Market Data

October 14, 2025

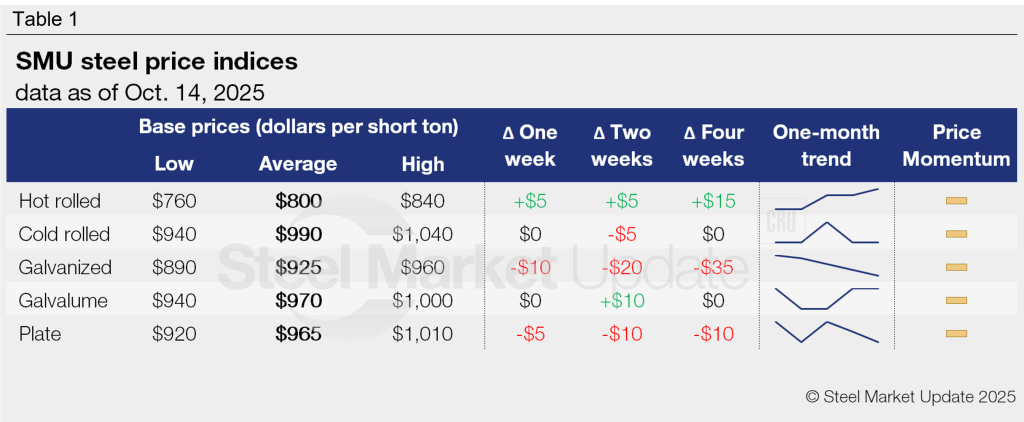

SMU Price Ranges: HR crawls back to $800/ton

Written by Brett Linton & Michael Cowden

Flat-rolled steel prices diverged this week, with hot-rolled (HR) coil prices inching higher even as prices for other products were flat or modestly lower.

SMU’s HR price stands at $800 per short ton (st) on average, up $5/st from last week. The modest gain came as the low end of our range firmed, and despite the high end of our range declining slightly.

As we’ve noted before, the higher bottom roughly coincides with Canadian flat-rolled steelmaker Algoma Steel Inc. leaving the US market. Meanwhile, the domestic HR market remains supported by lower import volumes, lower customer inventories, and fall maintenance outages.

(Editor’s note: SMU will release September service center inventory data to our premium members soon. Import volumes aren’t possible to ascertain until the US federal government shutdown ends.)

The big question remains around demand. Most sources said it continues to be lackluster. But several companies involved in supplying steel for the US border fence with Mexico – which is made largely from steel tubing – said they had seen an uptick in activity.

When it comes to value-added products, SMU’s cold-rolled coil price was unchanged at $990/st on average. And Galvalume prices were unchanged at $970/st on average.

On the galvanized side, our base price slipped to $925/st on average, down $10/st from a week ago. The low end of the rage continues to be defined by HR-base galvanized.

Why the decline in galv? Sources pointed to weaker construction and agricultural demand combined with increased domestic capacity. But some pointed to bright spots, such as solar. They also noted that spreads between HR and galv continue to tighten, a subject we’ll explore in more detail in one of our next issues.

SMU’s plate price was little changed at $965/st, down $5/st from a week ago. While some sources said demand remained subdued, others said plate prices should increase following a round of price hikes from domestic mills last month and an anticipated increase in project work.

SMU’s price momentum indicator remains at neutral for sheet and plate, meaning we see no clear direction for prices over the next 30 days.

Refer to Table 1 (click to enlarge) for our latest price indices and trends.

Hot-rolled coil

The SMU price range is $760–840/st, averaging $800/st FOB mill, east of the Rockies. The lower end of our range is up $30/st week over week (w/w), while the top end is down $20/st. Our overall average is up $5/st w/w. Our price momentum indicator for hot-rolled steel remains at neutral, meaning we see no clear direction for prices over the next 30 days.

Hot-rolled lead times range from 3–6 weeks, averaging 4.7 weeks as of our Oct. 1 market survey.

Cold-rolled coil

The SMU price range is $940–1,040/st, averaging $990/st FOB mill, east of the Rockies. Our entire range is unchanged w/w. Our price momentum indicator for cold-rolled remains at neutral, meaning we see no clear direction for prices over the next 30 days.

Cold-rolled lead times range from 4–8 weeks, averaging 6.5 weeks through our latest survey.

Galvanized coil

The SMU price range is $890–960/st, averaging $925/st FOB mill, east of the Rockies. The lower end of our range is up $10/st w/w, while the top end is down $30/st w/w. Our overall average is down $10/st w/w. Our price momentum indicator for galvanized steel remains at neutral, meaning we see no clear direction for prices over the next 30 days.

Galvanized .060” G90 benchmark: SMU price range is $968–1,038/st, averaging $1,003/st FOB mill, east of the Rockies.

Galvanized lead times range from 4–8 weeks, averaging 6.4 weeks through our latest survey.

Galvalume coil

The SMU price range is $940–1,000/st, averaging $970/st FOB mill, east of the Rockies. Our entire range is unchanged w/w. Our price momentum indicator for Galvalume remains at neutral, meaning we see no clear direction for prices over the next 30 days.

Galvalume .0142” AZ50, grade 80 benchmark: SMU price range is $1,294–1,354/st, averaging $1,324/st FOB mill, east of the Rockies.

Galvalume lead times range from 5–8 weeks, averaging 6.7 weeks through our latest survey.

Plate

The SMU price range is $920–1,010/st, averaging $965/st FOB mill. The lower end of our range is unchanged w/w, while the top end is down $10/st. Our overall average is down $5/st w/w. Our price momentum indicator for plate remains at neutral, meaning we see no clear direction for prices over the next 30 days.

Plate lead times range from 4–7 weeks, averaging 5.2 weeks through our latest survey.

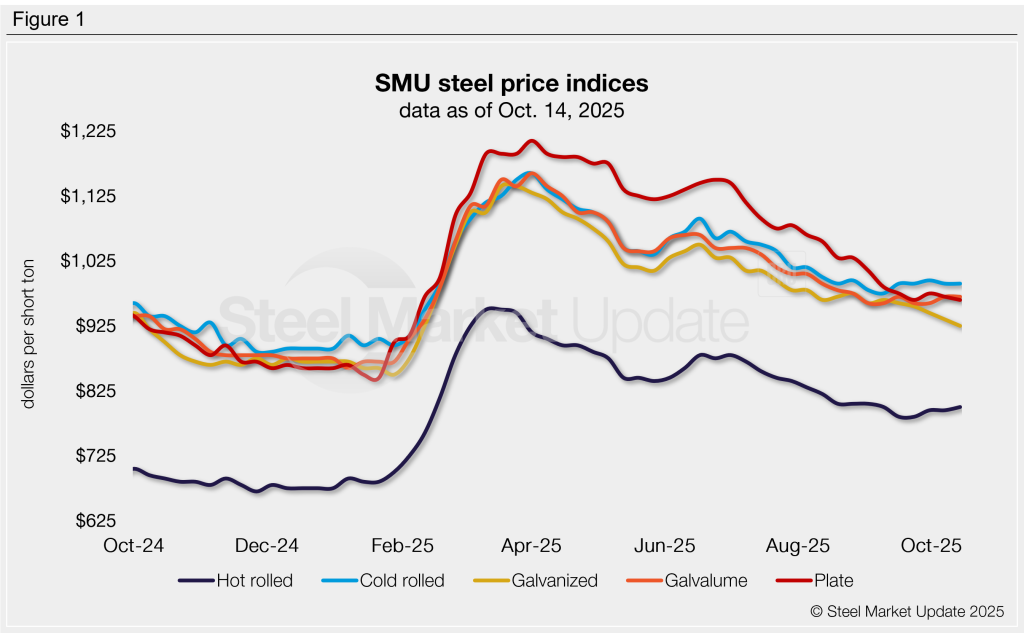

SMU note: The graphic above shows a history of our hot rolled, cold rolled, galvanized, Galvalume, and plate prices. This data is also available on our website with our interactive pricing tool. If you need help navigating the site or logging in, contact us at info@steelmarketupdate.com.

Brett Linton

Read more from Brett Linton