Prices

August 28, 2017

International Steel, Raw Materials Prices Strengthen

Written by Peter Wright

In this report, we examine the latest prices for iron ore, scrap, coking coal and zinc.

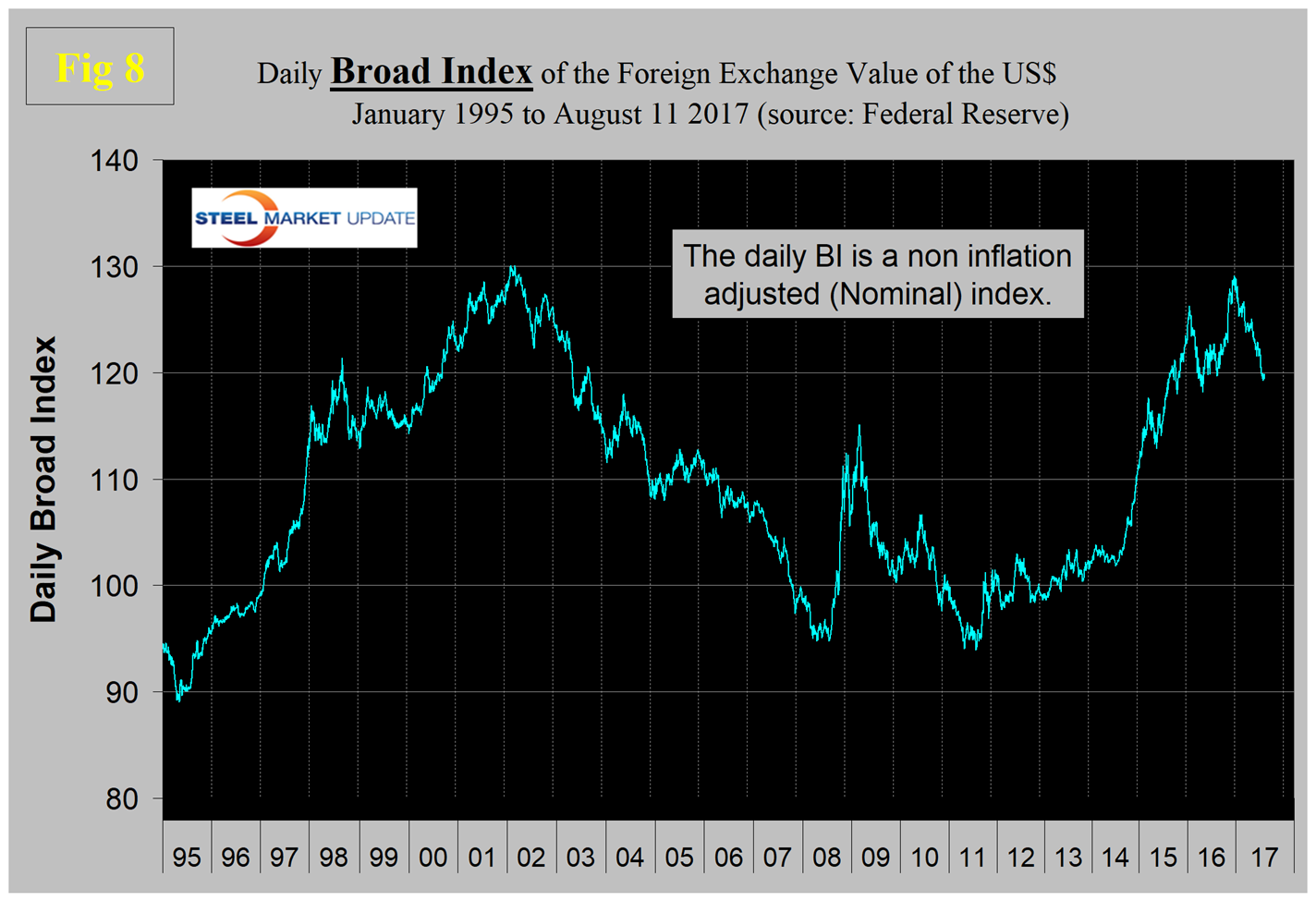

To put the raw materials analysis into perspective, we begin with Figure 1, which shows the spread between Chicago #1 busheling and hot rolled coil ex works Indiana through Aug. 18, both in dollars/net ton.

On this date, Aug. 28, Chicago busheling was priced at $341.07/net ton, ($382/gross ton) and HRC ex works Indiana was $630.00/net ton for a spread of $288.93/net ton. The spread reached a 2016 high of $385.46 in June last year.

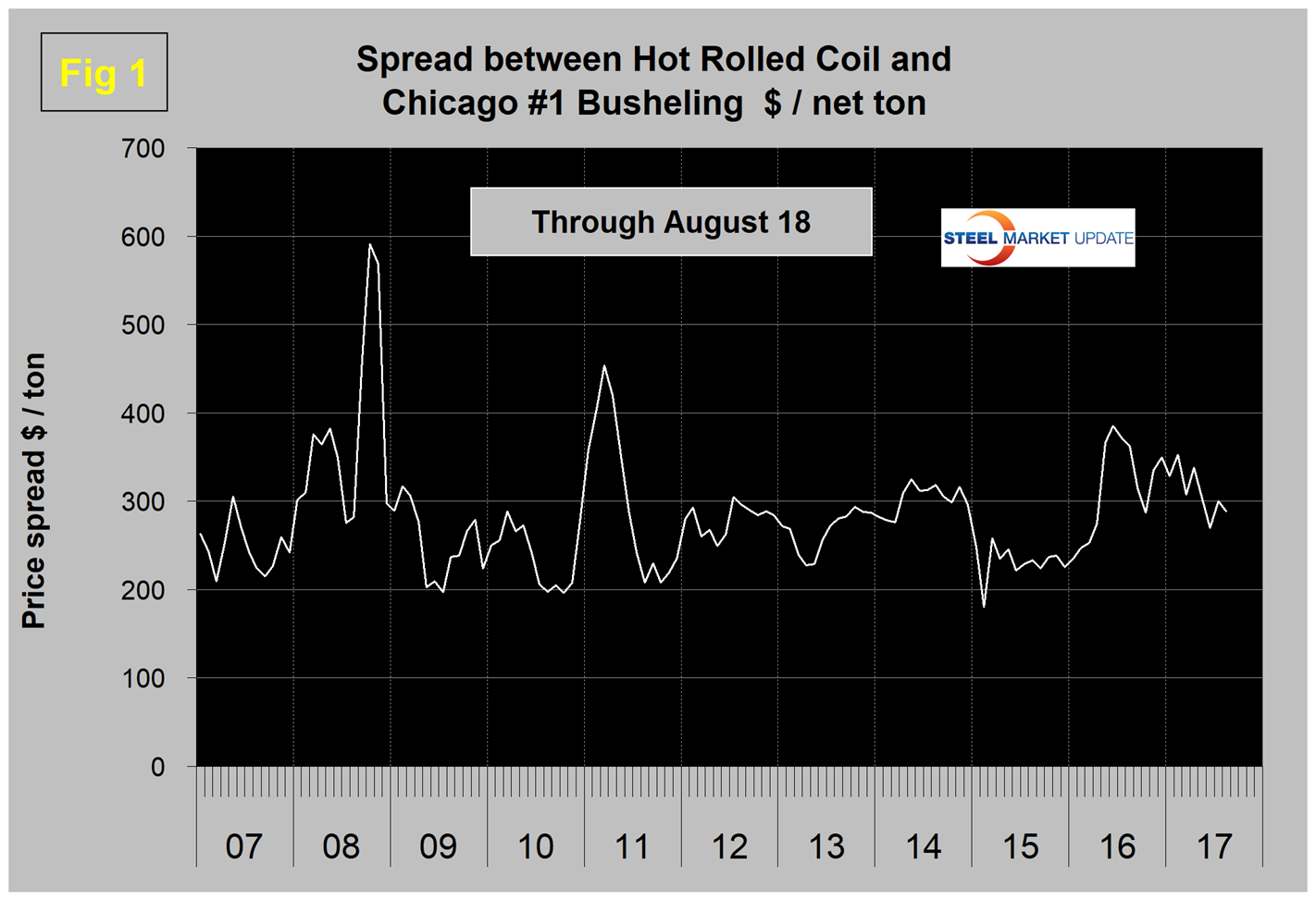

Scrap. Figure 2 shows the relationship between shredded and #1 busheling both priced in Chicago.

In August, Chicago shredded was up by $20/gross ton and busheling was up by $27, raising the busheling premium to $77, which was the highest premium for busheling since February 2015.

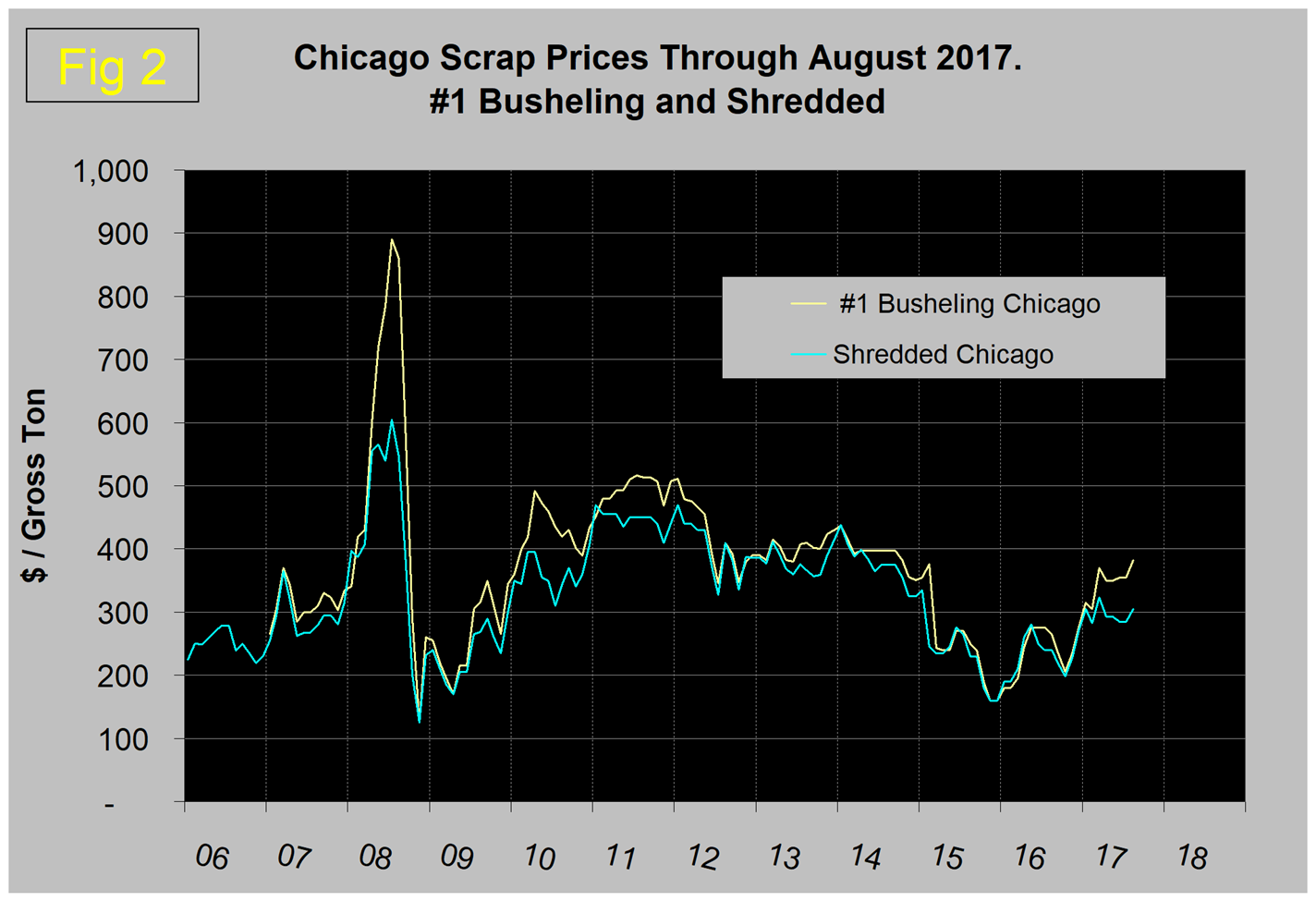

Iron Ore. The Platts IODEX of 62 percent Fe delivered North China fell below $40/dmt in January this year, then recovered to $92.30 on March 17. The price declined once again to $54.00 on June 9 and recovered to $79.35 on Aug. 22 (Figure 3).

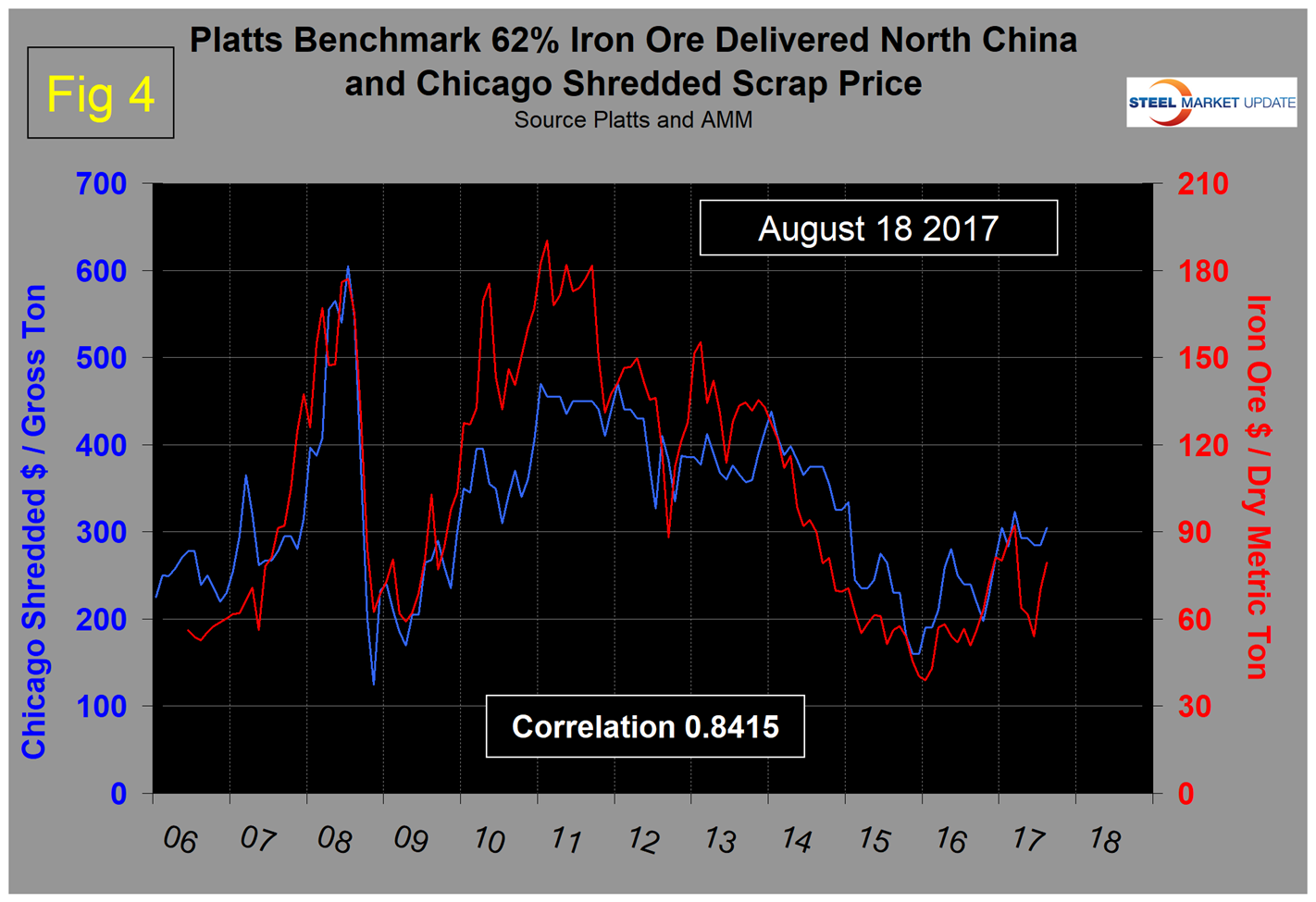

There is a long-term relationship between the prices of iron ore and scrap. Figure 4 shows the IODEX, and the price of Chicago shredded through Aug. 22.

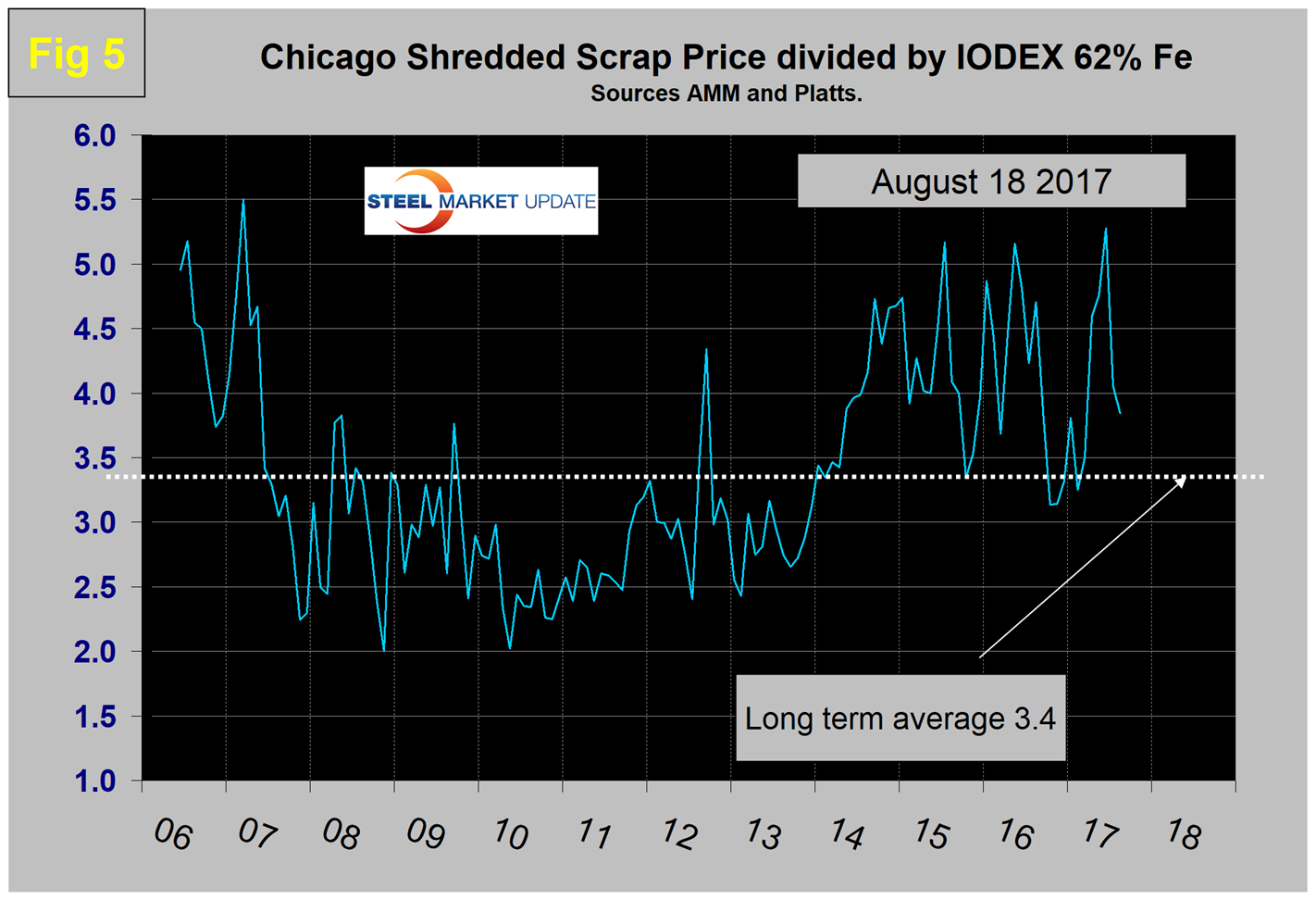

The correlation since January 2006 has been 84.15 percent, and in the last 10 years on average, scrap in dollars/gross ton has been 3.4x as expensive as ore in dollars/dmt. The ratio has been erratic since mid-2014, but overall since then has benefited the integrated producers. There was a six-month respite for the EAF operators in Q4 ’16 and Q1 ’17, but now the ratio is once again high with a value of 3.84 on Aug. 18. The June ratio of 5.28 was the highest in over 10 years (Figure 5).

Since Chinese steel manufacture is 93 percent BOF, this ratio has allowed them to be more competitive on the global steel trade market. In addition, in the last four years, there have been times when China could supply semifinished to the global market at prices competitive with scrap.

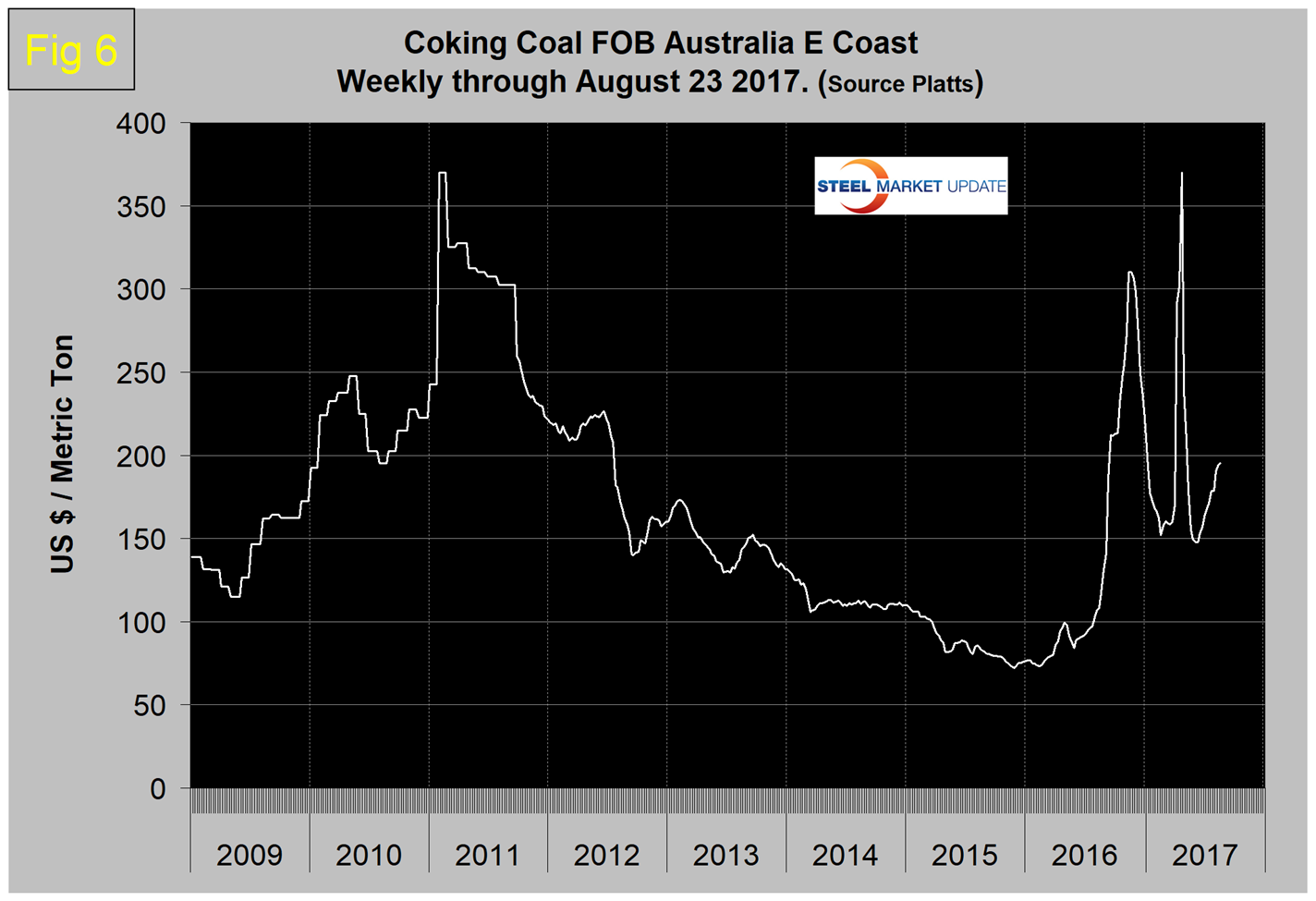

Coking Coal. On Aug. 23, Platts reported that the metallurgical coal market saw stronger interest from China last week owing to supply issue concerns from Shanxi and Mongolia. The price FOB East Australian ports shot up in April to $370 as Cyclone Debbie disrupted shipments from the East Coast of Australia (Figure 6). Through July 12, the price had declined to $147.90/dry metric ton and had recovered to $195.25 on Aug. 18.

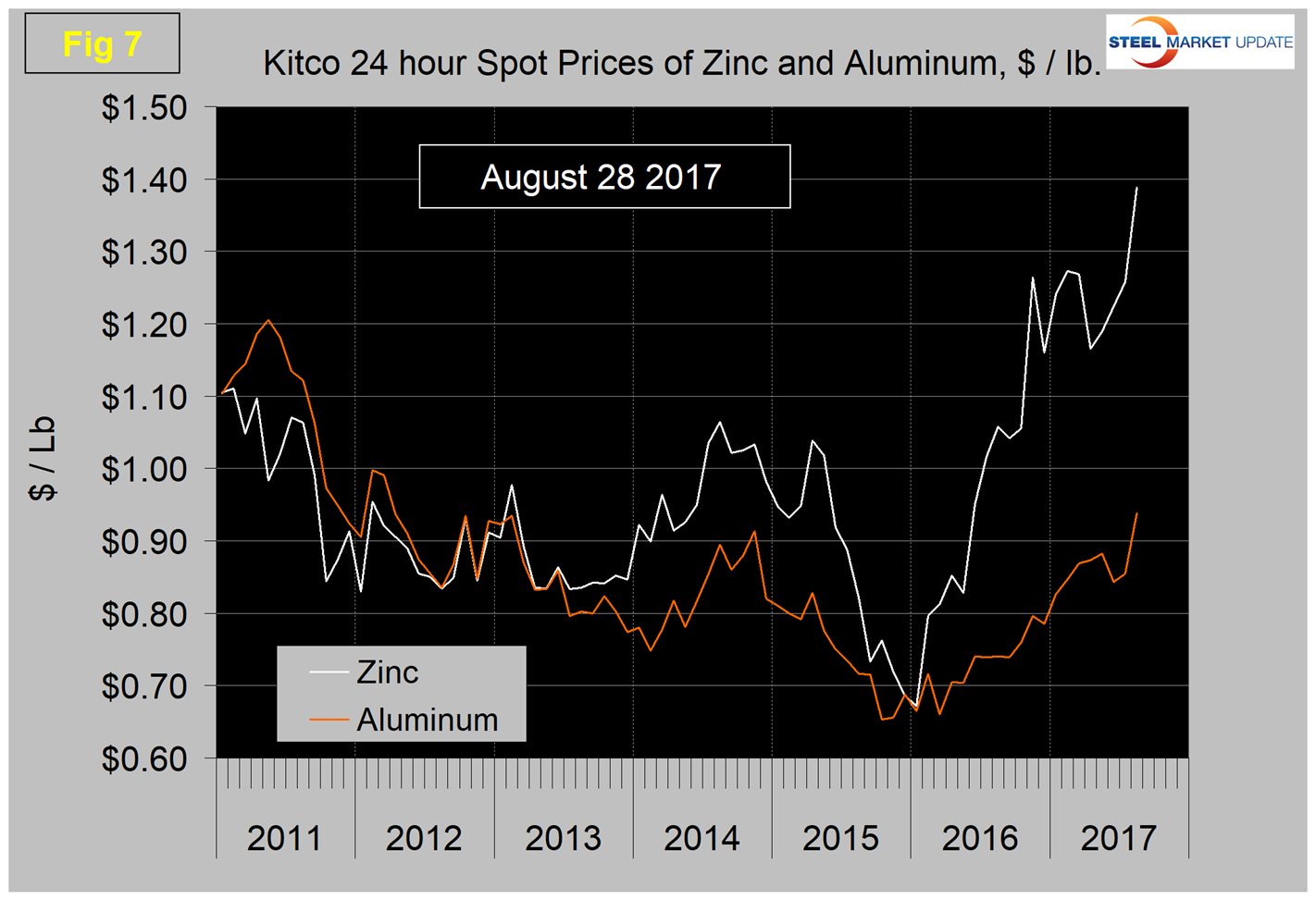

Zinc. The major use of zinc is for galvanizing. Other significant uses include the alloying of brass and bronze and in zinc-based alloys used in the die-casting industry. Kitco publish a daily spot price of zinc, which we have transcribed to Figure 7.

Just as a point of reference, we have included aluminum in the same graph. The price of zinc soared to $1.4146/lb. on Aug. 20 before sliding back to $1.3881/lb. on Aug. 28. According to Kitco, the LME 60-day inventory level has fallen from just over 380,000 tons on Feb. 28 to 247,000 tons on Aug. 28.

London zinc rose to its highest price in a decade on Monday, Aug. 21, and nickel also rallied as investors ploughed into metals used by China’s steel sector, seeing robust demand even as capacity is constrained by Beijing’s drive to reform bloated industries, reported Reuters. “Metals are pretty strong. The USD has been weaker and the Federal Reserve has turned a bit more dovish, so that is supportive,” said analyst Lachlan Shaw of UBS in Melbourne. Shaw noted that China’s steel and aluminum markets could tighten with central-government-mandated cuts over the winter, although the aluminum cuts should be offset by rising Shanghai warehouse inventories. The recent low was $0.6723/lb. in Jan. 2016.

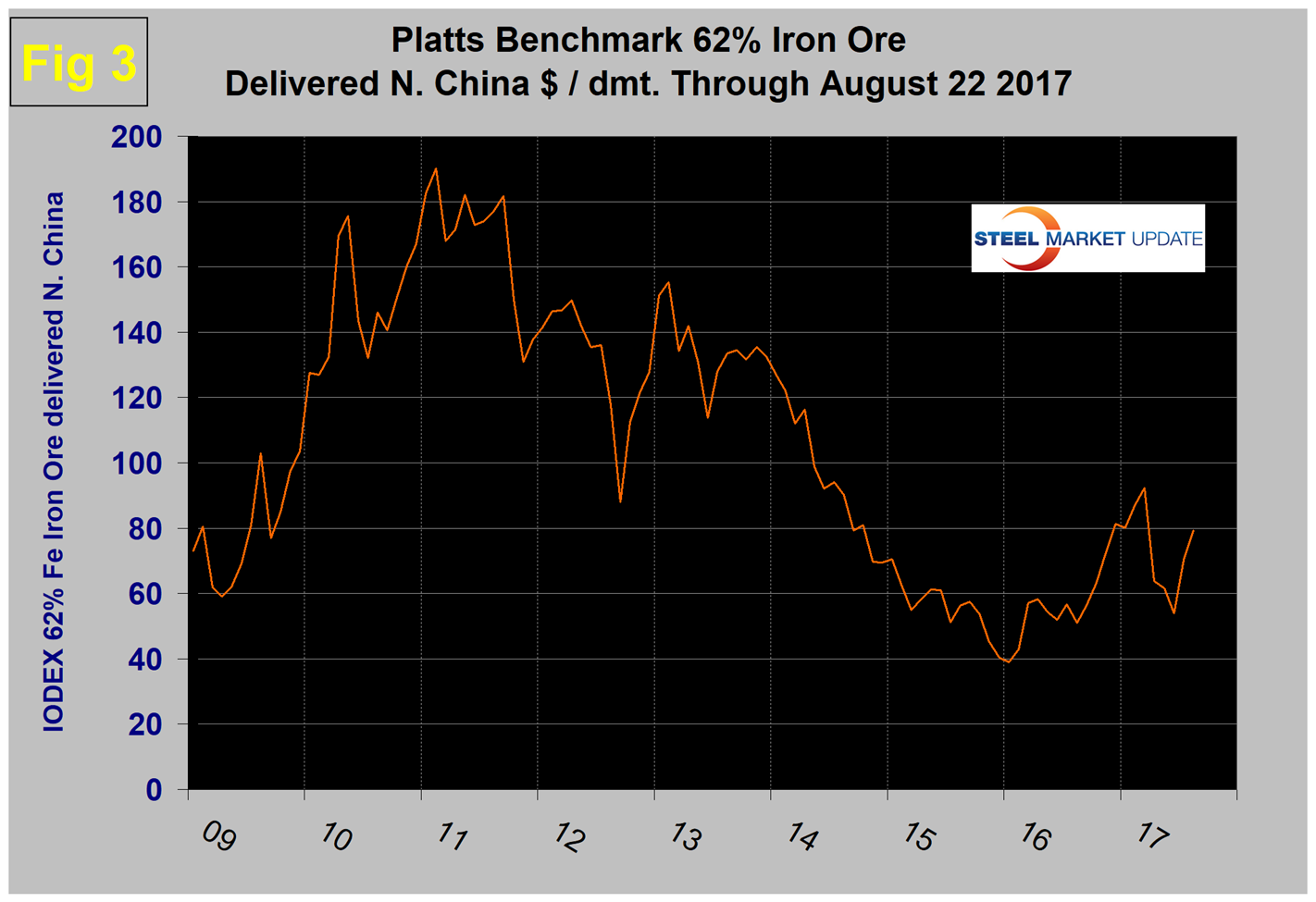

SMU Comment: Last week, Platts reported that international steel prices and raw materials continued to strengthen in the week ending Aug. 18 with near-term sentiment appearing to be strong. The prices of raw materials are driven by normal supply and demand forces, and also by unexpected events such as cyclone Debbie that recently hit the supply side of the coke equation. However, behind the scenes there is an inverse relationship between commodity prices and the value of the U.S. dollar on the global currency markets. As we reported in our currency update last week, the value of the dollar declined by 7.4 percent between Jan. 3 and Aug. 11 this year (Figure 8). A weakening dollar will put upward pressure on the price of those global commodities that are priced in dollars.