Market Data

August 16, 2018

SMU Price Momentum Indicator on Flat Rolled Adjusted to Lower

Written by John Packard

A couple of months ago, Steel Market Update was speaking in front of a group from the financial community. We were asked, “What do you look for as a sign when prices are about to change direction?” Our answer was a mill price increase announcement.

Earlier this week, ArcelorMittal USA announced a $30 per ton price increase on cold rolled and coated products. SMU found the coated announcement a bit odd since we have been watching a collapse of zinc pricing on the LME for some time now (zinc is used to coat cold rolled or hot rolled substrate to make galvanized steel). The last price increase announcement was back on April 19 when ArcelorMittal USA advised an across-the-board $50 per ton increase, placing a floor on hot rolled at $900 per ton. Since then, the mills have been silent (and prices either rose or remained stable).

SMU views the AMUSA price increase as a sign of a weakening market.

Steel Market Update is adjusting our Price Momentum Indicator from Neutral to Lower.

![]() On Tuesday of this week, the CRU Group held a webinar for both CRU and SMU member companies. CRU Principal Analyst Josh Spoores provided their outlook for hot rolled and plate steels in the United States. He made a comment that stuck with us: “Imports should be setting the price for domestics.”

On Tuesday of this week, the CRU Group held a webinar for both CRU and SMU member companies. CRU Principal Analyst Josh Spoores provided their outlook for hot rolled and plate steels in the United States. He made a comment that stuck with us: “Imports should be setting the price for domestics.”

SMU spoke with Josh Spoores this afternoon to getter a better understanding of what he meant by that statement. He told us the bottom of the market should be the global steel price + the 25 percent tariff + freight to the United States + any other costs (insurance, trader margin, etc.).

We have discussed pricing with a few trading companies and customers who are buying foreign steel, and we learned the numbers on hot rolled delivered into USA ports (or border) are below $800 per ton ($40.00/cwt). So, with our index referencing HRC pricing at $890 per ton, there is plenty of room for the market to correct.

As we have discussed elsewhere in tonight’s newsletter, zinc has dropped to lows not seen since 2016. There is an expectation building in the market that coating extras will be adjusted at some point soon. Steel buyers are telling SMU the original resistance by the mills to discuss extras is being replaced with a more conciliatory tone.

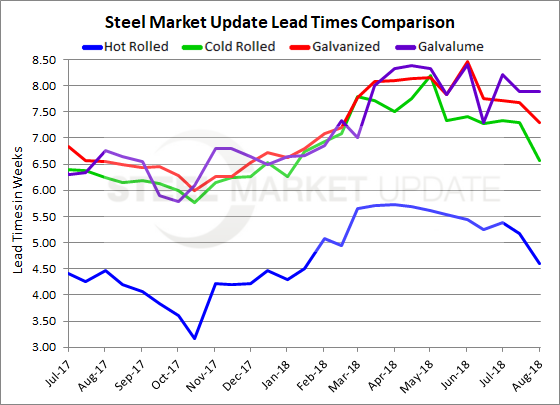

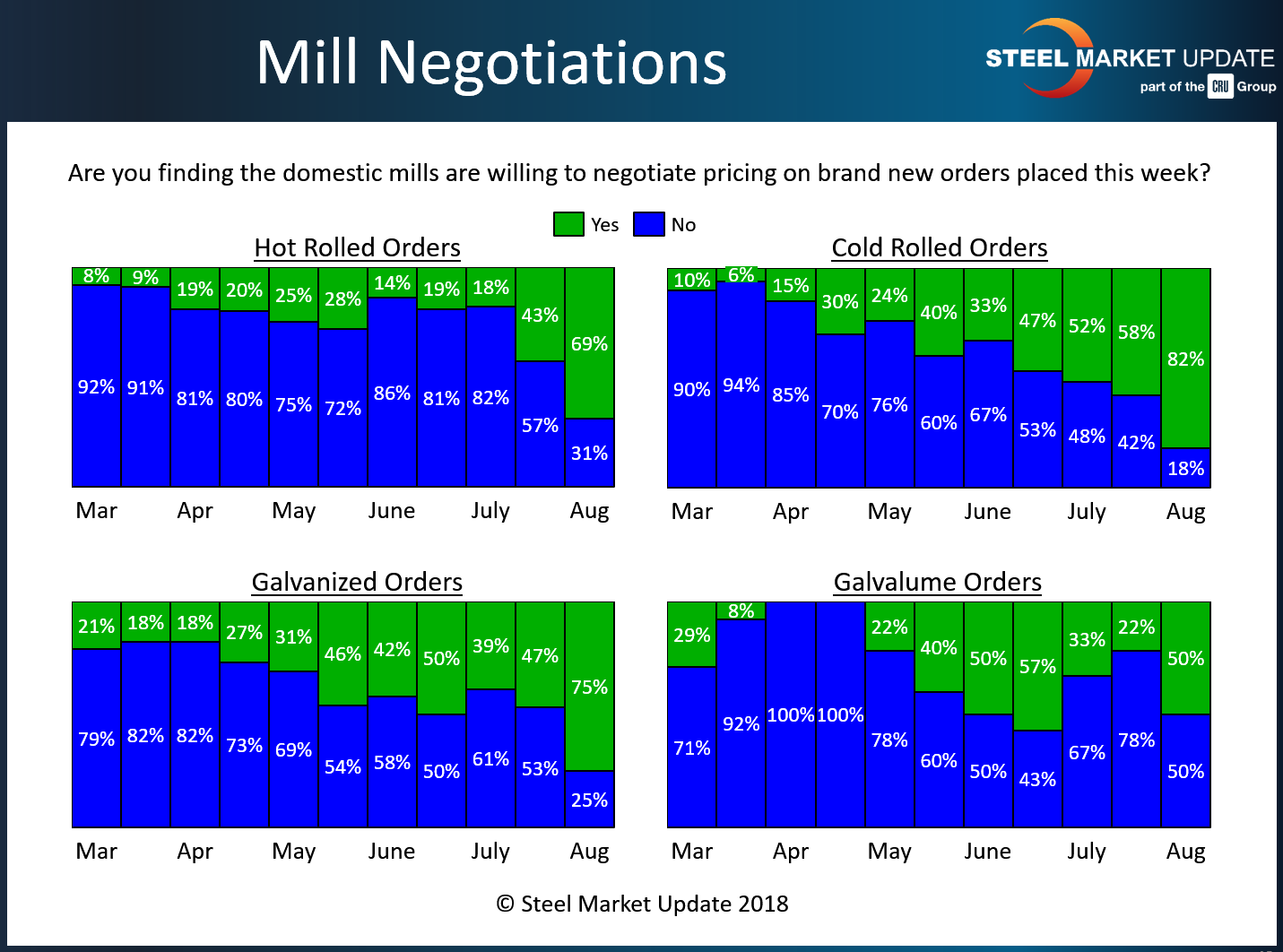

Lead times have been getting shorter on all products. As lead times shrink, the need to buy steel is reduced and inventories can be better managed. The shorter lead times have led to more discussions between buyers and sellers regarding what is a fair and reasonable price. When markets are tight, those conversations are restricted.

This afternoon, we spoke with a domestic steel mill who told us that the market needed to correct. He made the same comment as Josh Spoores above when he told me steel prices need to move to the “import parity point.” He said the sooner this happens the better for dissuading more imports from coming into the United States. After all, if you can buy domestic at $800 and foreign (including the 25 percent tariff) is just below $800, there is no incentive to buy foreign.

There is also more availability of steel coming online. JSW Ohio has been offering approximately 50,000 tons of slabs to be rolled to hot rolled into the market. There are still some questions as to the quality of the product, but we have to assume under the new ownership these issues will be addressed.

We also understand that one of the domestic mills is toll processing foreign slabs for an international trading company. This is also putting tons into the market around the $40.00/cwt ($800 per ton) level and affecting the psychology of the steel buyers.

The combination of these signs has prompted us to adjust the SMU Price Momentum Indicator to Lower from Neutral. We are of the opinion flat rolled prices will slip over the next 30 to 60 days.

We will advise how we see Momentum on plate later this week.