Logistics

April 9, 2021

Trucking Capacity Strained by Recovering Economy

Written by Sandy Williams

The U.S. trucking industry is straining to keep up with demand as imports and retail shipping vie with construction and manufacturing for limited truck capacity.

Imports fell as the coronavirus took hold last March, but surged to 2.1 million TEU (20-foot equivalent units) in August 2020 as global economies reopened. The August record was subsequently broken in October as imports peaked at 2.21 million TEU. The National Retail Federation is expecting 2 million TEU or more to be the norm throughout this summer.

“We’ve never seen imports at this high a level for such an extended period of time,” said NRF Vice President for Supply Chain and Customs Policy Jonathan Gold. “Records have been broken multiple times and near-record numbers are happening almost every month. Between federal stimulus checks and money saved by staying home for the better part of a year, consumers have money in their pockets and they’re spending it with retailers as fast as retailers can stock their shelves.”

As importers struggle with finding trucks to haul their shipments from ports to final destinations, the construction industry, which continued to operate during the pandemic, faces multiple supply disruptions and material shortages. Although nonresidential construction lagged due to economic uncertainty, the housing industry boomed in 2020 as work-from-home inspired a consumer exodus from urban areas and homeowners sought to expand their living space.

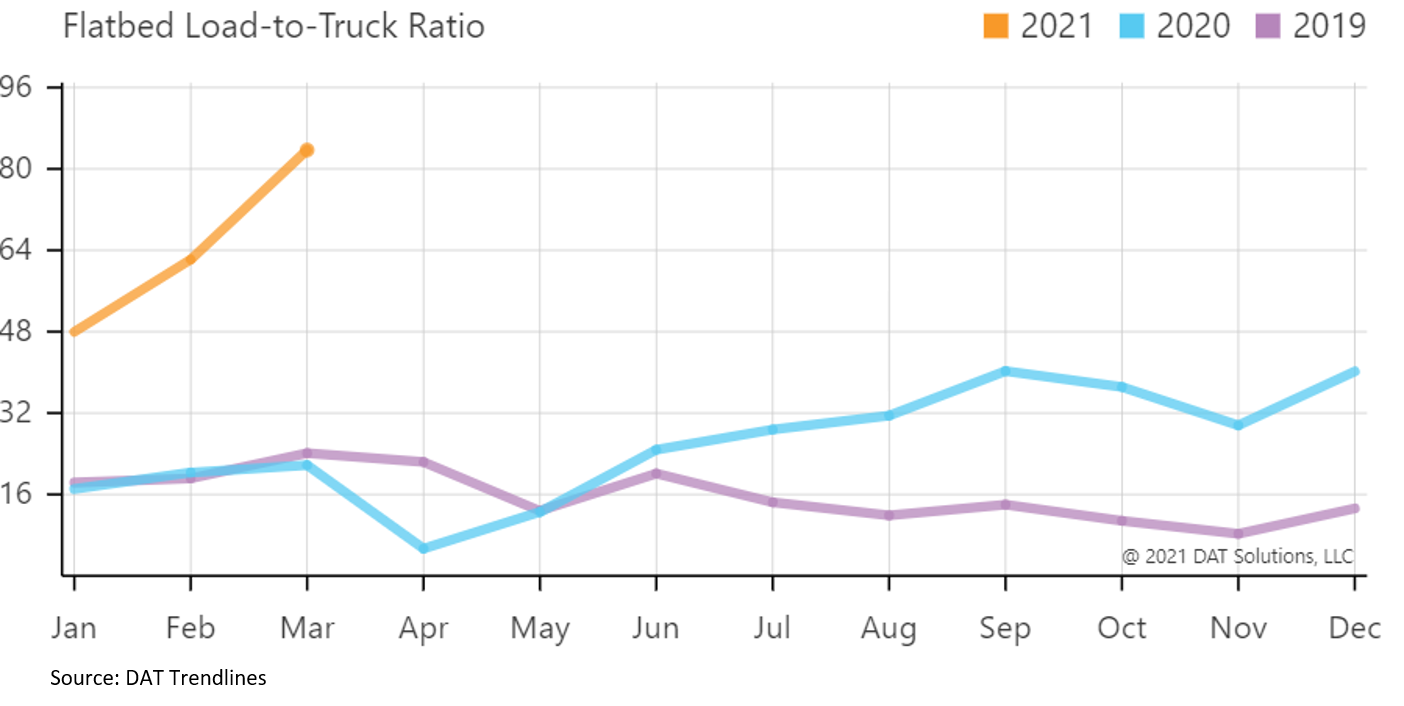

Large building supplies such as steel, lumber, tresses and concrete block are generally transported on flatbed trucks. DAT Trendlines reports the national flatbed load-to-truck ratio as of April 4 was 96.24—representing 96 plus loads for every available truck.

Tight capacity means higher rates. Average spot rates for flatbeds rose from $2.49 per mile in January to $2.86 per mile at the beginning of April. The Midwest and Southeast averaged even higher at $3.22 per mile and $3.02 per mile, respectively.

Flatbeds are also in hot demand in the industrial sector. Industrial manufacturing requires flatbeds for transport of steel and other raw materials as well as completed heavy equipment. The latest PMI from the Institute for Supply Management shows manufacturing demand and production accelerating in March.

“The manufacturing economy continued its recovery in March,” said Timothy Fiore, chairman of the ISM Manufacturing Business Survey Committee. “Extended lead times, wide-scale shortages of critical basic materials, rising commodities prices and difficulties in transporting products are affecting all segments of the manufacturing economy.”

Weather has been another negative factor for the trucking industry. The polar vortex that impacted most of the South in February caused shipping delays and backlogs that caused freight shipments to decline 3.2% month-over-month, said Cass Information Systems in its February 2021 Freight Index.

“Reversing a seasonally adjusted 3.0% m/m increase from December to January, this slowdown reflects both the short-term weather effects and likely longer-lasting supply chain pain points, which are anticipated to slow the industrial recovery for a few months,” said Cass.

Commercial Metals Company noted in its recent earnings release that the weather disruption accounted for roughly half of the year-over-year 6% decline in downstream shipments in Q2 FY 2021 .

The Cass Truckload Linehaul Index accelerated 8.1 percent year-over-year in February and is expected to continue to rise in the near term. “Driver demographics are tightening, and the economic stimulus will add more competition for drivers as parts shortages limit truck production in early 2021,” said Cass.

“Parts” include the microchip shortage that is impacting the auto industry and now spreading to commercial trucks. FTR Transportation Intelligence estimates Class 8 vehicles require 15 to 35 chips. “A big deal,” said Don Ake, FTR vice president of commercial vehicles in his April update. “If you don’t have chips, you have obvious production problems. Typically, you have supply chain issues and then they get better. What’s happened recently is that they’ve intensified.”

Besides microchips, truck manufacturers also report shortages of wood flooring for trailers, tires, harnesses, stamped parts, steel and aluminum. “It’s all mixed together, and it’s all bad,” said Ake.

“Demand is ahead of supply, but in this case, supply is constricted,” he added. “It’s not like we’ve hit capacity. It’s like we can’t get to capacity.”

A driver shortage is another complication for the truck carriers. “While the driver shortage temporarily eased slightly in 2020 during the depths of the pandemic, continued tightness in the driver market remains an operational challenge for motor carriers and they should expect it to continue through 2021 and beyond,” said Bob Costello, chief economist at the American Trucking Association. ATA estimates the industry will need roughly 1.1 million new drivers, or 110,000 per year, to keep up with demand in the next 10 years.