Analysis

September 5, 2025

CRU: US longs market holds steady despite tariff pressures

Written by Alexandra Anderson

The analysis above was first published by CRU. To learn about CRU’s global commodities research and analysis services, visit www.crugroup.com.

The US longs market remained stable this month despite ongoing challenges from tariff-impacted imports, even as end-use demand was relatively unchanged and scrap prices held flat in August.

Domestic mills strengthened their position as reduced import volumes tightened supply availability across key product categories.

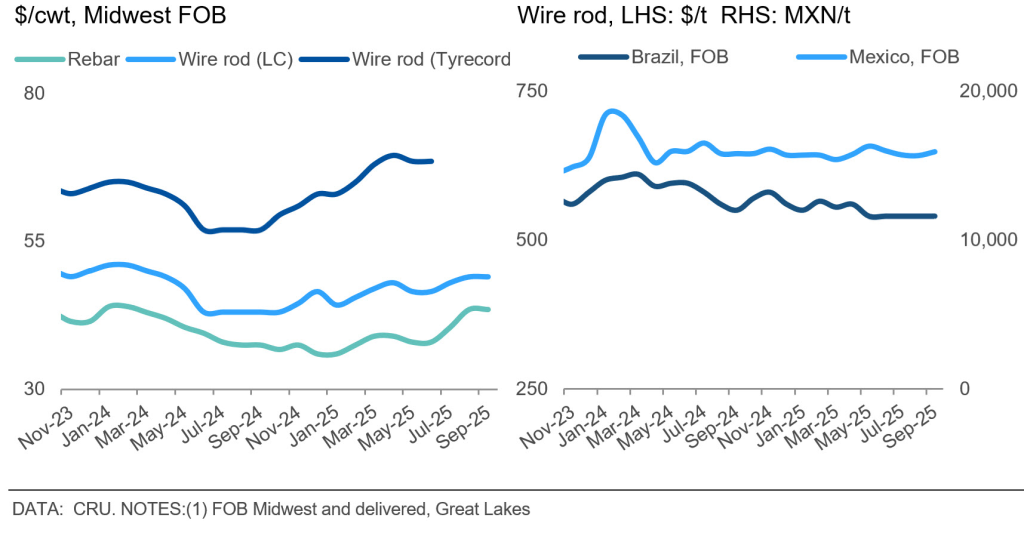

Rebar prices held steady month on month (m/m), supported by declining import volumes and constrained supply conditions. Merchant bar and structural steel prices similarly remained flat, though stronger beam demand has limited availability and generated bullish price expectations among market participants.

Wire rod markets experienced divergent trends based on grade specifications. LC wire rod prices remained unchanged, while HC and tire cord grades continued their upward trajectory initiated in June. Tariff impacts drove HC wire rod prices higher as import volumes decreased, forcing buyers to rely more heavily on domestic sources. Tire cord prices rose more than $15/cwt since June, reflecting the market’s significant dependence on imports and buyers’ efforts to diversify supply sources against potential future tariff actions.

The replacement of imports has bolstered domestic consumption, though fundamental end-use demand has not increased substantially. Construction spending continues to struggle, declining 2.2% year over year (y/y), not seasonally adjusted, according to US Census Bureau data. Residential construction fell 4% annually, while non-residential construction dropped 0.8%.

Leading construction indicators paint a mixed picture. The Dodge Momentum Index, tracking construction starts, fell 10% in July, though data centers continue supporting construction activity. The Architecture Billings Index has contracted for 31 of the past 35 months, with commercial and industrial sectors showing the most resilience.

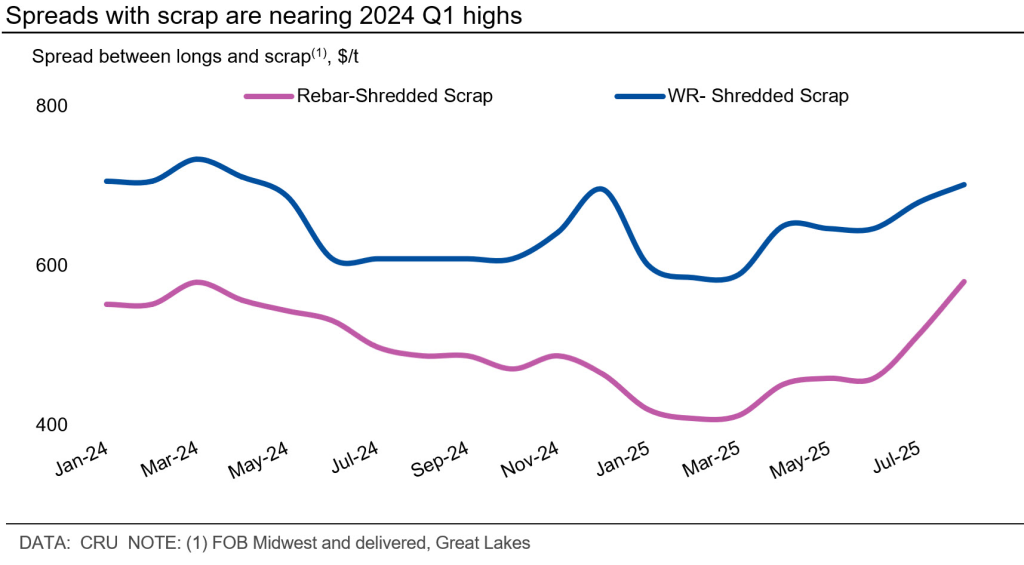

Scrap markets settled sideways for the fourth consecutive month as supply and demand remained balanced. The exemption of pig iron from Brazil’s 50% tariffs eased metallics market supply concerns. In the current trade environment, import prices have gained greater market influence than traditional scrap cost considerations.

Brazil’s longs market holds steady m/m. Market participants report ample inventories and measured buying amid high interest rates, which is keeping demand weak. IABr data show that July longs production remained stable m/m, with year-to-date up by 2.2%. Imports eased 14% m/m in July but rose 2% y/y. Year-to-date import volumes are 15% higher y/y, with China being the main source of imports, followed by Egypt.