Market Data

April 18, 2017

Oil and Gas Prices and Rotary Rig Counts through April 2017

Written by Peter Wright

The prices of oil and natural gas drive the consumption of oil country tubular goods (OCTG) and related steel products. The energy markets represent a large portion of the hot rolled coil used to make welded tubular goods as well as equipment used to drill and pump oil and natural gas.

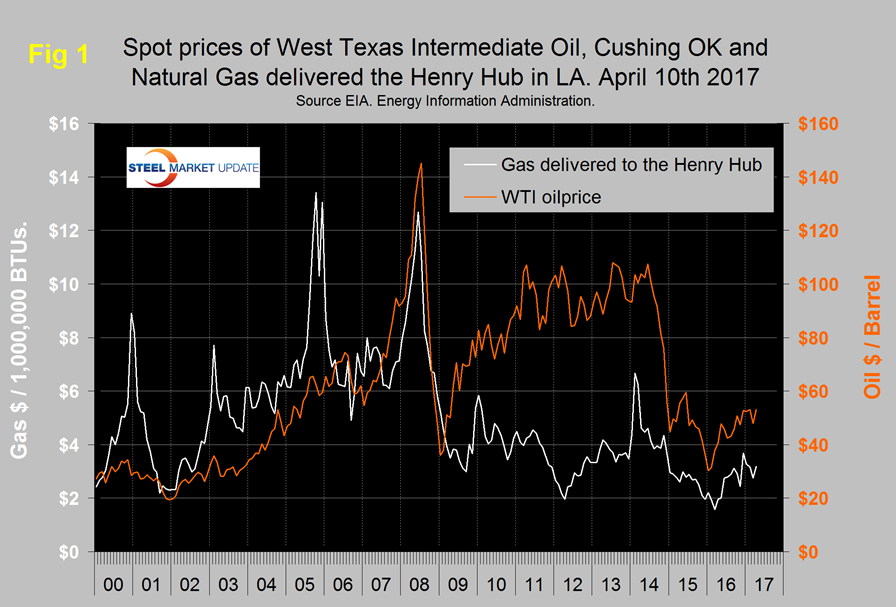

Figure 1 shows historical oil and gas prices since January 2000.

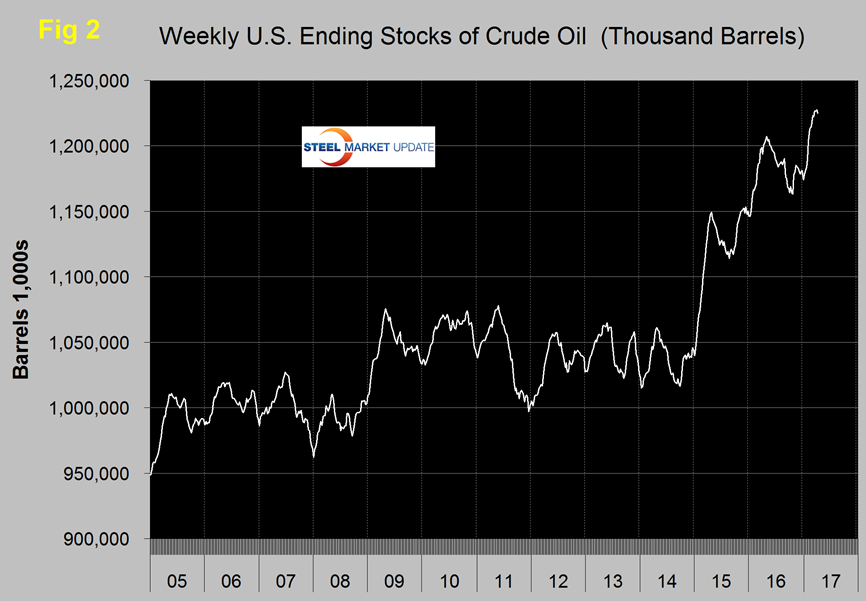

The daily spot price of West Texas Intermediate (WTI) rose through $50 on December 8th and stayed above that level until March 8th when it fell below $50 and stayed there until March 30th. In April the price has risen every day until the latest data when it reached $53.06 on April 10th. Brent closed at $54.79 on the same day. Data source is the Energy Information Administration (EIA). The recent oil price is not being supported by US inventories which in w/e April 7th were at near an all time high (Figure 2).

Also on April 7th the EIA reported that U.S. crude oil imports averaged 7.9 million barrels per day last week, up by 28,000 barrels per day from the previous week. Over the last four weeks, crude oil imports averaged about 8.1 million barrels per day, 3.0 percent above the same four-week period last year.

On April 3rd Andrew Hecht wrote, “OPEC is likely to extend the production cut announced at the end of 2016 as the Saudis have a vested interest in maintaining a stable oil price into 2018. The Saudis will be selling at least 5 percent of Aramco via an IPO and a stable oil price around the $50 per barrel level will enhance the valuation of the initial public offering of those shares. The Saudi Royal Family is anxious to diversify some the nation’s risk away from petroleum revenues, and they will use the proceeds for the IPO to fund a sovereign wealth fund that will invest in other businesses around the world. The three dominant oil producers in the world are the Saudis, Russians, and the United States. It is in the best interest of all three nations for the oil price to remain around the $50 per barrel level. At that price, the Russians receive a stable revenue flow, and U.S. production can flourish, and the Saudis can cash in on their crown jewel, Aramco. $50 per barrel is a sweet spot for crude oil. While producers would love to see it a lot higher, they felt the pain of a price below $30 per barrel in February 2016. Consumers would love the price to drop to those levels once again, but they have memories of prices north of $100 per barrel in 2014. The best compromise is always one that makes all parties unhappy to some degree. $50 is a pivot point that the world can comfortably live with for the foreseeable future I expect $50 to act as a pivot point for active month NYMEX futures and I do not expect the price to fall much below $45 or rise much above $55 per barrel. The Middle East remains a turbulent and unstable region of the world so that potential for a shock in the oil market would more likely come on the upside.”

On April 14th Economy.com had this to say, “Unprecedented compliance is propping up oil prices. As of February, the 11 OPEC members that agreed to cut or keep flat their supply were complying with 105 percent of the stated oil production cuts. Jawboning by Saudi Arabia at the CERAWeek conference in Houston rattled the oil market, causing oil prices to briefly fall below $50 per barrel. The Saudis talked oil prices down to send a message to noncompliant OPEC members that Saudi Arabia alone would not shoulder the burden of the OPEC production cuts. Talking oil prices down also accomplished the Saudi goal of forcing U.S. producers to think twice about ramping up crude oil production aggressively. While many U.S. shale investments are profitable at below $50 per barrel, many are not.

We expect OPEC compliance to be fairly strong through June, when OPEC members will decide whether to extend the six-month production cuts. We expect the cuts to be extended, but either they will be scaled back marginally or compliance with the cuts will erode.”

On the morning of the April 7th the latest data from the EIA, the price of natural gas, delivered the Henry Hub was $3.18, up from $2.75 in our March report but down from a recent high of $3.69 on December 9th. Natural gas fuelled the largest share of electricity generation in 2016 at 33 percent, compared with 32 percent for coal and in 2017, natural gas and coal are both forecast to fuel 32 percent.

On March 28th Maria Cosma wrote, “with President Trump in the Oval Office, the coal industry expects a wave of environmental deregulation beyond taking aim at the Clean Power Plan. The president has moved quickly to fulfill his promises. In February, he signed a bill rolling back a regulation to protect waterways from surface mining waste. That same month, Scott Pruitt, Oklahoma’s former attorney general with a history of lawsuits against the EPA, was appointed to head the agency and scale back its oversight. Weeks later, the president asked Congress to cut the EPA’s budget by a third. However, natural gas will have the final say in the coal industry’s outlook, not Washington DC. Developments in oil and gas resources and technologies still threaten coal demand, and many power companies are still pursuing the switch to natural gas. At best, coal demand will receive a short-term boost from higher oil and gas prices before plateauing long term. Even with trend improvement in known technologies and limited movement in oil and gas, coal production will remain below 2014 levels for the foreseeable future. The slow pace of federal regulation has pushed many states to adopt their own environmental standards. Nine Northeastern states are part of a cap-and-trade program for carbon dioxide emissions, and California has a similar state program. Twenty-nine states have adopted Renewable Portfolio Standards, which require power companies to maintain a certain mix of fuel sources that favor renewable energy, and eight states have renewable energy goals. These smaller-scale efforts will chip away at coal’s share of generating capacity, even if federal regulations are scaled back.”

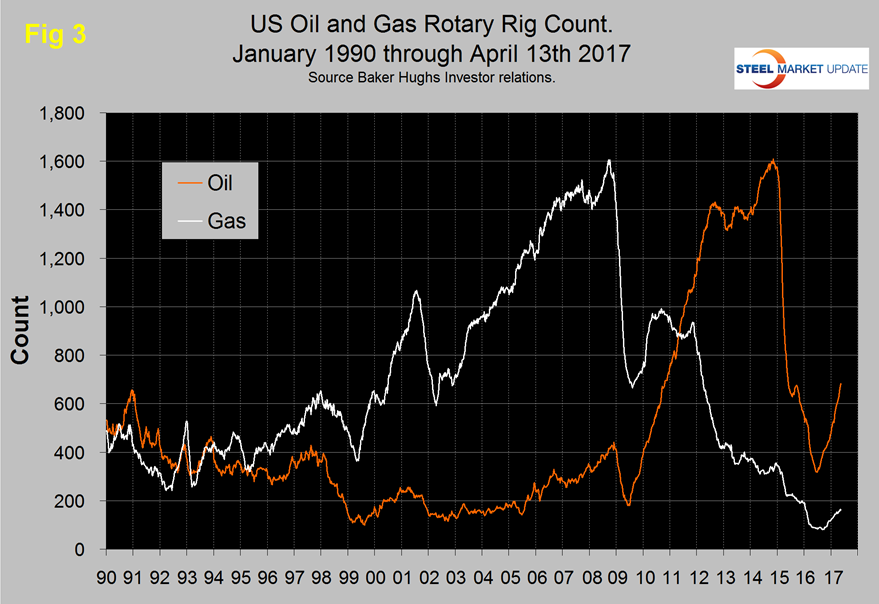

The total number of operating rigs in the US and Canada on April 13th was 963, down from 1,094 on February 24th. The decline was entirely in Canada which has an extremely volatile and seasonal count. The oil rig count in the US has risen every week for 13 consecutive weeks through April 13th when it reached 683. The US gas rig count has risen from 136 on January 13th to 162 on April 13th. The y/y growth rate of US plus Canadian total rigs was 100.3 percent in the latest data. Figure 3 shows the Baker Hughes US Rotary Rig Counts for oil and gas equipment in the US (explanation below).

The US oil rig count is now higher than at any time since mid 2011. The gas rig count is recovering more slowly and is still down from the level at the beginning of last year.

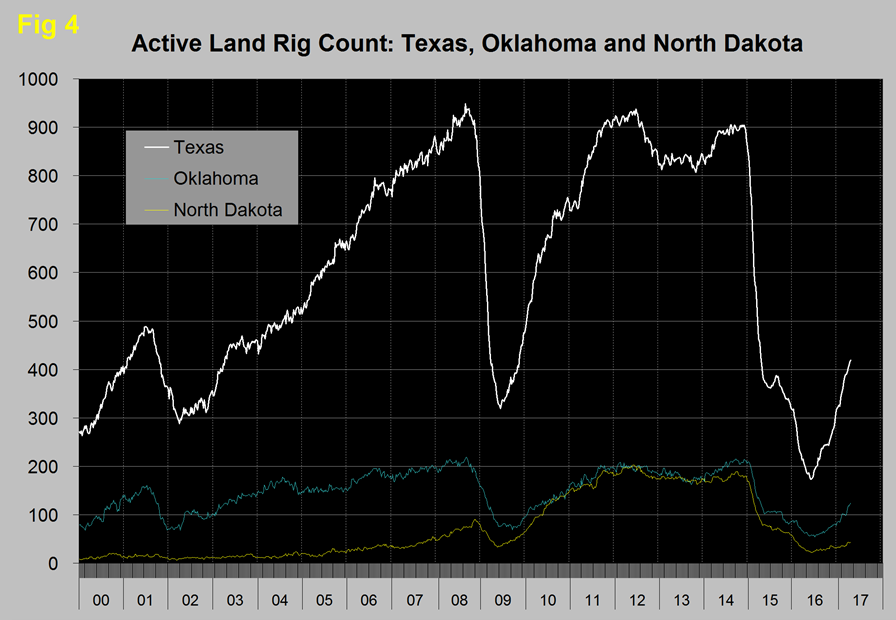

On a regional basis in the US, the big three states for operating rigs are Texas, Oklahoma and North Dakota. Figure 4 shows the land rig count in those states since 2000 and that non conventional drilling in North Dakota is down by 75 percent from its heyday in late 2014.

Baker Hughes Rotary Rig Count: These are a weekly census of the number of drilling rigs actively exploring for or developing oil or natural gas in the United States. Rigs are considered active from the time they break ground until the time they reach their target depth and may be establishing a new well or sidetracking an existing one. The Baker Hughes Rotary Rig count includes only those rigs that are significant consumers of oilfield services and supplies.