Plate market participants anticipate producer hikes

Plate market participants expect domestic producers to issue a $40-60 per short ton (st) price increase.

Plate market participants expect domestic producers to issue a $40-60 per short ton (st) price increase.

The Dodge Momentum Index (DMI) fell 6.2% in January to 272.7, retreating from December’s downwardly revised reading of 291.0, according to the latest data released by Dodge Construction Network.

Baker Hughes' latest rig count report shows oil and gas drilling picked up in the US this week, but slowed in Canada. Oil drilling in both countries is down from last year, while gas drilling has picked up, mainly in the US.

SMU’s Steel Buyers’ Sentiment Indices both edged lower this week following the multi-month highs set in mid-January.

November apparent steel supply declined 9% or 772,000 short tons (st) from October to 7.61 million st, the lowest measure recorded since February 2021

November steel exports tumbled 15% from October to the lowest monthly export rate since July 2020.

SMU’s latest steel buyers market survey results are now available on our website to all premium members. After logging in at steelmarketupdate.com, visit the pricing and analysis tab and look under the “survey results” section for “latest survey results.” Past survey results are also available under that selection. If you need help accessing the survey results, or if […]

One third of the steel buyers responding to our market survey this week reported that domestic mills are negotiable on new spot order pricing. Mills began to hold a firmer stance on prices towards the end of last year, tightening their grip in early January and holding it since.

Steel mill lead times marginally declined on sheet products this week but edged higher on plate, according to responses from SMU’s latest market survey. Overall, lead times remain one to two weeks longer than levels seen three months ago.

Sheet market participants said conditions this week were more stable than in past weeks, but they remain cautiously optimistic overall.

SMU’s February ferrous scrap market survey results are now available on our website to all premium members.

Domestic steel shipments rose month-on-month and on-year in December, according to the latest figures from the American Iron and Steel Institute (AISI). At the same time, full-year 2025 shipments increased.

Flat-rolled steel prices inched upward again this week as mixed demand appeared to be offset by limited supplies.

Steel imports remain weak in November and December according to recently released final US Commerce Department data. Many of the sheet and plate products we follow slipped to multi-year lows.

The amount of raw steel produced by US mills eased last week according to the AISI. Production remains strong compared to the multi-month lows seen at the end of the year.

The latest Institute for Supply Management (ISM)’s Manufacturing PMI report found manufacturing activity expanded in January 2026. The preceding 26 consecutive months’ reports showed manufacturing activity in contraction.

The Chicago Business Barometer rose further in January, moving into expansion territory for the first time since November 2023, said MNI and ISM.

Participants in the hot- and cold-rolled coil markets said winter storms in the East and Midwest may disrupt weekly order volumes and prices.

The latest count of operational oil and gas rigs increased in both the US and Canada this week, according to the latest data released from Baker Hughes.

This news item was first published by CRU. To learn about CRU’s global commodities research and analysis services, visit www.crugroup.com. Canada’s Algoma Steel signed a binding Memorandum of Understanding (MoU) with Hanwha Ocean to support Canada’s submarine program and Algoma’s diversification strategy. A new structural steel beam mill may result. Financial support, subject to conditions being […]

All but one of the steelmaking raw materials we track increased in price over the last month

Metalforming manufacturers anticipate strong near-term economic conditions that will give way to increasing orders, according to the Precision Metalforming Association (PMA) Business Conditions Report for January 2026.

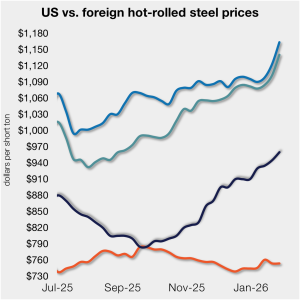

The price gap between US hot-rolled coil and landed offshore product inched higher, even as prices stateside and abroad mostly moved in tandem vs. last week.

SMU polled steel buyers on an array of topics earlier this week, ranging from market prices and demand, to inventories, imports, and evolving market events.

What do SMU's latest survey results show about the current market take on tariffs and where HRC prices are going?

Sheet prices mostly continued their uneven but steady march higher this week, according to SMU’s latest check of the market.

Raw steel output from US mills climbed last week to the highest rate seen in over four months, according to the latest American Iron and Steel Institute (AISI) figures

The latest tally of operational oil and gas rigs increased this week in both the US and Canada, according to the latest figures published by Baker Hughes.

SMU columnist Daniel Doderer looks out over the economy as it regards the steel industry.

SMU’s Steel Buyers’ Sentiment Indices both increased this week to multi-month highs