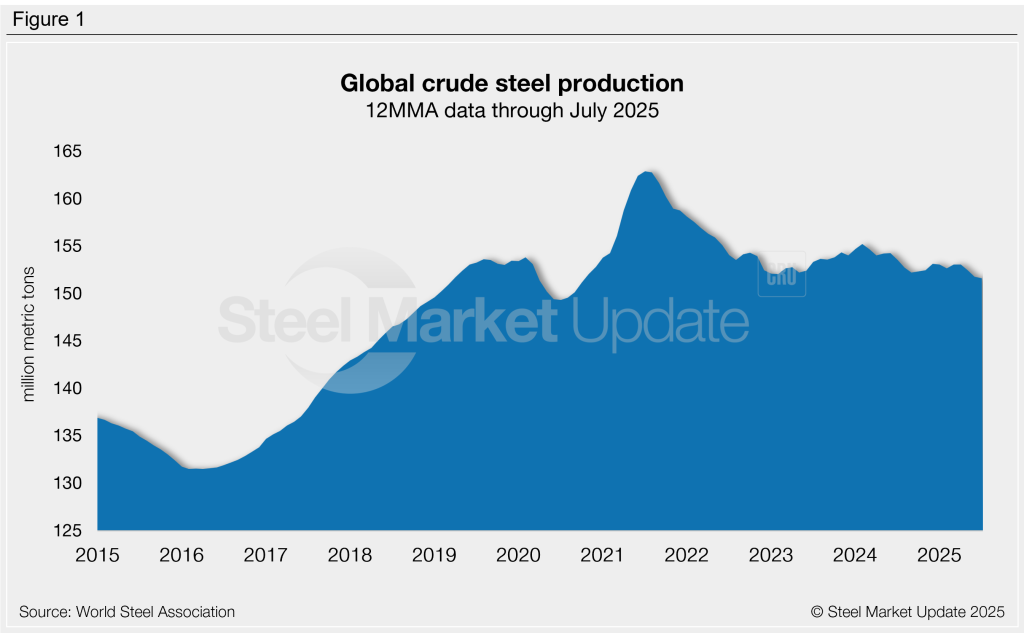

On an annualized 12-month moving average (12MMA) basis, production averaged 151.6 million mt per month over the past year (Figure 1). This annual rate is 1% lower than the same period one year prior. Annual output has generally remained in the 152-154 million mt range over the past three years, similar to pre-pandemic levels.

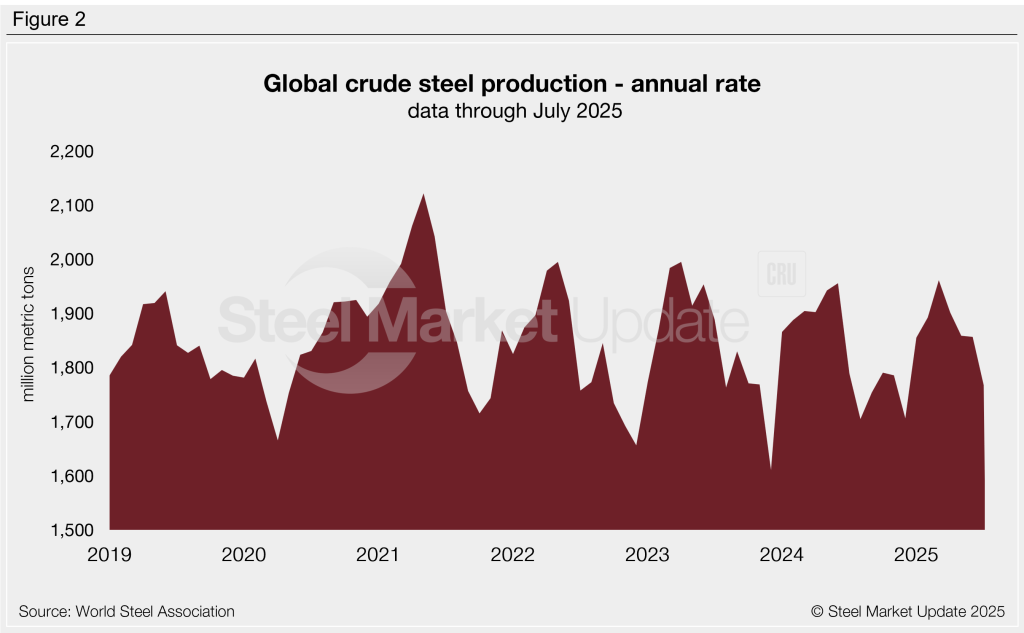

Daily production averaged 4.84 million mt per day in July, 5% lower than June and the lowest daily pace of 2025. Over the past year, daily production ranged from 5.37 million mt (March) to 4.67 million mt (August and December). At July’s rate, annualized global production would total approximately 1.77 billion mt (Figure 2).

Regional breakdown

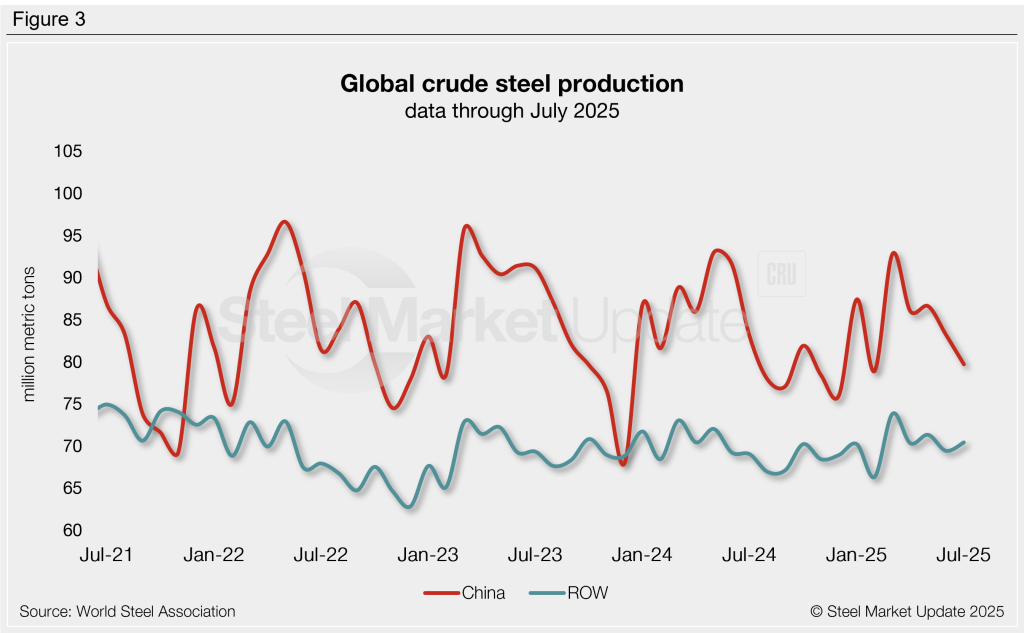

China accounted for 53% of July’s output, producing 79.7 million mt (Figure 3). Chinese output fell 4% month over month (m/m) and was also down 4% from one year ago. Production averaged 82.2 million mt per month across the last year. Since 2023, Chinese mills have consistently accounted for 50-57% of total global production.

Steel output from the rest of the world (ROW) totaled 70.4 million mt in July, up 1% from June and 2% higher than the same month last year. ROW production has averaged 69.4 million mt per month over the past year.

Top producing countries

India retained its position as the second-largest steelmaker in July, producing 9% of the global total. Other significant producers included the United States and Japan at 5% each, Russia and South Korea at 4%, Turkey, Brazil, and Germany at 2%, and Iran at 1%.

Comparing YTD output by country to the same period of 2024 reveals modest shifts in market share. Across the first seven months of 2025, German production fell 12% compared to the same period of 2024, Iran and Japan were down 5%, and Russia declined 4%. India was the outlier, with production increasing 10%.